Spain in deeper trouble

The last thing that financial markets needed this morning was a wobbly Spanish auction, but that’s exactly what they got. Spain’s borrowing costs have soared, with 10 year Spanish government bond yields jumping a massive 20bps at one point. On the face of it the auctions looked OK with the 19s covered 2.13 times and 26s covered 2.57 times, but despite the much higher yields on offer, the Spanish treasury only managed to shift €1.5bn of the 2026s with the market looking for between €1.75bn and €2bn. One bank reported zero buying interest from their clients, and with the auction not well placed, dealers have been selling into the market.

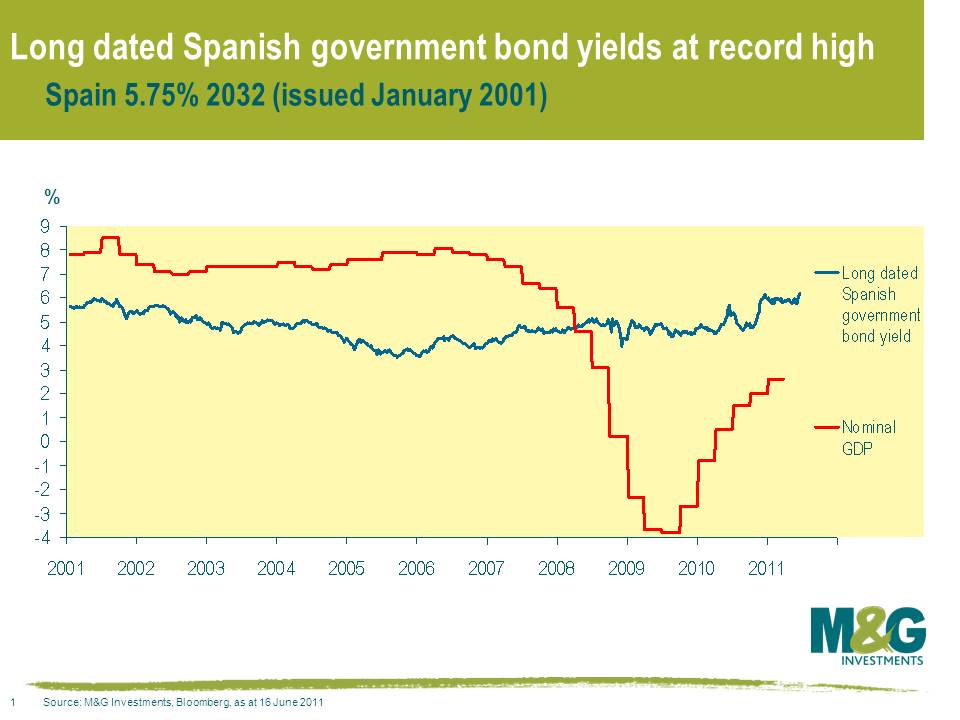

It’s difficult to focus on the long term when there’s such a big short term risk of a horrible air shot as the authorities collectively try to kick the proverbial can, but attached is an updated chart from a previous blog showing Spain’s long term borrowing costs versus its nominal growth rate. Spain’s long term borrowing costs greatly exceed its current nominal growth levels. Its potential long term real growth rate may now be as little as 1%, and with the ECB desperate to demonstrate its inflation fighting credentials, Spanish nominal growth potential could quite feasibly be below 3%. For Spain’s debt levels to stabilise, either Spain’s borrowing costs will need to halve or it will have to run a large sustained budget surplus to make up this gap.

Given that it’s exceptionally unlikely that Spain is in any position to run a sustained budget surplus (the Spanish regions are expected to report bigger deficits than previously forecast), Spain’s public debt/GDP ratio will steadily deteriorate. The firewall that markets thought existed between Greece, Portugal and Ireland and the much bigger and systemic economies of Spain and Italy is in danger of being an illusion.

Finally, Spanish 5y CDS finished May at 253.5bps according to Bloomberg, resulting in a tie for last month’s competition. Martin Price from Sarasin was the lucky fellow to be drawn out of the hat so a signed copy of Reinhart and Rogoff’s book is in the post to you. Incidentally, Spain 5y CDS has blown out to over 310bps as at today.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox