It’s the regulation, stupid: the ECB’s ABS purchase programme

The ECB is finally joining the Quantitative Easing (QE) party. Un-sterilised asset purchases have been a major policy tool in most of the developed world over the past few years but next month (as the Fed ends theirs, incidentally) the ECB will make its first foray into QE proper by embarking on an asset backed security (ABS) purchase programme.

Through this programme, focused on “simple, transparent and real” asset backed securities, the ECB hopes to stimulate lending to the real economy and so help see off the ever looming prospect of deflation. A healthy ABS market should hopefully offer banks a long-term alternative to cheap central bank funding, backed as these instruments are by loans as varied as car loans, mortgages and credit card payments.

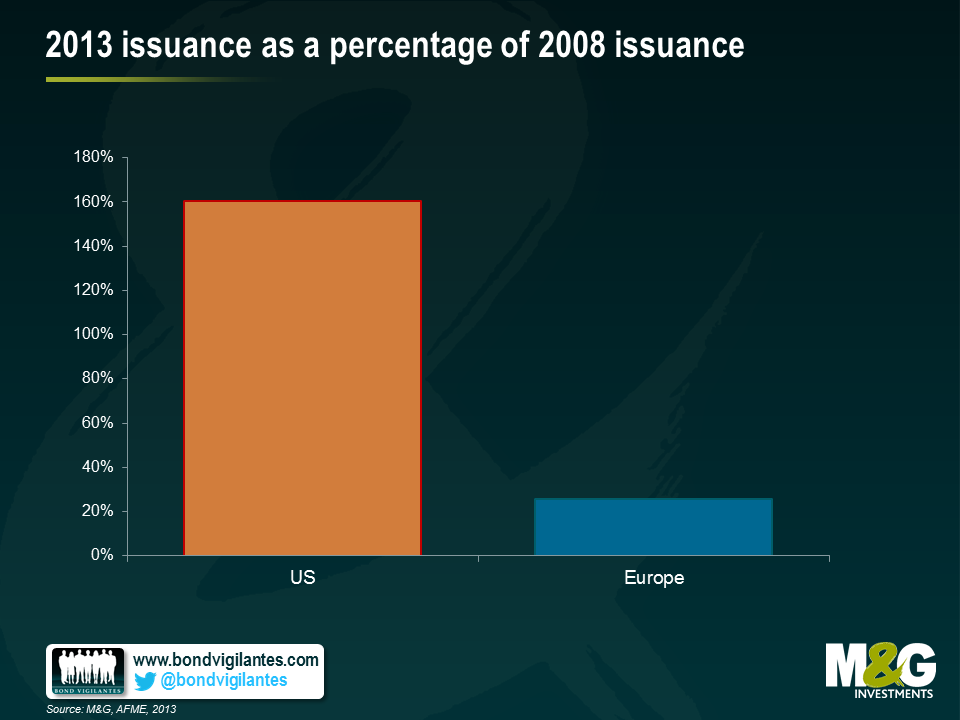

It’s pretty clear that the market in Europe is in need of invigoration, having been all but closed for business since the financial crisis. ABS issuance in Europe in 2013 totalled just €183 billion (according to data from the Association for Financial Markets in Europe) compared to €711bn back in 2008. The US market is by contrast in far ruder health, with 2013’s total of 1.5 trillion Euro’s worth of issuance, comfortably surpassing 2008 issuance of the Euro equivalent of 934bn.

But – and there is a but – there is a very substantial obstacle currently standing in the ECB’s way. This takes the form of a regulatory barrier – namely, the treatment of securitisation under the latest version of the Solvency II proposal. Under Solvency II, as it stands, insurance companies (a large pre-crisis investor base) have to hold twice as much capital to invest in a five year AAA-rated Dutch RMBS than if they hold a covered bond of the same rating and maturity, backed by similar assets. For peripheral eurozone issuers the situation is even starker – the capital charge on a five year A+ Spanish RMBS stands at approximately 20%, versus a charge of 7% for a similar covered bond. While this doesn’t apply for asset managers such as ourselves, it presents a very real disincentive for insurers, who must calculate that they can achieve a better return on capital elsewhere.

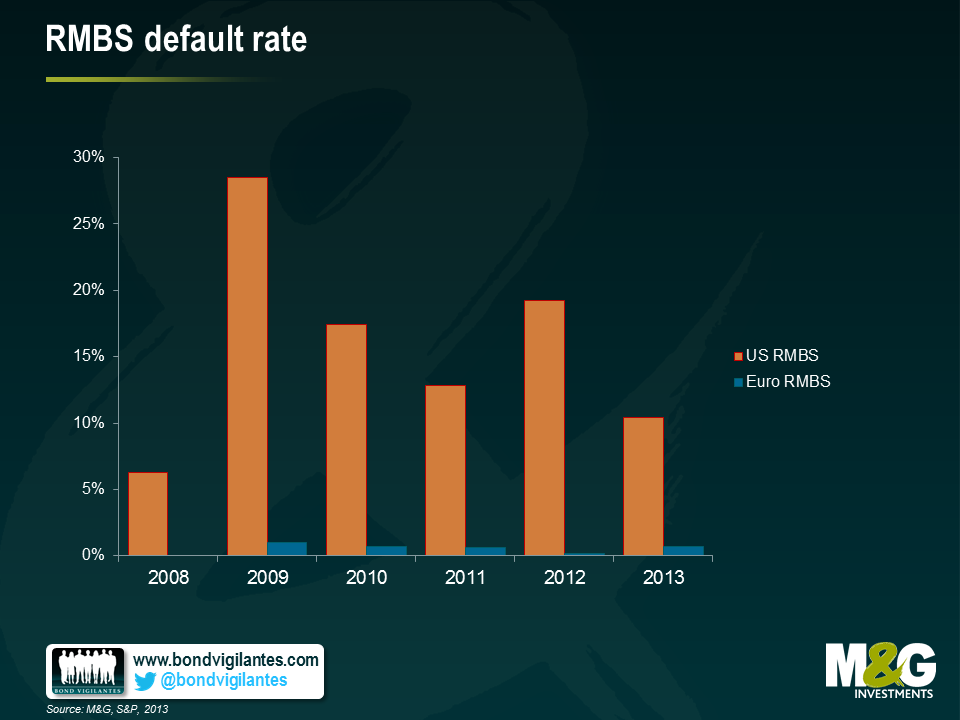

The idea behind these elevated capital charges is surely to protect balance sheets against the likelihood of default. But a quick look at default data makes for interesting reading. According to a Standard & Poor’s default study, default levels on European RMBS have reached a high of just 1% over the last six years. Yet in the US, where capital charges are more in line with those on corporate bonds, default levels on RMBS have been far higher – up to 28.5% in 2009, and still a little over 10% in 2013. Whilst there is some differentiation between regulatory classifications of ABS securities, in general, US capital charges are significantly lower than in Europe across all instruments.

This is a particularly pressing issue on two counts: not only does the ECB hope to kick off its ABS purchase programme in October, but the draft Solvency II legislation is due to be voted on at the end of September. Unless the European Commission moves swiftly to adapt the existing draft regulation, any attempts by the ECB to stimulate the market will likely be in vain. At a minimum, the ECB needs to at least equalise the capital treatment of instruments such as RMBS with that of other asset-backed products such as covered bonds.

After all, without demand from a wider client base than the ECB itself, there will be little incentive for issuers to supply these instruments. In this case, the market will continue to stagnate, and a valuable opportunity to invigorate lending to the real economy will likely be wasted.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox