The ‘January Effect’ – a boost for high yield?

The ‘January Effect‘ is a relatively well known stock market anomaly, whereby equities have historically performed better in January than in any other month of the year. Most explanations for the January effect focus on how tax-conscious investors sell stocks in December that are down for the calendar year, in order to write off losses against their capital gains. This behaviour pushes the prices of these poorly performing stocks lower, but bargain hunters then buy these artificially cheap stocks at the beginning of January, thus pushing their prices up. I suspect that this theory only goes some way to explaining the January effect, as it would suggest that stocks should do badly in December but this doesn’t seem to be the case.

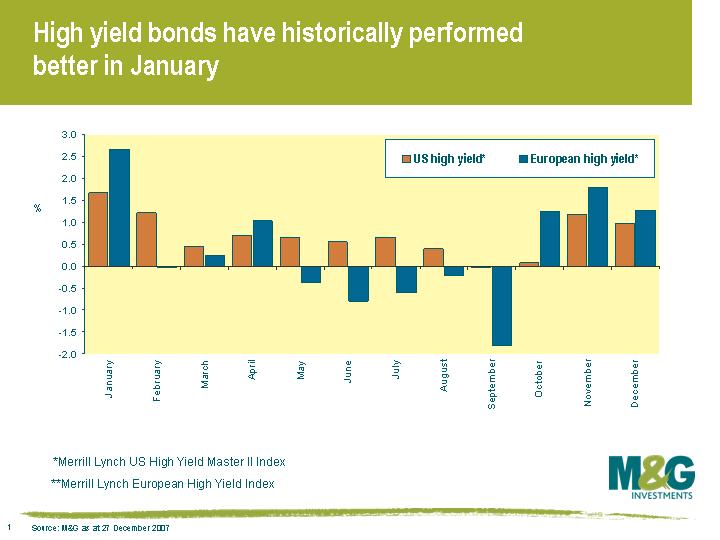

Anyway, I thought I’d have a look at the US high yield bond market, and interestingly it tells a similar story. This chart (click to enlarge) shows that high yield bonds in the US have on average returned 1.7% in Januaries since 1987, half a percent ahead of the next best month. The same pattern can be seen in Europe, where Januaries have outperformed the next best month by 0.7% on average (although it’s harder to draw conclusions because European data only goes back to 1997). The tax explanation for the January effect makes less sense for high yield bonds, because individual investors don’t typically buy individual high yield bonds. What we’re probably seeing here is the fairly close correlation between high yield bonds and equities.

Anyway, I thought I’d have a look at the US high yield bond market, and interestingly it tells a similar story. This chart (click to enlarge) shows that high yield bonds in the US have on average returned 1.7% in Januaries since 1987, half a percent ahead of the next best month. The same pattern can be seen in Europe, where Januaries have outperformed the next best month by 0.7% on average (although it’s harder to draw conclusions because European data only goes back to 1997). The tax explanation for the January effect makes less sense for high yield bonds, because individual investors don’t typically buy individual high yield bonds. What we’re probably seeing here is the fairly close correlation between high yield bonds and equities.

As readers of this blog will be aware, our view is that the high yield market is not pricing in the risk of recession right now (for example, see here). High yield has performed poorly over the past six months, and we’ve heard decidedly little from the rally monkey recently (this is something that a trader from an investment bank used to send to the market on a good day in order to get those animal spirits going). Will we be hearing a bit more from the monkey next month?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox