Foreign investors still love gilts

After December’s big sell-off in US Treasuries on the back of fears about the US’s creditworthiness, and the surprise at yesterday’s record monthly budget deficit in the UK, there’s been a lot of talk about a bond market “buyers’ strike”. In particular the western bond markets’ reliance on Asian central banks has made many nervous that a change in risk appetite there could result in strings of uncovered bond auctions and significantly higher yields as borrowing costs rise.

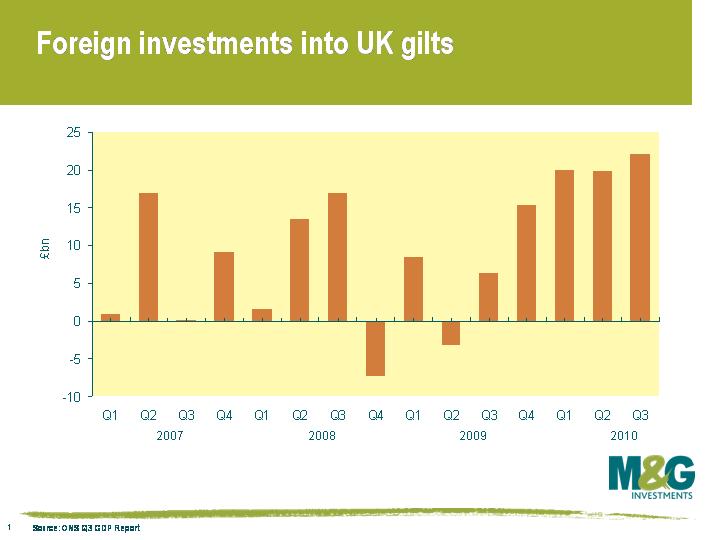

Perhaps this is overly pessimistic. Although this data is for Q3, and therefore doesn’t reflect the most recent wobble in confidence, it shows that foreign investors bought £22.115 billion of UK gilts in that quarter – and £77 billion over a 12 month period, a massive help for the UK’s financing requirements. This shows that overseas investors are confident that the UK will remain a AAA rated bond market (with the debt burden tackled by the Tory/LibDem austerity programme), and also reflects a safe haven status at a time when peripheral European bond markets have been collapsing. So no need for panic in the UK gilt market yet – but if yesterday’s numbers reflected the start of a string of poor budget deficit numbers, and inflation remains higher than most gilt yields (you don’t earn CPI until you lend out to 8 years on the yield curve, and you don’t earn RPI anywhere outside of inflation-linked gilts) then there will be cause to worry.

Here’s the link to the statistics – the gilt numbers are on page 100, column F.3321.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox