French bonds following the path trampled by Greece, Ireland, Portugal, Spain and Italy

We’ve already discussed how EFSF doesn’t work as a private sector solution to the Eurozone debt crisis here, and have explained how the idea of turning the EFSF into a monoline insurer is ludicrous here. EFSF bonds continue to perform poorly – the inaugural €5bn 5 year EFSF bond issued in January came with a yield spread of about 40 basis points over 5 year German government bonds, and is today at 150 basis points.

However perhaps more worrying than the poor performance of EFSF bonds is the dire performance of French government bonds, particularly in the last couple of weeks. French spread widening poses a major problem because the tail tends to wag the dog when it comes to credit ratings, as argued here. In other words, widening spreads tend to cause credit rating downgrades, which tend to cause further spread widening. A French downgrade would be particularly problematic to the European leaders who still seem to believe that the EFSF is a tenable solution to the Eurozone debt crisis since the EFSF structure needs AAA rated guarantors. To quote FT Alphaville, the loss of France’s AAA rating would lead to the EFSF beast beginning to eat itself.

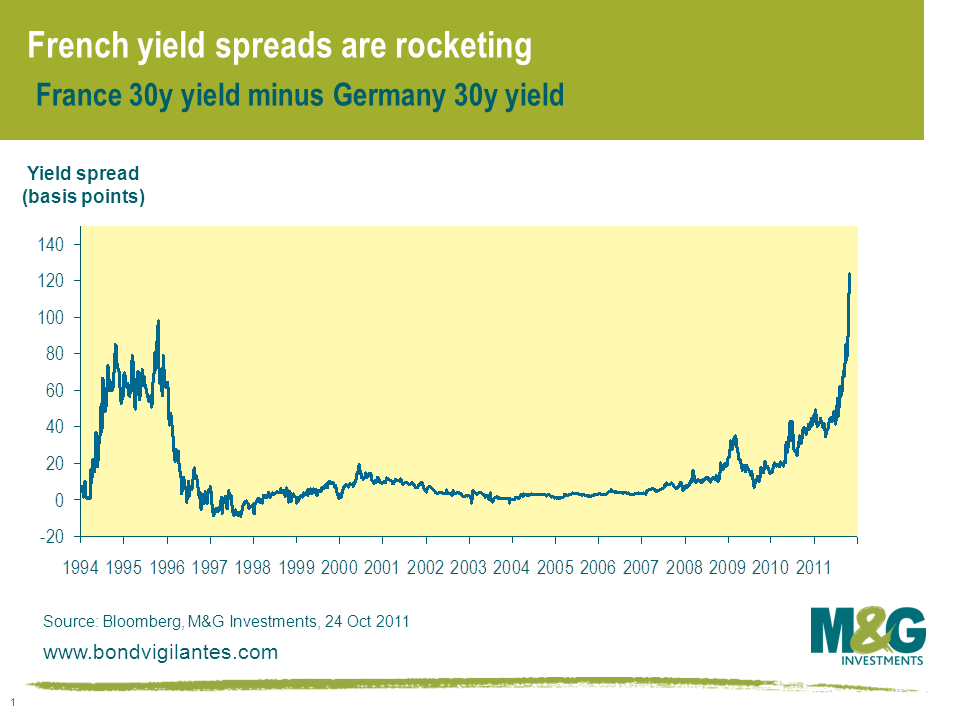

The chart below shows how long dated French government bonds have significantly underperformed long dated Germany, with spreads blowing out from 70 basis points in mid September to 124 basis points this morning. More worrying still is that the French spread widening has not come about because Germany borrowing costs have plummeted – long dated Germany bond yields are at a similar level now versus where they were in mid September – but has instead come about because 30 year French government bond yields have jumped from a mid September low of 3.3% to above 4.0% today.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox