Respect Your Seniors – TXU Default Case Study

On 29th April, Energy Future Holdings Corp (the energy business formerly known as TXU) filed for Chapt 11 bankruptcy, listing $49.7bn in debt liabilities. This came after several months of back and forth negotiations between various creditors and the owners of the business. As such the filing was widely expected and the market had been pricing this in.

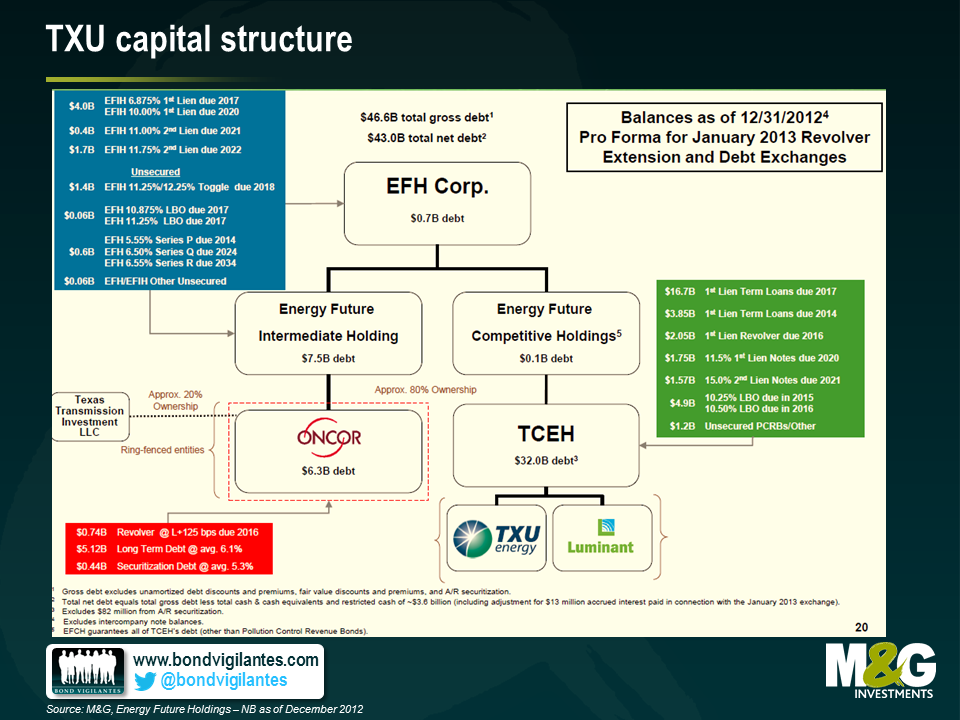

One thing that was quite an eye-opener, however, was the huge range of recovery values on the various tranches of debt issued by the business. Part of this was due to the inherent complexity of the company’s capital structure. The company had 14 separate major bond issues, issued out of a range of different entities with differing claims on the company’s various assets as shown below:

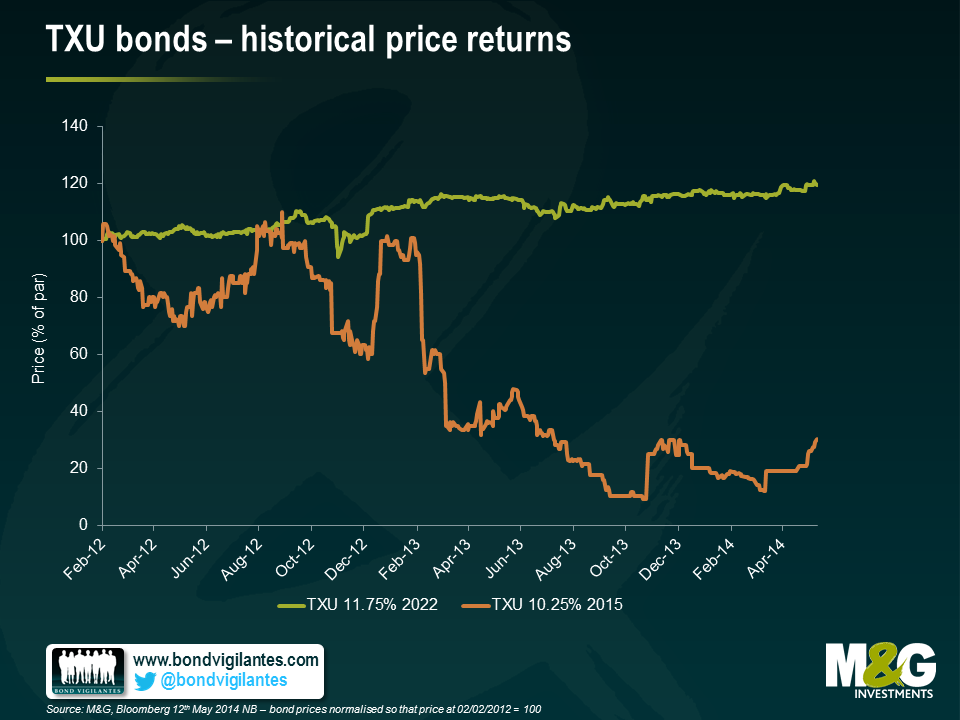

This great diversity of debt and different legal entities in the capital structure has meant similar differentiation in recovery values for the bonds. Below are some of the trading levels we currently see in the market for the more liquid bonds. At one end of the extreme, the TXU 11.75% 2022’s are currently trading at 119.5% of face value whilst the TXU 10.5% 2016’s languish at 8.8 cents in the dollar. The difference in price reflects the bonds’ relative position in the queue of claims for the company’s assets.

The difference of experience in terms of total returns from these bonds is also stark. Holders of the 11.75% 2022 bonds enjoyed a capital return of c 20% over the past two years (on top of the 11.75% coupon each year), whereas holders of the 10.25% 2015 bonds have been hit with a capital loss of c.70%.

What we think this illustrates very well is that seniority and position in a capital structure has a major impact when determining potential downside for high yield investors. Indeed this factor can often be more important in the event of a default than the quality and credit worthiness of the underlying borrower. Additionally, and somewhat counter-intuitively, it also shows that bondholders can still experience positive returns even if the business they have lent to goes bankrupt.

Whilst the TXU bankruptcy is one of the echoes of the last LBO frenzy of 2006 and 2007, we believe that where you invest in the capital structure will also be important going forward. When default rates do eventually rise from their currently low levels, investing in bonds that rank senior in a capital structure will be one way to limit the potential downside of a high yield portfolio.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox