The Great British Austerity Myth

On the right is UK Chancellor George Osborne, the austerity axeman. On the left was opposition leader Ed Miliband, the fiscal freedom fighter. But it now appears that Miliband and co are so alarmed that Cameron and Osborne are better trusted by the electorate to run the now booming UK economy that they are quietly embracing Tory austerity. The Liberal Democrats have accused the Tories of pursuing austerity for austerity’s sake, but are still targeting eliminating the budget deficit in the next three to four years. That essentially leaves the Scottish National Party, which is urging Scots to vote for independence so that Scotland can ”escape Westminster’s austerity agenda”.

The problem with all this austerity posturing is that it’s built on a completely phoney premise. As confirmed by data released today, there hasn’t been any UK austerity, at least not for a couple of years. Indeed, that probably goes a long way to explaining why the IMF predicts that the UK will have the fastest growing economy in the developed world this year.

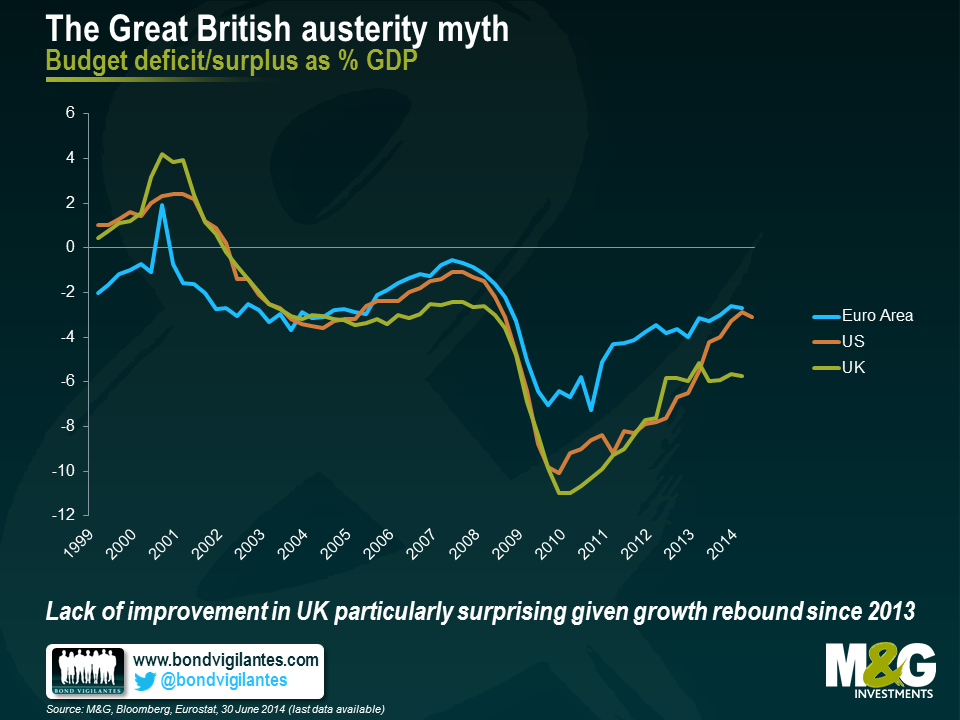

The chart below puts the UK’s budget balance into international context. The US has seen immense fiscal consolidation, which was a major drag on growth in 2011-2013 but which will substantially fall hereafter, and is one of a number of reasons why we’re US economy bulls. Eurozone fiscal consolidation was enforced by markets to an extent, although the Eurozone as a whole – as per the US – is currently running a budget deficit akin to levels seen in 2004-05. And Germany, a country under zero pressure from markets, expects to balance its budget this year. The UK economy grew almost three times faster than Germany’s in the year to Q2, and yet its deficit remains huge by historical standards.

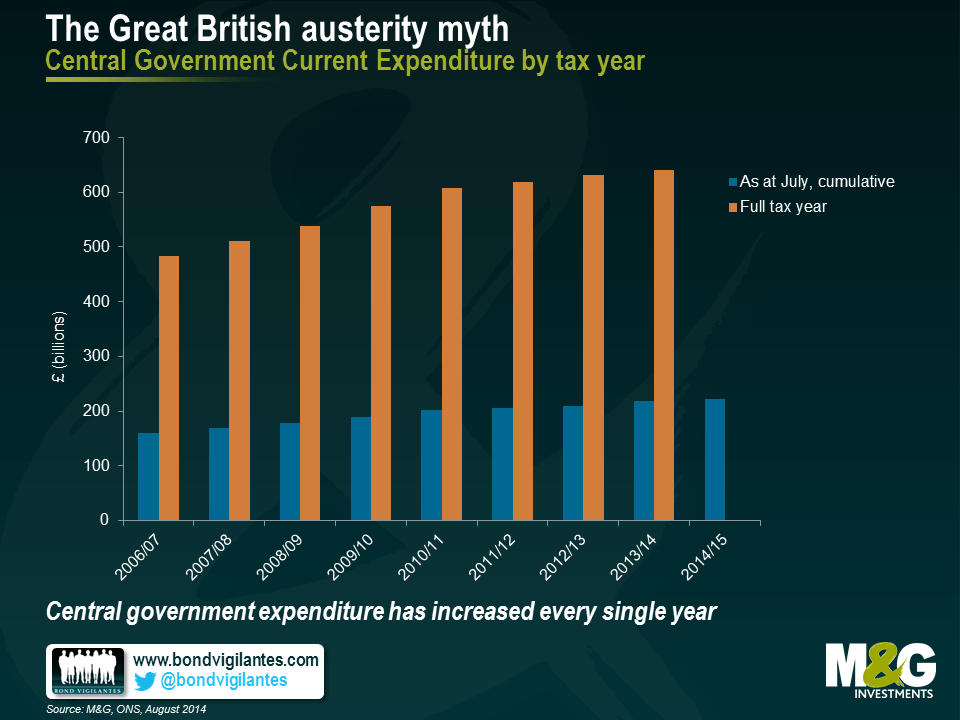

The primary reason for the UK’s unfrugal fiscal policy is an inability to cut back on government spending. It’s not just overspending, however. Tax revenues in the first four months of this tax year are 1.9% below where they were in July 2013, and that’s in nominal terms, let alone real terms. The Office for Budget Responsibility (OBR) will be able to provide more detail on this when they release their summary later today. It’s likely that part of this is due to the front loading of receipts last year, thus making like for like comparisons tricky, and the OBR will probably forecast a pick up in receipts towards the end of this year.

The chart below illustrates how government spending in the UK has increased every single year.

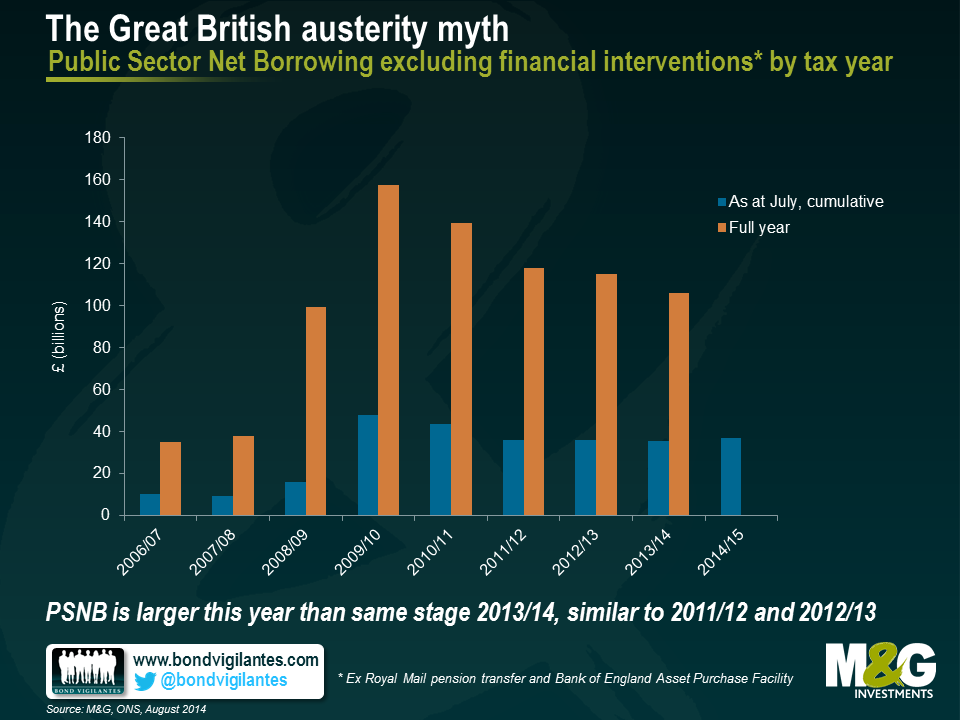

An addiction to spending combined with weak tax revenue growth means that the Public Sector Net Borrowing figures are going nowhere fast. In the four months to July, Public Sector Net Borrowing (ex financial interventions) was actually higher than in 2021/12, 2012/13 and 2013/14. Again, the OBR will have more to say about this later, but there’s no denying that the UK’s government finances make grim reading.

Now all that said, I’m not suggesting that the UK government should necessarily adopt tighter fiscal policy. While current fiscal policies aren’t sustainable in the long term, loose fiscal policy has recently been successful in generating strong economic growth, and more importantly it appears to have helped encourage the private sector to finally start investing. Furthermore, you would traditionally expect countries that run sustained loose fiscal policy to have relatively steep yield curves, but the opposite is true in the UK at the moment, with some longer forward yields close to record lows. In other words, the markets don’t care – yet – and a good argument can be made for the government to fund some much-needed and ultimately productive UK infrastructure investment. All I’m saying is that the UK electorate deserves a lot more honesty in the debate.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox