QE – quite extraordinary.

WOW. QE begins in earnest in the UK tomorrow, and is being done because conventional monetary policy has reached its limit (see previous blog article). QE involves swapping cash, issued by the Bank of England, for financial assets. The process of exchanging newly printed bank notes for assets that are then retained by the BoE forces excess sterling into the economy, and in theory, this increase in money supply will eventually be deposited with financial institutions who in turn lend it on. In theory, this process should stimulate the economy.

An important point is that QE differs from the straightforward printing of money and giving it away. This is because once the money has been created, it can be withdrawn by the selling of the acquired assets, which means the BoE is able to drain money out of the system at a later date when the fight against inflation becomes an issue again.

The BoE’s first target with the printed money is the gilt market. Gilts have been chosen as they are liquid, exist in significant quantity, and have traditionally been the least risky sterling asset from a credit risk perspective. Buying gilts therefore allows a swift and significant money expansion, and money destruction when the process is reversed. The purchase of gilts obviously drives their yields down and their prices up, bringing longer term interest rates down for the government. In driving down gilt yields, corporate bonds, which are priced off gilts, should also fall, thus reducing the cost of borrowing for corporates.

Like anything in economics, the effect this will have on gilt prices is a function of the size of the purchases (demand) versus the quantity of available assets (supply). The BoE’s announcement to buy £75 billion worth of gilts of between 5 and 25 years is tantamount to 25% of the existing stock of 5-25 year gilts, so it’s no surprise that gilts have rallied hard in the past week.

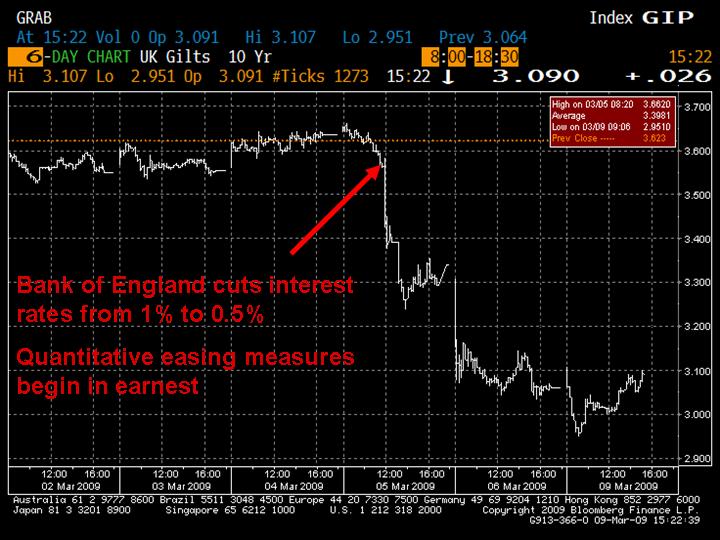

This chart shows the sharp fall in the 10 year gilt yield since last Thursday, with the benchmark 10 year gilt yield falling from 3.6% at the time of the announcement to below 3% earlier today, a record low. A 10 year gilt has a duration of just over 8 years, so a 0.6% fall in yield equates to a price return of about 4.8% in just a couple of days (0.6% x 8 years).

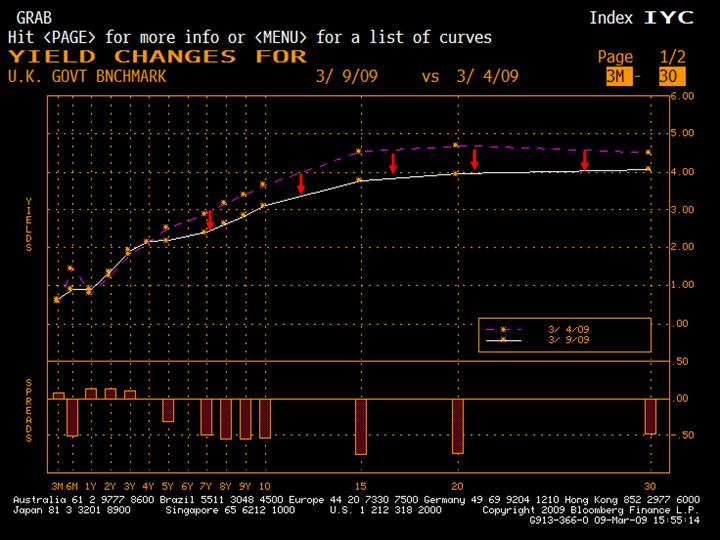

The second chart shows the change in the shape of the yield curve from the initial announcement to now. This dramatic move has been very positive for medium and longer dated gilts, and has had the desired effect of driving down long term interest rates now that short term rates have hit their lower limit. We will have to wait and look for signs for whether this works its way through the real economy as the academics predict – it may happen quickly, slowly, or not at all.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox