It’s been another massive year for the global economy. Europe saw LTROs, Greece got a haircut, sovereign downgrades and record high unemployment rates. The peripheral European nations attempted to implement austerity measures with limited success. The US re-elected President Obama and the focus quickly shifted to the upcoming fiscal cliff. In the UK, an Olympics induced bounce in growth was the sole bright spark for an economy which appears to be stuck in quick sand and may well lose its prized AAA rating in 2013.

The IMF, being unusually succinct, probably summed up the state of the global economy the best by entitling their latest World Economic Outlook “Coping with High Debt and Sluggish Growth”. The advanced economies account for around two-thirds of global GDP and if they are sluggish then global growth will be sluggish too.

With all this uncertainty and risk in 2012, how have fixed income markets performed? Surely government bonds will be the safe haven of choice?

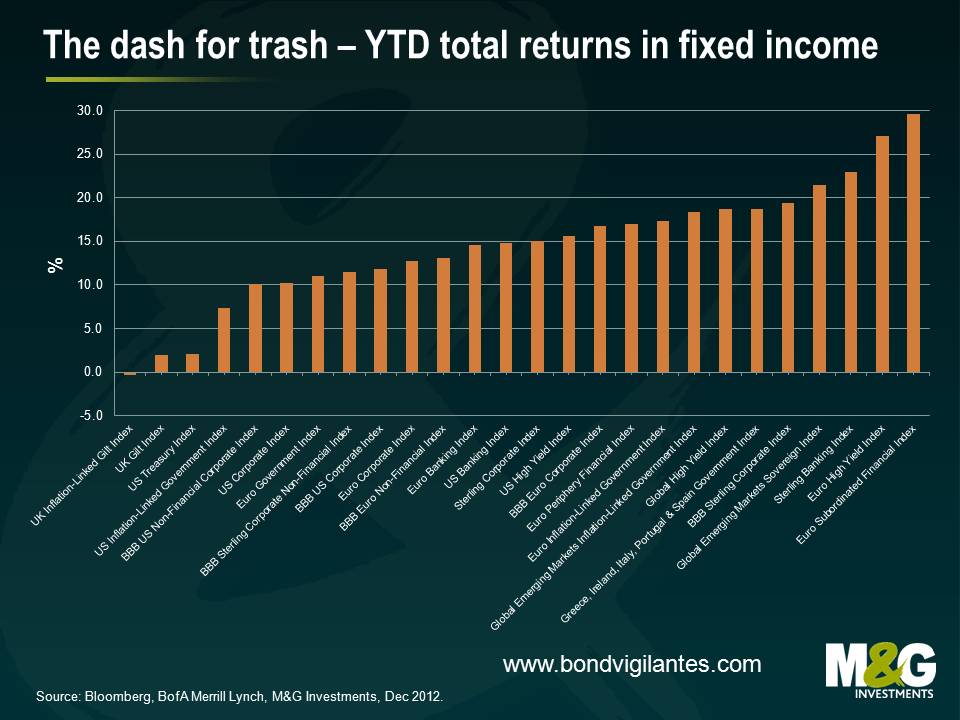

In absolute and local currency terms, it’s been another great year for the markets with everything generating a positive return except UK linkers. It’s been a fall in grace for UK linkers, which were actually one of the best returning asset classes of 2011. The UK linker market was buffeted in 2012 by weak growth expectations and uncertainty surrounding proposed changes to the RPI calculation.

But looking elsewhere, investors had the opportunity to secure some excellent returns in 2012 by taking some risk. The best performing asset class of our sample was European subordinated financial debt which registered a return of 29.5%. European high yield wasn’t far behind with a return of 27.1%, followed by Sterling banks which returned 23.0%.

ECB President Mario Draghi and the ECB’s measures to support the Eurozone also had a positive effect of debt investors in peripheral Eurozone debt, with an index made up of bonds from Greece, Ireland, Italy, Portugal and Spain government bonds up 18.7%. Not a bad return for investors considering the question marks hanging over the ability of these nations to service their respective debt obligations in an environment of political uncertainty and recessionary levels of growth.

Other highlights include global high yield (up 18.7%), European peripheral financials (up 17.0%) and US high yield (up 15.6%). At the less risky end of the spectrum, European investment grade corporates returned 12.8% and US investment grade corporates returned 10.2%. Emerging market debt also did well, with EM sovereigns debt posting a fantastic return of 21.4%.

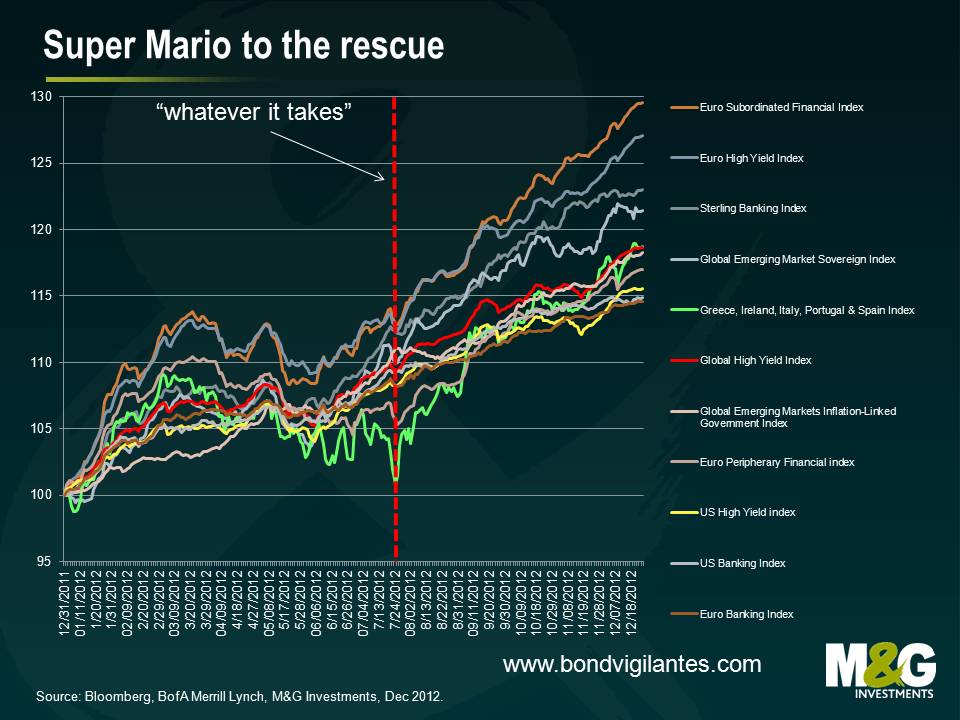

As outlined earlier, it appears that the global economy faces some substantial fundamental headwinds. So how was it that the riskiest asset classes in fixed income have performed the best? Three little words – “whatever it takes”. Mario Draghi’s speech in late July supercharged returns for the riskiest asset classes and stimulated the “dash for trash”. “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough”.

Well Mr Draghi, the markets have certainly believed you. For example, an index of government debt issued by Greece, Ireland, Italy, Spain and Portugal had up until the speech date generated a return of around 5%. The index ended up generating a 17% return, with investors comforted by Mr Draghi’s comments.

It seems to us that the Ostrich effect (the avoidance of apparently risky financial situations by pretending they do not exist) had a significant impact on markets in 2012. And in a world of ultra-low interest rates and negative real returns in cash, investors must take on risk. It is precisely what central banks are encouraging us to do. But uncertainty breeds volatility and in order to generate higher returns investors must face this volatility head on. It will be a feature of the market in 2013.

About the only thing we can say for certain is that it is unlikely that fixed income will continue to generate excellent returns across the spectrum from government bonds to high yield. For example, double-digit returns in European investment grade are not normal and has occurred only three times in the last seventeen years. On the other hand, the asset class has posted a negative return in only two of those seventeen years, with the largest loss being -3.3% in 2008. In US high yield, the consensus amongst analysts is that high yield markets will generate a return of around 4-6%, the result of coupon clipping. Analysing returns for the asset class shows that a coupon-clipping year has occurred only once in the past twenty-five years.

We posted our bond market outlook last week. It looks like the US may experience a housing induced growth spurt, Europe will eventually get round to dealing with its issues and the UK has a long way to go to secure economic growth. We like non-financial corporates, are worried about EM debt valuations and remain confident that there are still attractive investment opportunities in several areas of the fixed income universe. For an expansion of these views and more, please see here.

It was a tough quiz this year – sorry. Here are the answers for you. The winner was Mike Haslam of Barclays Wealth who scored 20 out of 20. Congratulations – please let us know which charity you’d like to nominate for the £200 donation from us. The nine runners up, who like the winner receive a copy of Philip Coogan’s excellent book Paper Promises are:

Sam Morton, Mizuho International

Matthew Riley, Falcon Money Managment

Paul Amery, Index Universe

Mark Dufton, Charles Stanley & Co Ltd

Nick Tudball, BNP Paribas

Will Lewis, Hansa Capital

Adam Grimsley, Blackrock

Johnny Smith, Nomura

Andrew Woolston, Blackrock

- What was created especially for Winston Churchill in 1950 as a brandy-like celebration drink?

Carlsberg Special Brew was created for Churchill’s visit to Copenhagen in 1950, and was originally called V-beer. - “We’re just going to draw the raffle numbers now”. Who and when?

Bradley Wiggins opened his Tour de France victory speech this year with these words, a nod back to the low budget, cash strapped days of UK bike racing where races were organised out of scout huts and village halls. - What’s this called?

This is Ampelmann, the East German pedestrian traffic light symbol.

This is Ampelmann, the East German pedestrian traffic light symbol. - “Beam me up Scotty”. Why was it third time lucky this year?

James Doohan, who played Scotty in Star Trek, had his ashes blasted into space on a rocket. It was third time lucky because the first two rockets his ashes were on both blew up after takeoff. - How is James Gatz from North Dakota better known?

He is the Great Gatsby from F. Scott Fitzgerald’s novel. - Held in 1994, it is said to be the biggest rock or pop concert ever. Who and where?

Although crowd numbers are difficult to judge when it gets this big, Rod Stewart’s MTV concert on Copacabana Beach probably had around 3.5 million attendees! - Archaeologists recently discovered a mummy in the Valley of the Kings, covered in chocolate and nuts. Who is it believed to be?

Pharaoh Roche. - The winner of this 7.4km race gets a red coat with a silver badge. Which race?

Doggett’s Coat and Badge, the world’s oldest rowing race (run since 1715), held on the River Thames. - What do all the cover stars of this magazine have in common?

This is iD, the style magazine. All of the front cover stars have an eye closed (usually winking).

This is iD, the style magazine. All of the front cover stars have an eye closed (usually winking). - Which fairground ride’s name derives from a military training game seen by crusaders in Turkey in the 12th century?

Carousel. - The Nike swoosh, a cheap US hipster beer, and a prize for fast ships. What?

The Blue Ribbon/Riband. Nike was originally called Blue Ribbon Sports, Pabst Blue Ribbon is a cheap, ironic hipster lager, and the Blue Riband was a prize for the fastest ship across the Atlantic. - What were bulky, ungainly monstrosities more suitable for the wide open vistas of a Scandinavian airport?

This is how London Mayor Boris Johnson described the bendy bus, replacing them with the new double deckers. - It shows a hundred consecutive pulses from the pulsar CP 1919, but is best known as what?

The image of those pulses was used as the cover of Joy Division’s Unknown Pleasures album. - Coppi was the first, Pantani the last. To do what?

To win both the Giro d’Italia and the Tour de France in the same year. Bradley next in 2013? - Who famously finished the story of Bleak House, and was then sitting down to start Great Expectations that afternoon?

Neville Chamberlain told the House of Commons in 1934 “we have finished the story of Bleak House, and are sitting down this afternoon to the story of Great Expectations”. - Who’s stationary did this logo head up?

This was Captain Robert Scott’s stationary from the doomed Terra Nova expedition to the South Pole in 1911-12.

This was Captain Robert Scott’s stationary from the doomed Terra Nova expedition to the South Pole in 1911-12. - Following electromagnetic surveys, and eyewitness accounts from elderly locals, it’s hoped that a dig will uncover 36 of them in Burma. What?

It’s hoped that the dig will turn up crates containing RAF Spitfires, buried in the jungle to keep them out of Japanese hands in WWII. They’d be worth many millions of pounds each and could be in virtually mint condition. - Earlier this year, a hedge fund managed to seize an asset as part of its claim against Argentina following the latter’s sovereign bond default. What was it?

Elliott Associates, a hedge fund and owner of Argentinian debt, seized an Argentinian naval ship, the Libertad, docked in Ghana earlier this year. However, it looks as if the government is about to release the ship. - Who is this?

It is Snufkin, from the Moomins.

It is Snufkin, from the Moomins. - As he looked through a hole in a wall in 1922, someone asked him if he could see anything. He said “Yes, wonderful things”. Who?

Howard Carter. The archaeologist was the first to peer into Tutankhamun’s tomb through a crack in a doorway. Lord Carnarvon asked him if he could see anything, and this was Carter’s reply.

Congratulations to all the winners. We’ll be in touch shortly. Happy Christmas everyone and thanks for reading the blog in 2012.

It may not have felt like it, but 2012 has actually been a pretty good year for investors. Bond holders in particular have had a decent 12 months: the government bond bull run has continued and investment grade and high yield corporate debt appears on track to deliver some excellent returns. Major equity markets also look likely to end the year in the black.

These broad-based gains on global stock and bond markets have occurred against a still challenging macroeconomic backdrop. In fact, looking back at our last annual outlook, many of the things we were worried about then – “double dips” and rising indebtedness in developed countries and the risk of a significant policy error worldwide – have not only remained unresolved but have become, in some cases, more of a concern. But it’s not all bad news and we’re pleased to note pockets of progress in some parts of the world.

So what does 2013 have in store for financial markets? In our latest Panoramic outlook, Jim outlines his macroeconomic and market forecasts for the year ahead. And remember, there are still a couple of days left to enter the M&G Bond Vigilantes Christmas quiz for 2012.

Enjoy!

Last night’s move by the Federal Reserve to change its approach to US monetary policy to effectively reduce the focus on the inflation target was just the latest step in an accelerating project by the world’s monetary authorities. In a world where unemployment rates are well above pretty much anyone’s estimate of the natural rate, and in many geographies well above 10%, the need for growth is seen as much more pressing that the fear of missing the 2% inflation targets. So at the latest FOMC meeting the Fed decided that inflation would be tolerated if it nudged higher to 2.5% as long as unemployment remained too high (above 6.5%). You can read the text of the Fed’s statement here.

We call this move by the world’s authorities away from the old idea of 2% inflation targets Central Bank Regime Change. We wrote this blog about it in March. The chart is worth showing again.

The chart from the IMF shows us that in the period post Paul Volcker’s appointment to the US Fed in 1979 (the orange line), the monetary authorities kept interest rates higher than the rate of inflation (they were reacting to the damage that inflation caused in the 1970s). As a result inflation steadily fell – and as well as high “real” rates, the rhetoric was all about inflation (inflation targets, the Bank of England’s Inflation Report, independent central banks). It’s been an awesome 30 years (on the whole!) to be a government bond investor, as yields fell in response to inflation fighting credibility. However, I’ve added another line to the IMF chart (blue), showing how central banks have behaved since Lehman went bust, and the credit crisis was followed by the sovereign debt crisis. It’s a very different story, with sharply negative real yields. Nominal interest rates are near zero in much of the developed world, yet inflation has been sticky above 2%. This is deliberate central bank policy – negative real rates are designed to make it attractive to borrow to invest and stimulate growth (and to deliver gains to indebted consumers), and also to encourage risk taking as investors reach for yield (government bond investors buy credit, investment grade investors buy high yield etc.).

Negative real rates also have an impact which we’ll discuss in more detail another time – debt reduction for bust governments. There are a few ways to reduce debt burdens: strong real growth (seems out of reach for the foreseeable future), austerity (unproven and probably counter-productive, although some point to Canada and Sweden as success stories), default (will be necessary for some Eurozone economies without their own currency to depreciate) and inflation. It’s the last that’s likely to be effective – and as the red line on that chart shows, it’s the method by which the western economies reduced the war debts following WWII.

So whilst we don’t believe the world’s central bankers and finance ministers are sitting high in some Swiss cable car complex, stroking white fluffy cats and cackling maniacally, plotting to generate super high levels of inflation, this is becoming the pragmatic (only?) response to a world without other policy responses (no fiscal flexibility left). Now the Fed’s latest move to target both inflation AND unemployment rates is very interesting – when I was a young student of economics, the idea that you could chose BETWEEN inflation and unemployment was discredited. To quote, er, Wikipedia on that idea, known as the Philips Curve “while it has been observed that there is a stable short run trade-off between unemployment and inflation, this has not been observed in the long run”. So the idea that you can choose both is probably even more far fetched.

Anyway, what does the Fed’s action mean? Well watching Bernanke’s press conference last night it struck me that in changing the Fed’s guidance away from the “no hikes until 2015” towards the unemployment and inflation numerical targets should actually be seen as a potential monetary TIGHTENING. After all, we are exceptionally bullish on US housing as a driver for growth in 2013 and 2014, so if things go well we could end up with the Fed raising rates ahead of the old 2015 date.

So I’ve asserted that Central Bank Regime change is taking place, but I thought it would be worthwhile to put together a brief list of the evidence so far. Here it is.

Evidence for Central Bank Regime Change

- The level of real rates set by the Central Banks: the best evidence is obviously shown on the graph itself. Are central bankers hitting inflation targets? Not really – for example the Bank of England has only had CPI at or below the 2% target for 6 months in the last 5 years, and for much of that period it’s been above 3% (and above 5% at one point!). On latest data the UK, the Eurozone and the US all have negative real rates of 1.75% or higher. Western central banks are even considering setting negative NOMINAL interest rates. Only Japan of the major economies has positive real rates at the moment – although we think this might change dramatically, as I’ll discuss below.

- The US refocus on the dual mandate: after three decades of inflation targeting, the Fed has been moving towards this new objective for a year or so now. First Charles Evans of the Chicago Fed started floating the concept of an unemployment target, then Janet Yellan (Bernanke’s probable successor) of the San Francisco Fed joined him, leading up to last night’s actions. This was pushing on an open door for Ben Bernanke who has written the following in his previous academic life…

- Bernanke’s 4% inflation target for Japan: in this paper, Japanese Monetary Policy: A Case of Self-Induced Paralysis, written whilst he was at Princeton in 1999, Bernanke argues that the solution for an economy like Japan with a burst property bubble, broken banks, sluggish growth and deflationary pressures should be to target inflation of between 3% and 4%. Looks similar to the US situation, so why wouldn’t Bernanke think that this is the correct response from the Fed for the US?

- Mervyn King’s softening stance on the inflation target: I guess actions speak louder than words, and the lack of actual inflation targeting in the UK for the last 5 years should tell you more than any speech, but I’d never heard the Governor soften his rhetoric until these words in this speech Twenty Years of Inflation Targeting this October. “There may be circumstances in which it is justified to aim off the inflation target for a while in order to moderate the risk of financial crises”.

- New Bank of England Governor Mark Carney talks about a new regime of nominal GDP targeting rather than pure inflation targets: in a speech to the CFA Society of Toronto this week, Carney (who takes over at the BoE next year) suggested that when policy rates approach 0% (the “zero bound”), targeting nominal growth might be more effective than targeting inflation rates. He even used, for the first time from a central banker (?) the term “regime change”. “Under Nominal GDP targeting, bygones are not bygones and the central bank is compelled to make up for past missed on the path of nominal GDP.” Of course, targeting nominal GDP is a very effective way of reducing debt levels in an economy too.

- Japanese regime change, the “Abe Trade”: this weekend Japan goes to the polls with opposition leader Shinzo Abe of the LDP favourite to emerge as the new Prime Minister. Japan has yet to recover from its bust, decades ago, and Abe wants to aggressively target growth. With deflation of 0.4% in Japan despite the BoJ’s 1% inflation target, Abe wants the central bank to do MUCH more. This would include raising the inflation target to 2% (or even 3%) and doing whatever it takes (more QE, currency intervention) to achieve that. This is a manifesto commitment that might get watered down at a later date – but having seen a BoJ member in Tokyo recently I get the feeling that a hike in its inflation target is inevitable.

- Europe: hard evidence is more difficult to find, but with hawkish German ECB members like Axel Weber and Juergen Stark both resigning in 2011 (“It’s generally known that I’m not a glowing advocate of these (bond) purchases” – Stark) the ECB has been much more open to extraordinary balance sheet expansion (LTRO, SMP, OMT). And to more “traditional” Quantitative Easing at a later date?

So with all of this evidence that the authorities are changing how they think, and act, on inflation, you would expect that bond markets would have reacted badly right? If Ben Bernanke thinks 4% is an appropriate level for inflation in the US, you wouldn’t be lending money to the government at 0.65% for the next 5 years would you? And with Mark Carney taking over at the BoE next year, breakeven inflation rates (i.e. market inflation expectations) would be overshooting the 2% inflation target over the next few years too? Well 5 year Treasury yields are still well below 1% (helped by QE buying of that sector, announced last night) and UK breakeven inflation rates on a CPI basis are below the 2% inflation target. In both cases it feels as if state intervention in these markets (financial repression through QE, capital requirements etc.) will keep yields low despite high inflation. And this is entirely necessary – with half the US Treasury market maturing in the next 3 years or so, if yields ever did adjust higher then western governments, with marginal solvency in any case, could go bust quickly.

Anthony recently returned from a research trip to Singapore where he spoke to a number of investors. During his time in the Asian city-state, he took his Bond Vigilantes camera to share with all of us what he’s learnt about Singapore, its economy, and fixed interest markets.

Despite its small geographic size, the Singaporean economy is one of most prosperous in the world, fuelled by a strong international trade link. The Singaporean model advocates for a mixed economic framework where free-market policies coexist with the Monetary Authority of Singapore’s intervention in macroeconomic policy.

With an intact AAA Sovereign credit rating, Singapore finds itself in a fantastic fiscal position which, together with a rapidly developing financial market and robust banking system, has made it one of the most open and competitive markets in the world. And, with the third largest GDP per capita in the world, we wonder if perhaps the Asian city-state could provide some valuable economic lessons for its south-east Asian neighbours.

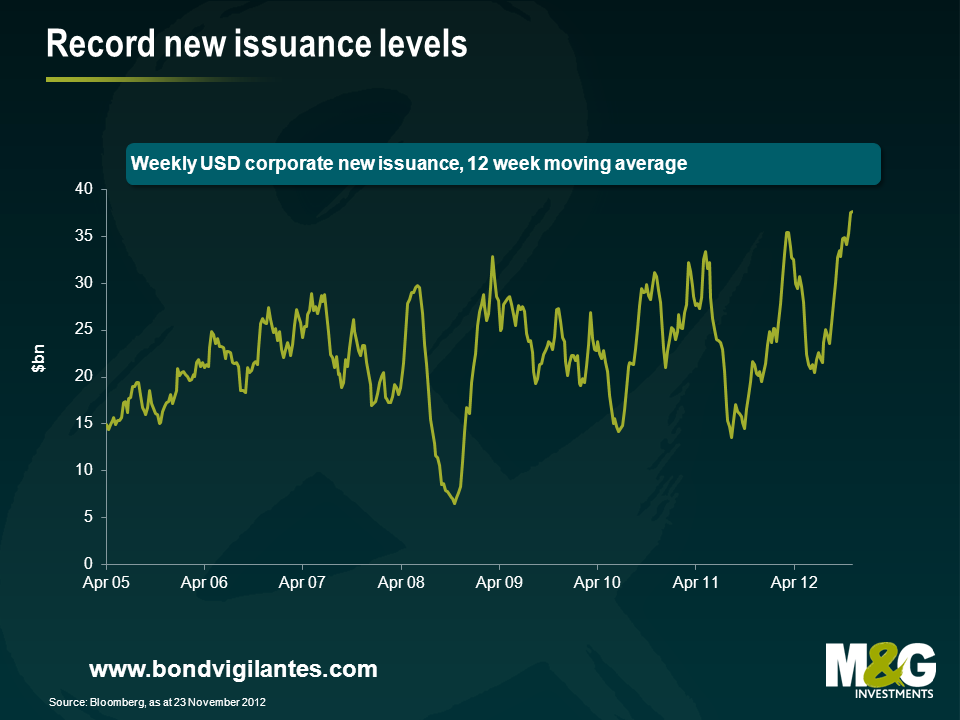

It has been a great few months for corporate bond issuance, as illustrated in the chart below. This huge flush of new transactions where buyer (investor) meets seller (issuer), shows that the primary market is in a historically healthy state, with buckets of liquidity. However, since the credit crunch there has been a great deal of discussion re the corporate bond market becoming less liquid, as dealers’ ability to bid for bonds has gone down the pan. Which is right?

Since the credit crunch began, the financial intermediaries who provide immediate liquidity for bond investors have been under a great deal of capital stress. Losses on securities, more conservative management, and reduced yet more expensive capital, have resulted in a shrinking of their market making balance sheets. This is illustrated in the chart below with data from the Federal Reserve showing primary dealer positions in corporates with maturities of more than a year.

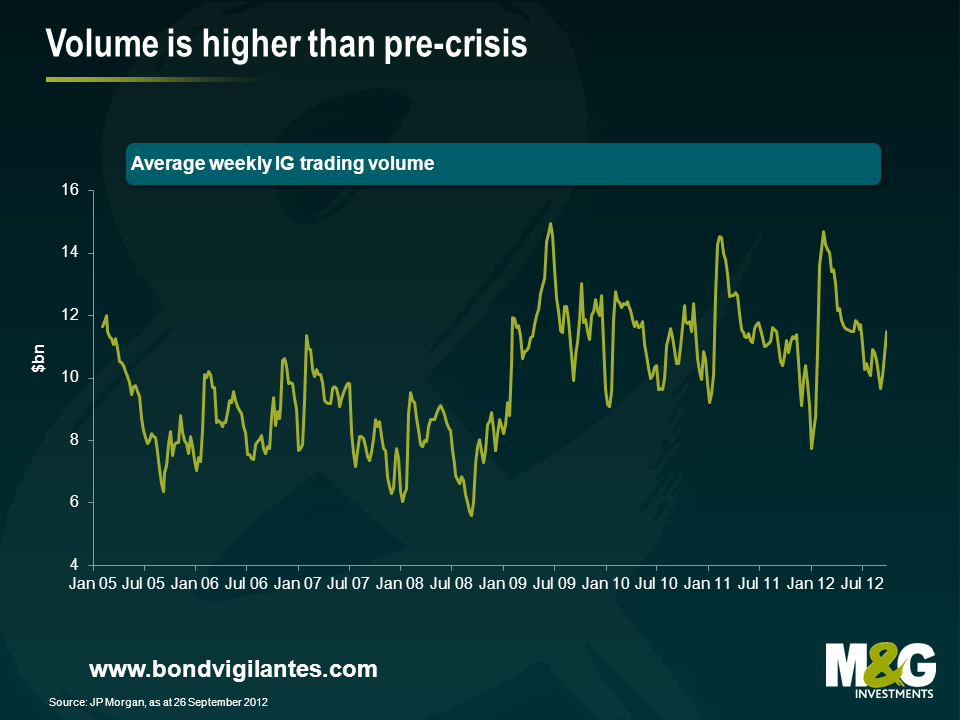

According to some market observers, the above indicates that traders’ ability to take on risk has collapsed by roughly 80 percent, and therefore corporate bond market liquidity must have collapsed significantly in tandem, due to the disappearance of this historic pool of capital to bid for securities. However, we think this is a rather simplistic way for investors to explore what is going on. The chart below shows a far more relevant number than the size of dealers’ books – the actual historic trading volume in secondary corporate bonds, which gives a stronger indication of real, rather than hypothetical liquidity. This shows that turnover has not collapsed 80 percent in the same way as dealer inventory, and in fact daily volumes are on a par with where they were in 2007. It is also worth noting that investment banks’, and their shadow bank counterparts’ percentage of this volume will have fallen, and so it is likely that transactions between genuine end investors have increased substantially in real terms, and as a percentage of this turnover.

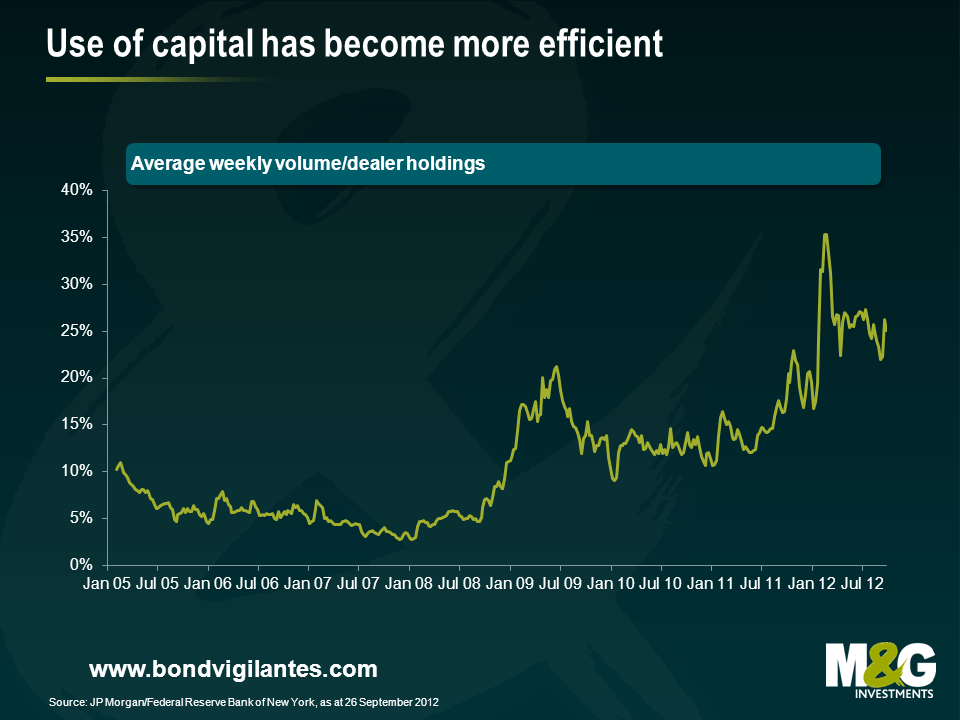

Back in 2007 the markets were exceptionally liquid. They were dominated by short term players using cheap regulatory capital to take on enormous credit risk. This was done directly by investment banks on their own account, or to warehouse positions to be sold on to vehicles such as CDOs and CLOs as they were launched. This activity has collapsed. So, along with the more stringent capital environment, the size of their inventories has understandably shrunk considerably. However, making markets and operating in the corporate bond market remains an important source of revenue for these financial intermediaries. Despite less capital being deployed, total secondary volume has recovered to 2007 levels, which means they have become more efficient and turnover per unit of inventory has gone through the roof, as illustrated below. The financial crisis has changed banks’ and investors’ appetites for and abilities to take risk.

