Ireland (austerity) vs Iceland (default) – who’s winning? And a Twitter update…

Back in March we wrote about Iceland’s response to the banking crisis, and how it differed to other countries that stepped in to support their banking systems. This week, Paul Krugman commented about Iceland’s exit from its IMF programme. The IMF has declared that programme successful, and Krugman claims that Iceland is back in the capital markets and has its “society intact”. He puts this success down to three things – debt repudiation (default), capital controls and currency depreciation. In fact the opposite of the approach that the distressed Eurozone economies are forced to endure.

Krugman acknowledges that Iceland has a way to go – unemployment is nearer 7% than the 1% it stood at before the crisis. But is default a better option than austerity and an overly hard currency?

Well we have a control of sorts for this experiment. Another member of Alex Salmond’s Arc of Prosperity, Ireland is taking the other path. Having borrowed EUR 67.5 billion from the EU and the IMF in 2010, Ireland committed to an aggressive austerity package, and far from defaulting, the government explicitly guaranteed the debts of its broken banking system. The 4 year austerity plan raised sales tax, cut government spending and reduced the minimum wage, with a plan to get the deficit below 3% of GDP by 2014. Is that working?

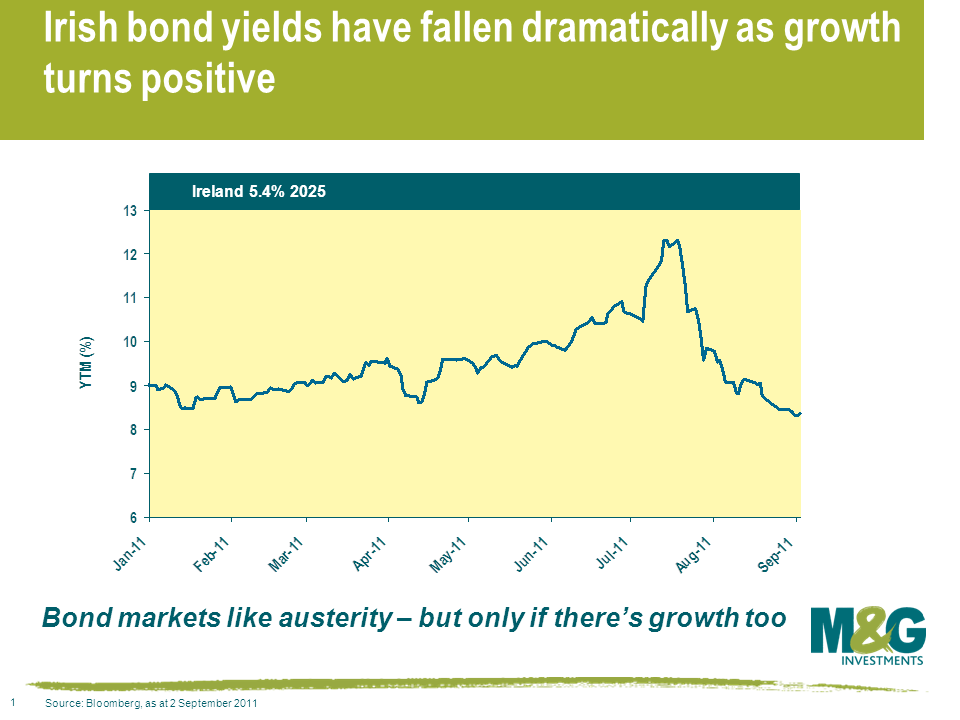

Well we’ve just seen quarterly GDP growth of 1.9%, the highest rate since the end of 2007 (most quarters since then have been negative), although unemployment remains around the 14% level, and I guess the best you could say is that it’s no longer rising. Stronger exports have helped – domestic weakness persists. One measure that has improved dramatically as the result of the austerity programme has been Ireland’s borrowing costs. Since mid July, the longest dated Irish government bond has fallen in yield from 12.5% to under 8.5%, making this one of the best performing bond markets in the world – and in sharp contrast to Spanish and Italian bonds over that period.

It will be interesting to see which approach to national indebtedness proves most successful over the longer term – I’ve always said that I thought that an early default against bondholders by the peripheral Europeans was the best outcome for those populations. It’s almost certainly what the populations would vote for, if, like the Icelandics, they were offered the choice. Credit rating versus a job for your kids? No contest. As George Osborne follows the austerity path for the UK in defence of its AAA rating (now lost by the US, which then saw one of biggest ever monthly rallies in its bonds), we’re also part of these experiments.

It will be interesting to see which approach to national indebtedness proves most successful over the longer term – I’ve always said that I thought that an early default against bondholders by the peripheral Europeans was the best outcome for those populations. It’s almost certainly what the populations would vote for, if, like the Icelandics, they were offered the choice. Credit rating versus a job for your kids? No contest. As George Osborne follows the austerity path for the UK in defence of its AAA rating (now lost by the US, which then saw one of biggest ever monthly rallies in its bonds), we’re also part of these experiments.

A while ago I wrote about the lack of protest songs from the youth of today. Turns out there were other ways of protesting about being a NEET (not in employment, education or training) than singing, but here’s a link to a huge list of 1980s protest songs. Also a link to a Billy Bragg article on a similar theme.

Finally a reminder about our new Twitter feed, @bondvigilantes. We’ve been going for a couple of weeks now, and as well as linking to this blog, we’ve tweeted our views throughout the day of the US AAA downgrade, and on our not very widely held assertion that Alistair Darling had a “good” credit crisis. We also tweeted a link to the new and utterly crucial remastered and complete Smiths box set. Join us, join us.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox