The IMF recently released a working paper entitled “Government Bonds and Their Investors: What are the Facts and Do They Matter?” which helps shine a light on whether a change in the investor base in recent years has had an impact on yields. One of the key trends since the onset of the crisis has been a shift in the ownership of government bonds from foreign holders back to domestic holders. This can partly be explained by the various forms of quantitative easing that central banks have embarked on and a move by banks to hold more government bonds.

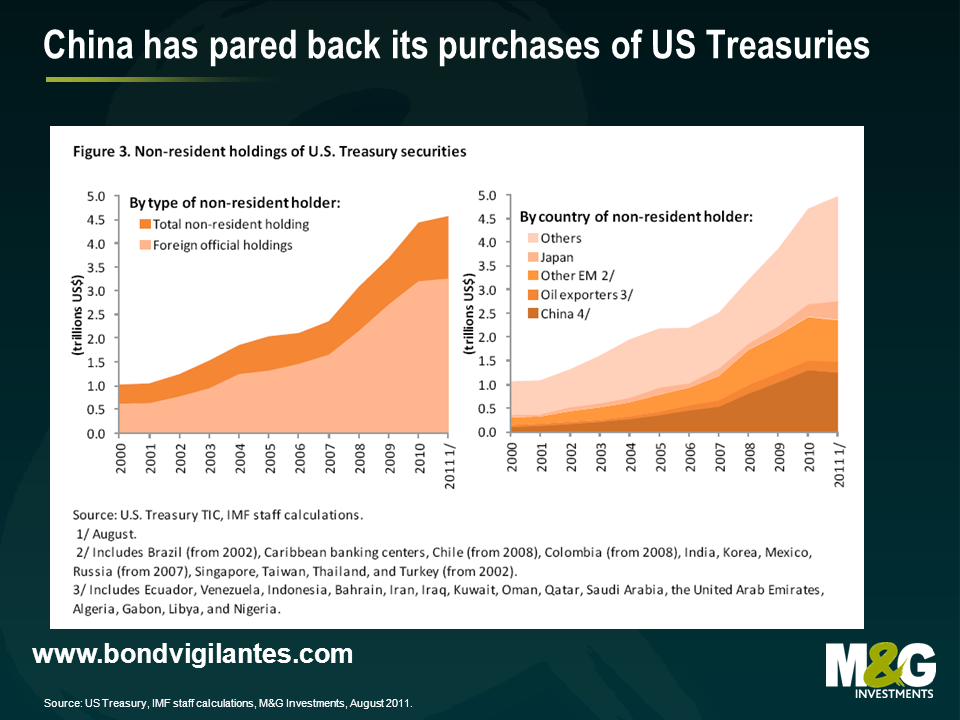

The IMF find that an increasing share of non-resident investors is associated with lower yields. The econometric results show that an increase (decrease) in non-resident investors by 10 percentage points is associated with a reduction (increase) in 10-year government bond yields of between 32 to 43 basis points, whereby the effect is closer to 66 basis points for euro area countries. With that finding in mind, let’s look at the proportion of non-resident holdings of government bonds across the countries.

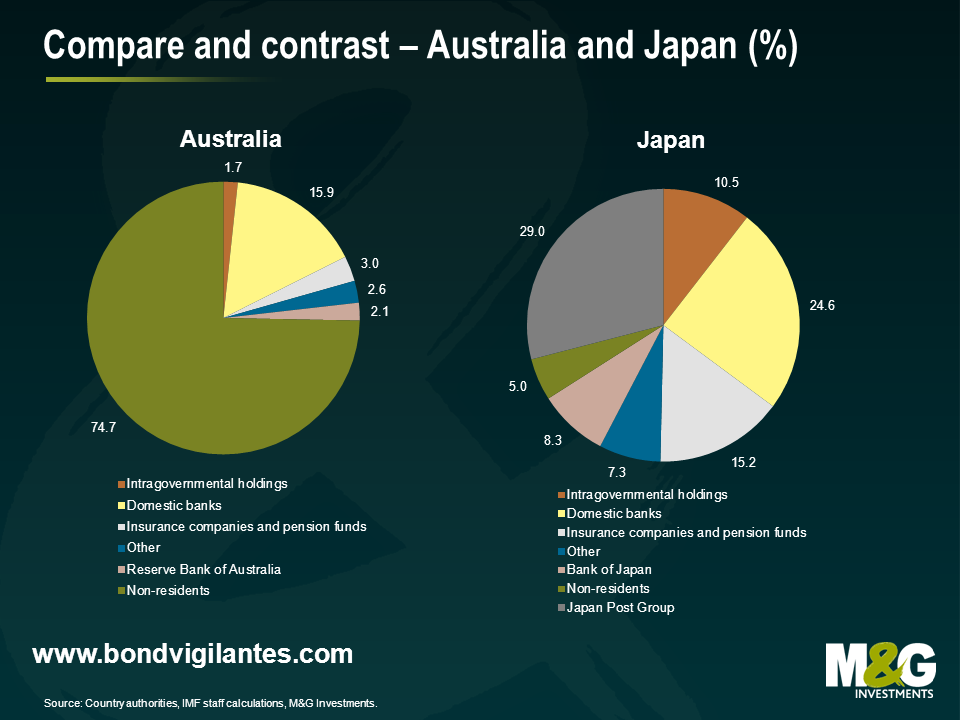

The first chart looks at who owns the government debt of Australia and Japan. We have written before about our concerns about the amount of Australian debt that non-resident investors own. For us, this is worrying as heavy foreign ownership of government bonds can be very dangerous, particularly when this is combined with a country running a current account deficit (i.e. the country is reliant on capital inflows from abroad). Non-resident holdings of AGBs has risen from around 30% in 2000 to over 80% today. In contrast, Japan has a very low share of non-resident holdings. This domestic investor base is mostly the result of pension savings and a strong home bias. The large domestic investor base has been associated with the low and stable yields despite very high debt.

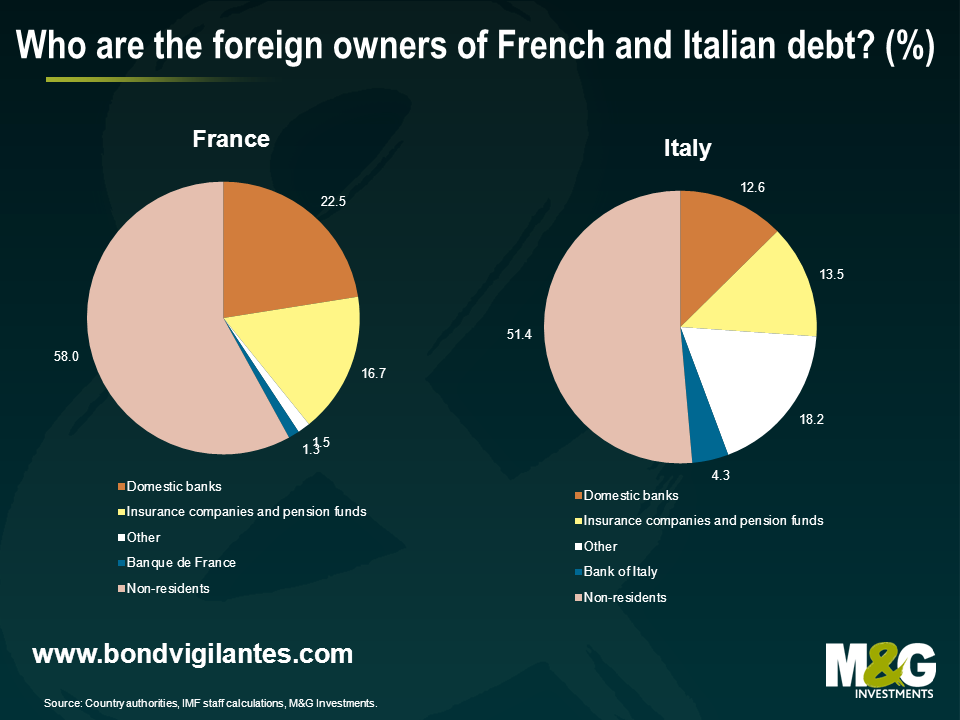

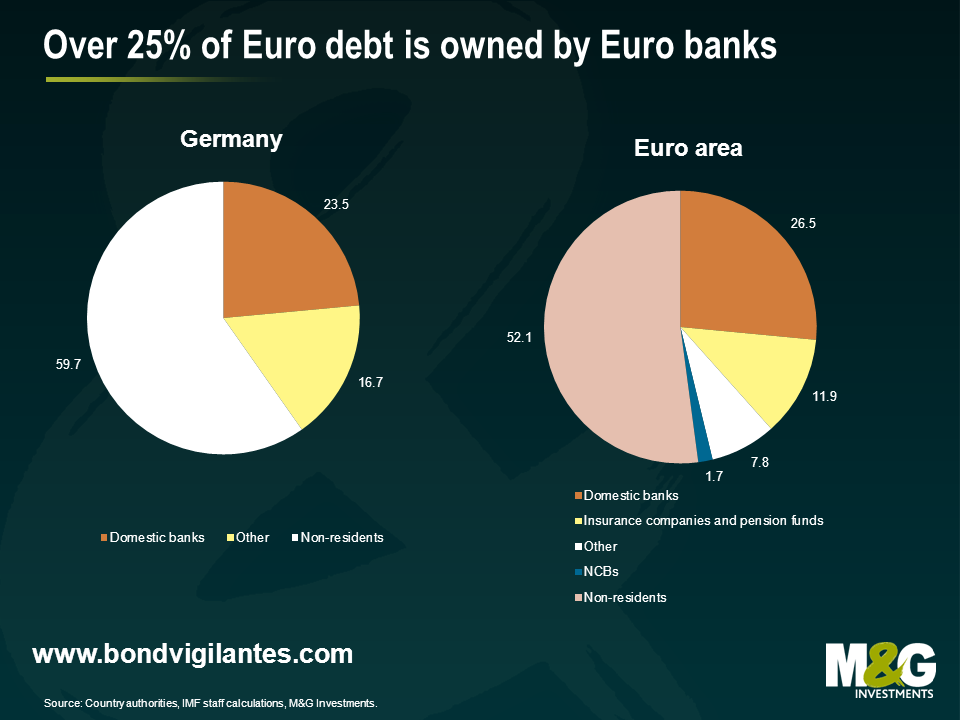

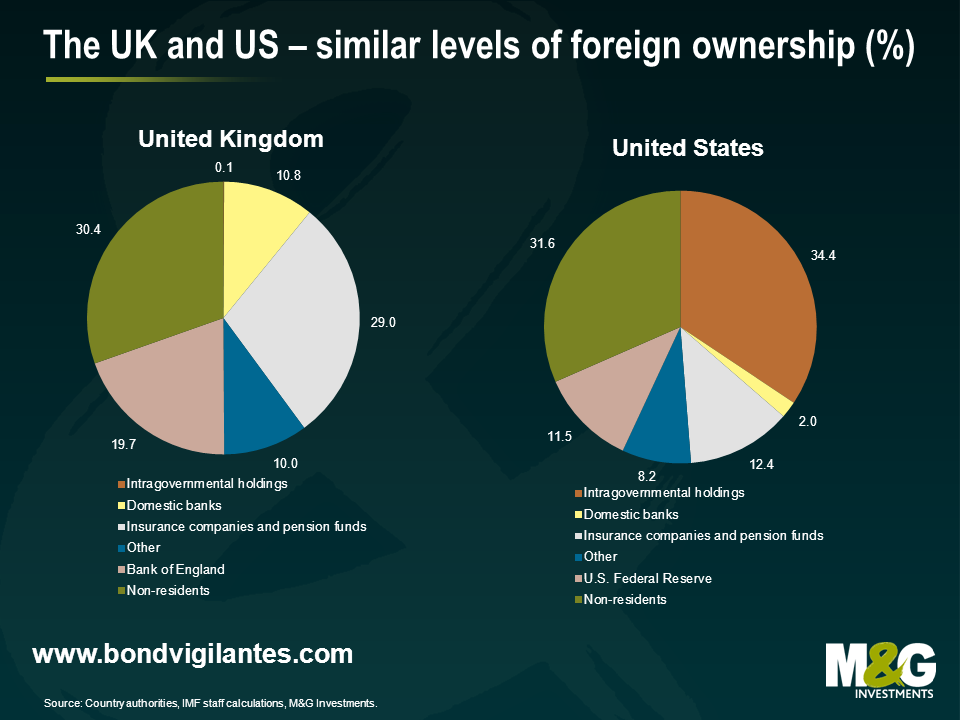

In many countries, non-resident holders make up the largest share of the investor base though this has fallen somewhat in recent years. This is particularly the case for euro area countries. Aggregating the data for individual countries across the euro area, about one quarter of the outstanding debt is held by euro-area residents other than the issuing country, while another quarter is held by residents outside the euro area. Despite the apparently very high share of non-resident holdings in the euro area, on aggregate the euro area depends less on foreign buyers than the United Kingdom or the United States.

Whilst the UK and US show similar ownership proportions for non-residents, there is a large difference in the proportion that domestic banks, insurance companies and pension funds own. In the United Kingdom, long term yields declined following the increase in pension funds’ holdings of gilts. This portfolio shift, in particular into ultra-long gilts, has been attributed to changes of U.K. pension fund regulations with the aim of reducing the maturity mismatch between assets and pension liabilities. In the US, the large proportion of intragovernmental holdings can in-part be attributed to the Social Security Trust Fund which holds about 20 percent of outstanding U.S. Treasuries.

The other interesting data in the IMF paper was on non-resident holdings of US Treasuries. The total amount of US government debt owned by China, the Oil exporters and other EM has been falling since 2010. That said, as at August 2011, non-residents owned almost $5.0 trillion of US Treasuries.

Last month I commented on the long term headwinds facing Asia and tried to cut through the sales cheese. The last few weeks have seen more evidence of a slowdown in Asia, and seemingly more people buying into the EMD story as valuations in a number of countries have hit extremely expensive levels. Taking one example, in the middle of last week the $2.25bn issue of Peru 7.35% 2025s reached a yield spread of 109 basis points over US Treasuries. Liquidity on the bond is not fantastic, with a bid-offer spread of 1% on screens, implying that over a one year time horizon the yield spread is an illiquidity premium, with almost zero credit risk priced in. Spreads are reaching levels of the super liquid days prior to 2008. Bubbletastic.

Some charts below.

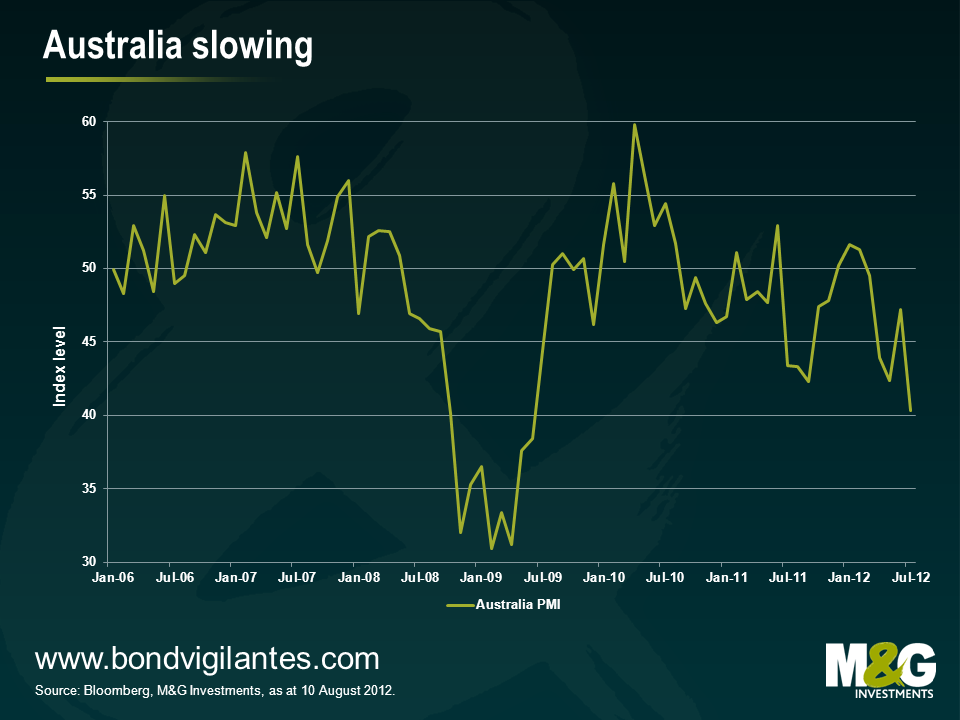

Australia’s economy appears to be struggling, with the Australian Dollar pushed higher by speculative inflows.

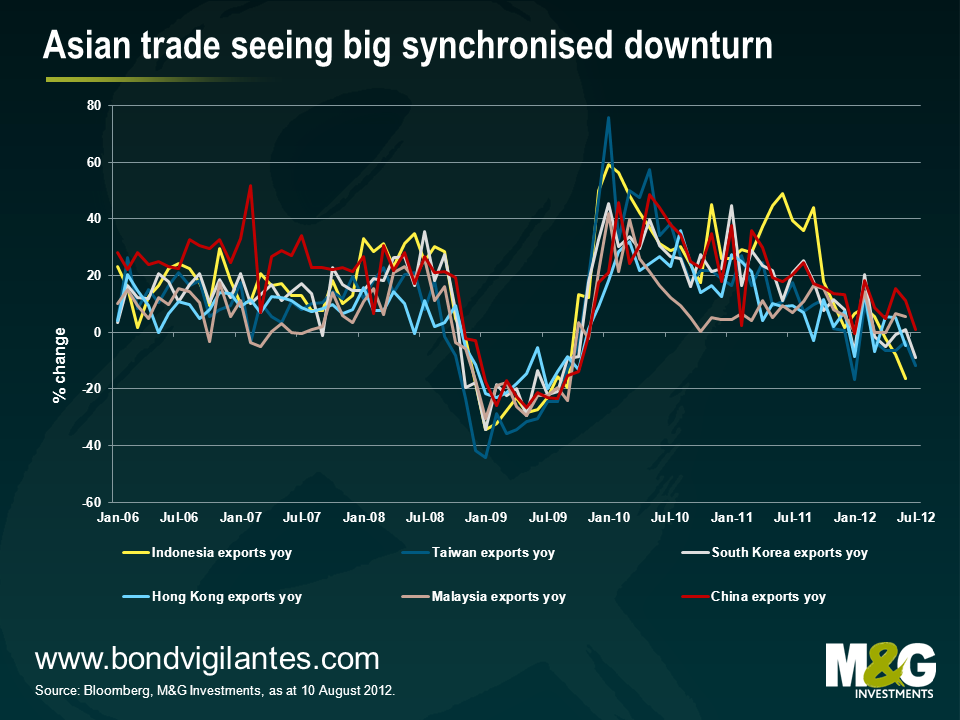

Many of the countries reliant on exporting to China are seeing flat or negative export growth year on year.

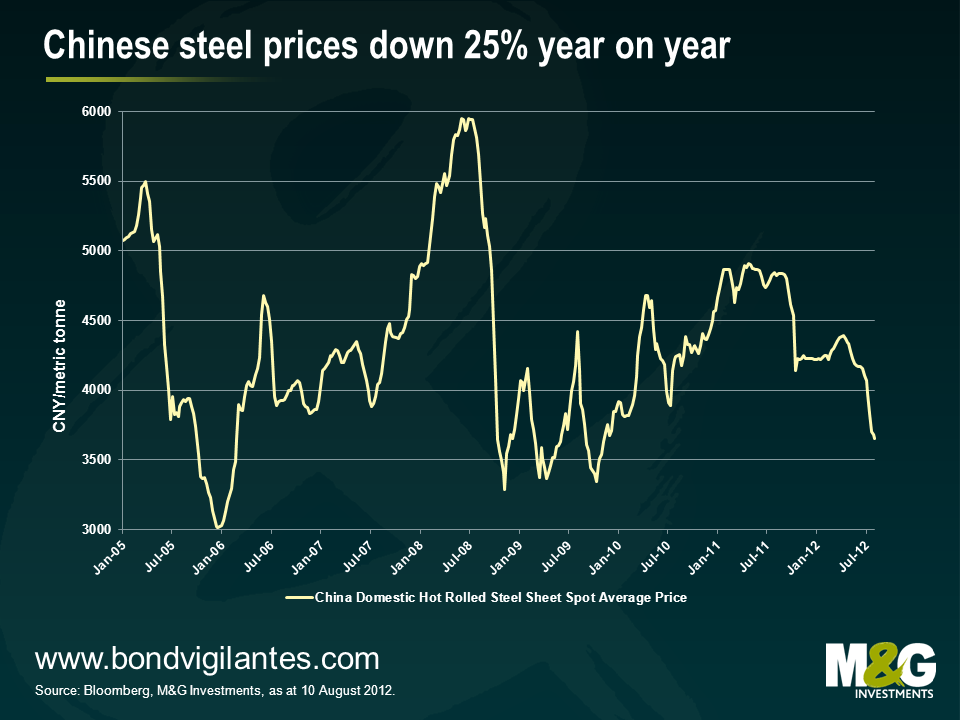

As discussed last month, Chinese growth has been highly dependent upon excessive investment growth. This has been driven by construction, which has been reliant on steel. So it’s interesting that steel prices have fallen 25% in the last year in China.

And finally the current bubbletastic spread levels on emerging market debt.

Rough cost of the Olympics – £9bn, US national debt – $15.8tn, Quantitative easing – £375bn. These numbers blow my mind. I know they’re big but I don’t really have a concept of how big. So I thought I’d try and put them into some context. I took a look at the national debt of the Euro’s peripheral countries and calculated how many gold medals each country would need to win to pay off their debts.

Of the 412 grams that a London 2012 gold medal weighs roughly 6 grams are gold, 381 are silver and the remaining 25 copper. Giving a market price today of about $700.

Below is a table of how many gold medals each country would have to win to get themselves out of the red:

| Gold medals needed | |

| Portugal | 273,728,118 |

| Ireland | 220,449,211 |

| Italy | 3,445,899,490 |

| Greece | 627,153,707 |

| Spain | 1,295,304,783 |

That works out to each member of the population needing to win the following:

| Gold medals needed per person | |

| Portugal | 26 |

| Ireland | 48 |

| Italy | 57 |

| Greece | 56 |

| Spain | 28 |

That there are only 302 possible medal events in the entire competition makes this pretty depressing reading for our European friends, especially given where they are sitting the medals table (as I type). If it makes you feel any better every US citizen would have to win 73 gold medals to get them out of their hole.