The financial crisis has also driven a significant fundamental shift in how capital markets work. The recycling of capital (through the mismatch of risk taken by banks that was the route of the credit crunch) by using short term deposits to lend long term that dominated the landscape in 2007, is now morphing into a new, hopefully more stable process of borrowers being funded via the corporate bond market. Bank lending has shrunk, and the capital markets, led by the expanding bond market have attempted to fill the gap. As bank lending is replaced by more permanent term bond lending, then term mismatch and credit risk in the banking system is reduced, and that term and credit risk is assumed by the bond investor. The bond investor not only gets paid for assuming this risk but also has to work out what liquidity premium they need to be paid on top of the term and credit risk they have taken on board with their corporate bond position.

This premium will vary over the cycle like the other drivers of returns – credit and interest rates. It will expand when credit markets are weak, and liquidity poor (eg autumn 2009). It will contract when the credit outlook is great and liquidity high (spring 2007), and is something all investors need to be aware of when investing in the asset class. An investor in corporate bonds should examine where we are in the liquidity cycle, and should be aware that the perfect liquidity and huge dealer inventories of 2007 contributed to the ensuing rout in the asset class, while the illiquidity of the winter of 2008 was a great opportunity to buy and take advantage of the expanded liquidity premium. We know from the last 5 years that to an investor in corporate bonds, perfect liquidity can be a precursor to more dangerous times than illiquidity can.

Is corporate bond liquidity brilliant or is it at record lows? Well, it appears that daily volume of primary markets is at record levels, while secondary market liquidity has not grown in line with the size of the market place, but is not as low as a simple analysis of dealer inventory would imply. It is hard to know what average daily liquidity should be, as the market has been evolving in the recent dramatic economic conditions. However, the total liquidity of all transactions, both primary and secondary, indicates a growing, interesting market place as banks are being replaced by the corporate bond market as the funding vehicle of choice.

For the sixth year in a row, we bring you the Bond Vigilantes Christmas Quiz. As always there are 20 questions, and the closing date for entries is midnight on Thursday 20th December 2012. Please email your answers to us at bondvigilantes@mandg.co.uk.

The prize is, once more, glory. But the winner will also get to choose a charity to which we will donate £200. He or she will also win a hardback copy of Philip Coggan’s excellent Paper Promises: Money, Debt and the New World Order. The nine runners up will get a paperback copy of the same. Conditions of entry are shown at the bottom of this post entry. Good luck!

- What was created especially for Winston Churchill in 1950 as a brandy-like celebration drink?

- “We’re just going to draw the raffle numbers now”. Who said this and when?

- What’s this called?

- “Beam me up Scotty”. Why was it third time lucky this year?

- How is James Gatz from North Dakota better known?

- Held in 1994, it is said to be the biggest rock or pop concert ever. Who performed and where?

- Archaeologists recently discovered a mummy in the Valley of the Kings, covered in chocolate and nuts. Who is it believed to be?

- The winner of this 7.4km race gets a red coat with a silver badge. Which race?

- What do all the cover stars of this magazine have in common?

- Which fairground ride’s name derives from a military training game seen by crusaders in Turkey in the 12th century?

- The Nike swoosh, a cheap US hipster beer, and a prize for fast ships. What?

- What were bulky, ungainly monstrosities more suitable for the wide open vistas of a Scandinavian airport?

- It shows a hundred consecutive pulses from the pulsar CP 1919, but is best known as what?

- Coppi was the first, Pantani the last. To do what?

- Who famously finished the story of Bleak House, and was then sitting down to start Great Expectations that afternoon?

- Whose stationery did this logo head up?

- Following electromagnetic surveys, and eyewitness accounts from elderly locals, it’s hoped that a dig will uncover 36 of them in Burma. What?

- Earlier this year, a hedge fund managed to seize an asset as part of its claim against Argentina following the latter’s sovereign bond default. What was it?

- Who is this?

- As he looked through a hole in a wall in 1922, someone asked him if he could see anything. He said “Yes, wonderful things”. Who was he?

To enter the competition, please click here and to view the T&Cs, please click here.

This competition is now closed.

The information we collect from you is used solely to notify you should you win the competition