Opportunities in Spanish ABS

As fund managers it’s our job to take risk when and where we are being paid (preferably overpaid) to do so. One area where I feel that this is currently the case is European residential mortgage backed securities (RMBS), particularly Spanish RMBS.

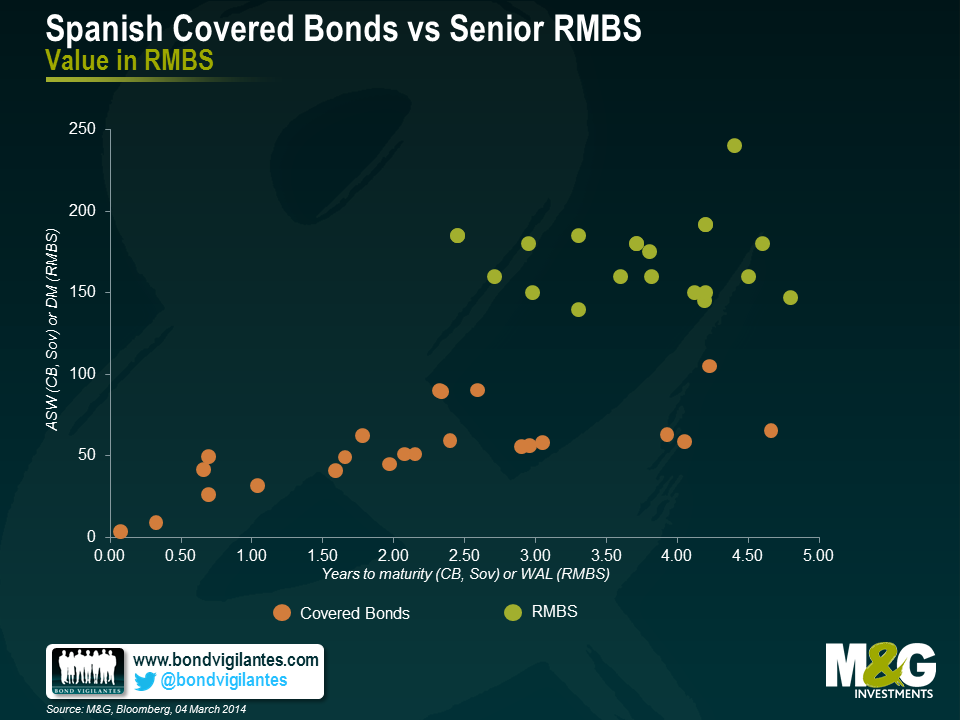

It’s fairly easy to find senior Spanish RMBS trading as much as 100bps wide of equivalent covered bonds at the moment. The collateral in these deals was originated by the same banks as in the covereds, they return the principal over a comparable time horizon, and contain features that will be beneficial to investors if the Spanish housing market begins to weaken again.

The chart below shows this relationship nicely. Here we have plotted (minus the names of the individual bonds) short-dated covered bonds issued by three Spanish banks and what we consider to be similar quality senior RMBS. The pickup I mentioned earlier is clearly evident in the 2.5-5yr maturity/weighted-average life area:

The main reason for this discrepancy is regulation. Financial regulators have deemed RMBS to be more risky than covered bonds and they therefore require banks and insurance companies to hold more capital on their balance sheets to compensate.

While I appreciate that covered bonds give investors dual recourse and that covered bond legislation in Spain is strong, I’m not sure how much the extra senior unsecured claim in a failed Spanish bank would actually be worth. Hence in general I prefer to hold a senior note in an RMBS deal where we have good visibility of the collateral, and which includes structural provisions that mean senior note holders potentially get their capital back sooner if the housing market deteriorates.

The ECB apparently takes the same view as the regulators and charges anyone wishing to use RMBS as collateral for repo transactions more than they do for covered bonds. They apply a haircut of 10% to RMBS but only 4.5-6% to covered bonds for investment grade quality instruments, assuming a five to seven year maturity. What I’m really saying is that I disagree with the regulators, and therefore see this as an opportunity to generate a higher return for a similar level of risk.

Interestingly the Bank of England applies the same haircut of 12-15% to both short-dated RMBS and covered bonds. The spread difference exists here too – albeit with both markets trading considerably tighter – which I think shows that it’s the regulation that is really skewing these markets.

I’m not arguing that investing in the Spanish mortgage market is without risk. But I do believe that investors who, like us, don’t repo their bonds or need to hold capital against them can and should take advantage of these kinds of unintended regulatory consequences.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox