If it’s Wednesday, it must be…Spain. Tail wags dog.

Following the downgrades of Greece (to junk) and Portugal (to A-) on Tuesday, S&P looked upon the carnage in sovereign bond markets that ensued and decided that on Wednesday it would be Spain’s turn. Spain’s sovereign credit rating was cut from AA+ to AA, just a notch, but enough to send its CDS spread up above 200 bps, and to see the credit spreads on its banks widen by 20 bps or more for senior bonds.

Whilst we know that fiscal positions in peripheral Europe are poor, and deteriorating, the worry is that the biggest input into the decisions to downgrade was the movement in bond prices. In other words, credit ratings were cut because the bond prices had fallen. To some extent this is rational – as interest costs rise with higher government bond yields, creditworthiness falls. The rating agencies have explicitly talked about this, for instance when Moody’s cut Greece’s rating earlier this month it said that “there is a significant risk that debt may only stabilize at a higher and more costly level than previously estimated”. In the high yield market the fall in the rating agency default forecast from 20% in 2009 to below 5% has been largely driven by lower junk bond spreads, not an improvement in revenues or profits.

But it does make you wonder what the point of the rating agencies is – if their ratings are largely reflecting what the bond market is telling them, who needs them? Isn’t the real information simply the price? The problem is that the rating agencies remain important; pension fund mandates include triggers forcing them to sell below certain ratings, and even the ECB has limits on the collateral that it will accept into its money market facilities based on the official credit ratings (currently junk bonds are excluded, although Greece still has investment grade ratings from other agencies so its debt remains eligible). The BBC’s Robert Peston has blogged this morning about the power of the credit rating agencies – I have less concern about the power, than the usefulness of ratings as investment information.

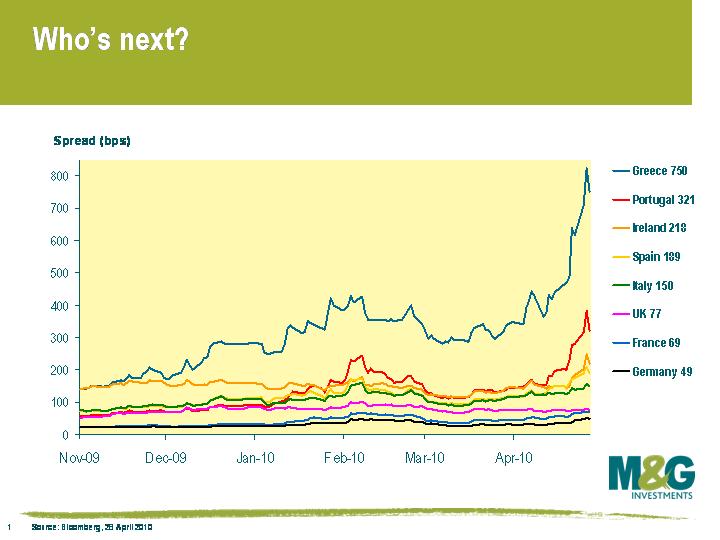

What’s the CDS market saying now about sovereign credit risk if we think that it’s a predictor of credit ratings? Greece’s junking by S&P was long overdue, and as at yesterday’s close, the cost of insuring Greek debt was higher than insuring Pakistan (B-) and Ukraine (B-) and only 100bps less than Argentina (B-). Portugal (A-) closed at 321bps, putting it between Latvia (BB) and Lebanon (B). The market is implying that Ireland’s AA rating is very vulnerable given that based on CDS of 218bps it’s sandwiched between Croatia (BBB), Hungary (BBB-) and Egypt (BB+). Spain (AA rated, 189 bps) is between Kazakhstan (BBB-) and Turkey (BB). All the credit ratings quoted above are S&P’s – generally speaking the other agencies have been even slower downgrading sovereigns, considering that Fitch and Moody’s still rate Spain AAA/Aaa respectively!

Interestingly, as you can see from this chart, the UK looks very much like an AAA rated issuer. UK 5yr CDS is the closest it’s been to France since September 2008 (albeit this is more to do with French default risk gradually increasing). We don’t expect a UK downgrade – but if there is one, you might imagine it will come on the back of a gilt market sell off rather than precipitating one.

Finally and on a slightly different topic, a US economist, David Hale, made public a private remark made to him by Bank of England Governor Mervyn King – “he told me whoever wins this election will be out of power for a whole generation because of how tough the fiscal austerity will be”. Maybe yesterday Gordon Brown was playing the long game and deliberately trying to destroy Labour’s chances in next week’s General Election? You might well argue that politically, this is a good election to lose – it also means that the Conservatives won’t be too miserable if they end up having to rely on LibDem support as they can share the burden of several years of voter anger.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox