The M&G YouGov Inflation Expectations Survey – Q3 2014

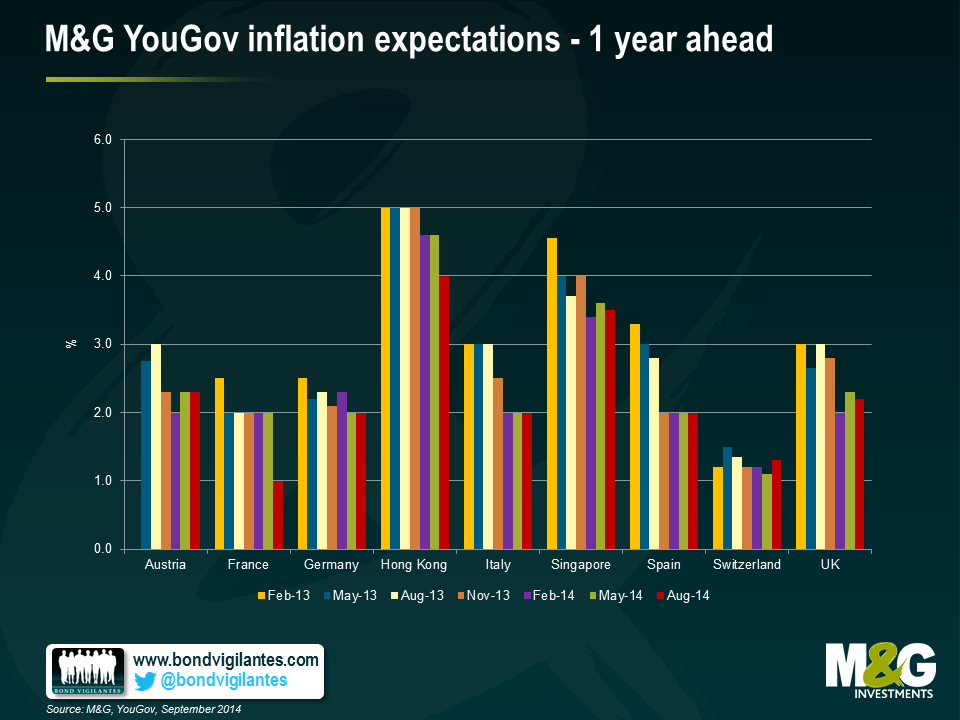

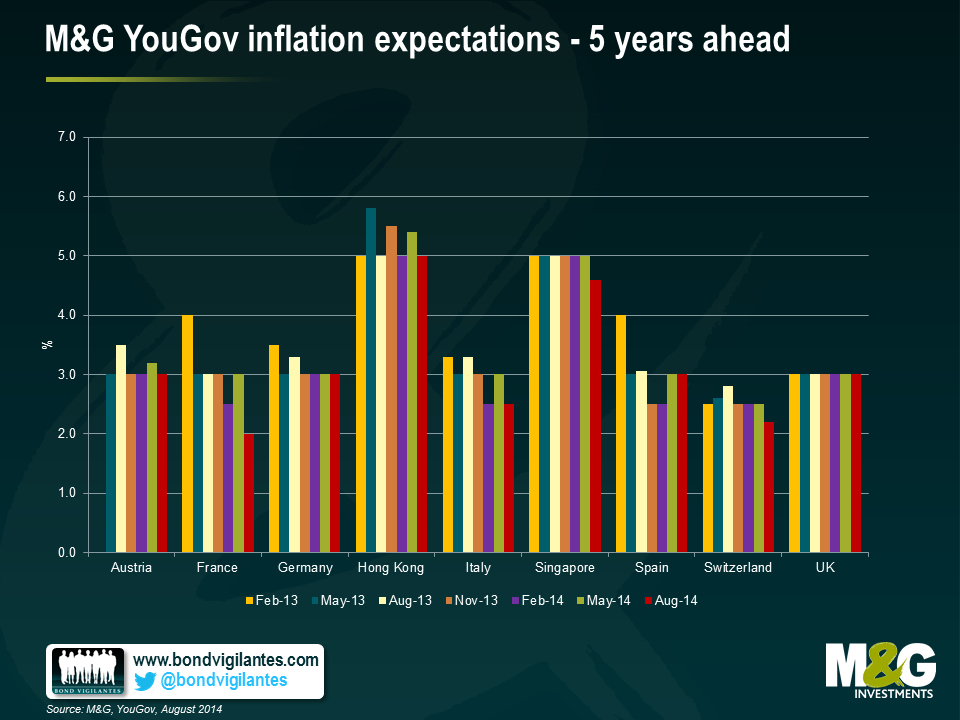

The results of the August 2014 M&G YouGov Inflation Expectations Survey suggest that inflation expectations have moderated across the UK, most European countries and Asia. Short-term inflation expectations in the UK have fallen from 2.3% to 2.2% after an upwards bounce in the May survey. However, over a five year period, expectations remain unchanged at 3.0% for the 7th consecutive quarter. UK consumers have modestly raised their confidence in the Bank of England, with 49% of respondents now expecting Mark Carney to deliver on price stability.

In Europe, short-term inflation expectations remain unchanged at 2.0% in Spain, Italy and Germany. However, in France, the expected rate of inflation for the next 12 months has dropped a full percentage point over the quarter and is now just 1.0%, the lowest level in the history of the survey. Notably, a larger proportion (48%) of French respondents believe their net income will decrease over the next 12 months, despite the fall in inflation expectations.

Over the long term, inflation expectations in all Eurozone countries surveyed except France remain above the European Central Bank (ECB) target, although there are signs of moderation in some countries. Compared to last quarter, inflation expectations have fallen across Austria, France and Italy, although not in Germany and Spain, where they have held steady at 3.0%. The downward pressure is most evident in Italy and France where long-term expectations have fallen to 2.5% and 2.0% respectively, amid an increasingly challenging political environment. The number of Italians in disagreement with their government’s current economic policy has increased notably over the quarter from 44% to 53%. Switzerland stands out as being the only country to report a rise in short-term inflation expectations (from 1.1% to 1.3%) and also for the high level of confidence that Swiss consumers continue to place on their central bank (54%).

In Asia, the gauge for inflation over the short term has fallen to the lowest level since the inception of the survey (Singapore 3.4% and Hong Kong 4.0%). Interestingly, despite reporting a reasonably high level (45%) of confidence in their central bank’s ability to achieve its inflation target, consumers in Singapore nevertheless expect inflation to more than triple to 4.6% over the next five years.

The findings and data from our Q3 survey, which polled almost 8,500 consumers internationally, is available in our latest report.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox