Ten reasons to like US high yield today

Global growth concerns, fears of a less accommodative Fed, and limited high yield market liquidity coupled with complacent and crowded investor positioning has served to reprice the US high yield market over the past few months. Following on from the worst quarterly performance in Q3 2014 for some three years, the US high yield market arguably now offers a significantly more attractive entry point. Whilst acknowledging that the market has moved faster over the past few days than I was able to write this blog, here are ten reasons why US high yield could be considered a buy at these levels:

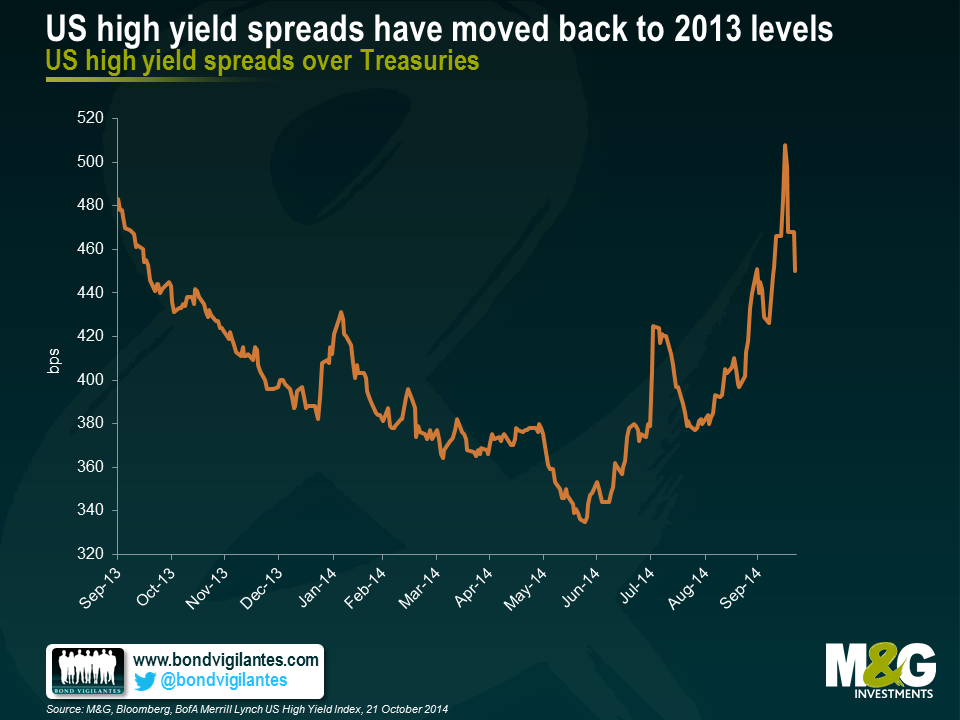

- Spreads have moved back to levels not witnessed since October 2013. In June this year, spreads had only been tighter for around 17% of the time (since our data began in the mid-1990s). The recent correction left this number peaking at around 40%.

- The yield on the BofA Merrill Lynch US High Yield Index recently reached 6.4%, having traded as low as 4.85% in June, and is currently around 6%, a level likely to appeal to institutional buyers.

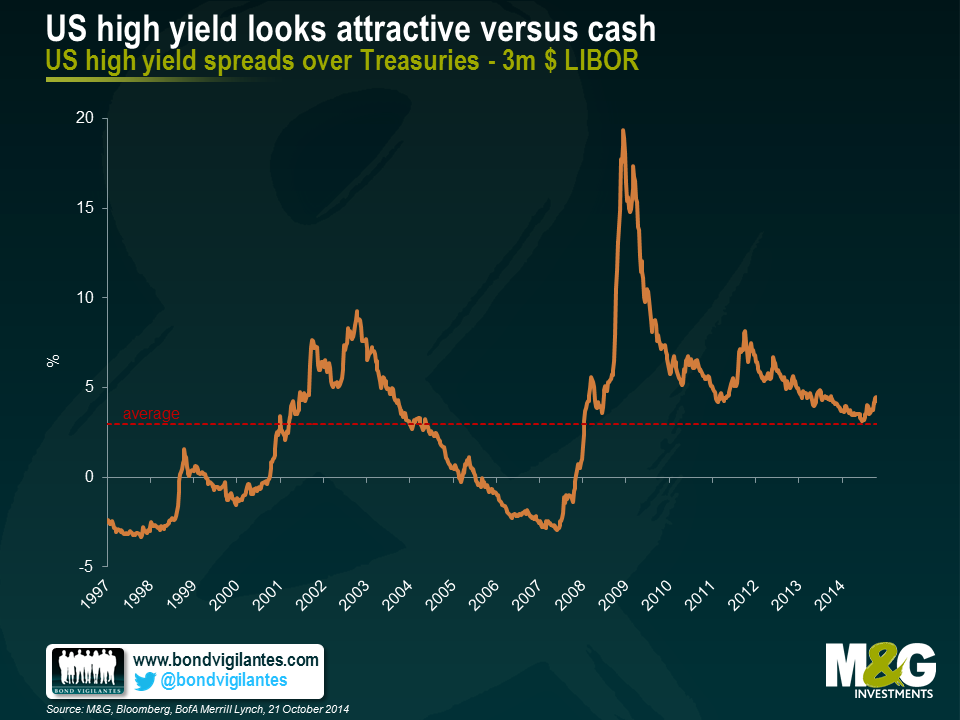

- Whilst the absolute level of yields may look low by historic standards, valuations relative to cash and government bonds still look compelling.

- Given the relatively high level of income the asset class generates, and a benign outlook for defaults, the asset class can suffer considerable spread widening before underperforming cash and government bonds. Assuming a 2% default rate and no change in government bond yields, high yield spreads would need to widen by approximately 100bps from current levels to underperform a similar duration US Treasury bond. This would see spreads back at levels not witnessed since 2012.

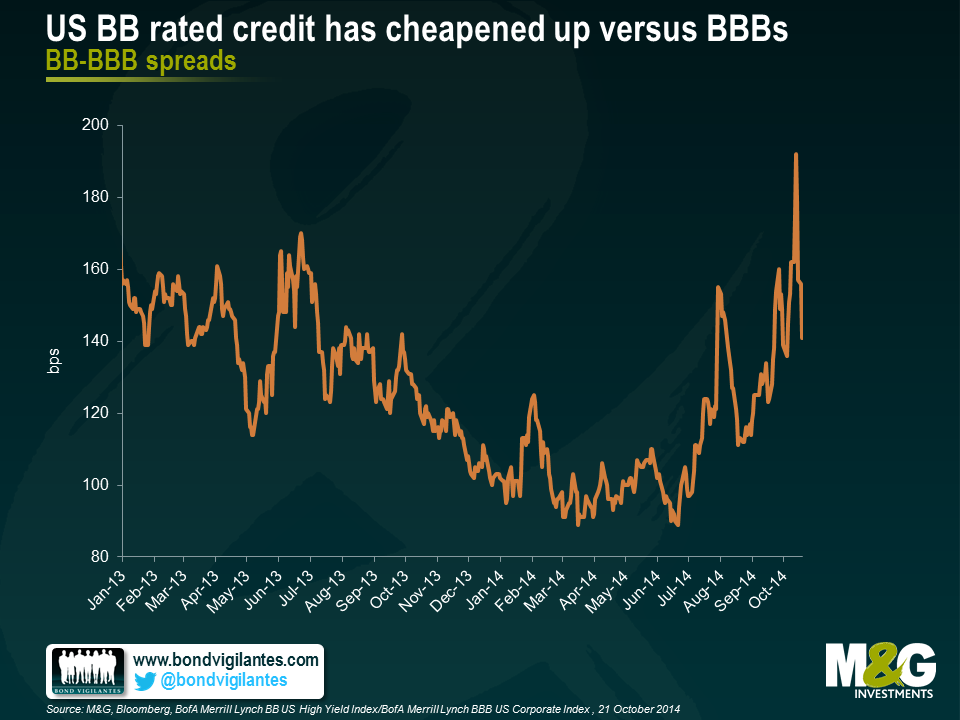

- Other fixed income assets have significantly outperformed high yield so far this year. According to BofA Merrill Lynch indices, US Treasuries have returned 5.5% and investment grade corporates have returned 7.7% year-to-date, while US high yield has gained 4.5%. As the chart below shows, BB rated bonds (the highest rated category of the high yield market) have cheapened up considerably vs BBB corporates.

- Technicals are in a much better place than they were a few months ago, with the asset class having witnessed some $21 billion of outflows in 2014 (according to BofA Merrill Lynch). New issue supply has slowly abated and the market is becoming more discerning about taking risk.

- US high yield company fundamentals, although having worsened slightly over the past couple of years, still look in reasonable shape, with leverage and interest cover both at 3.9x at an index level.

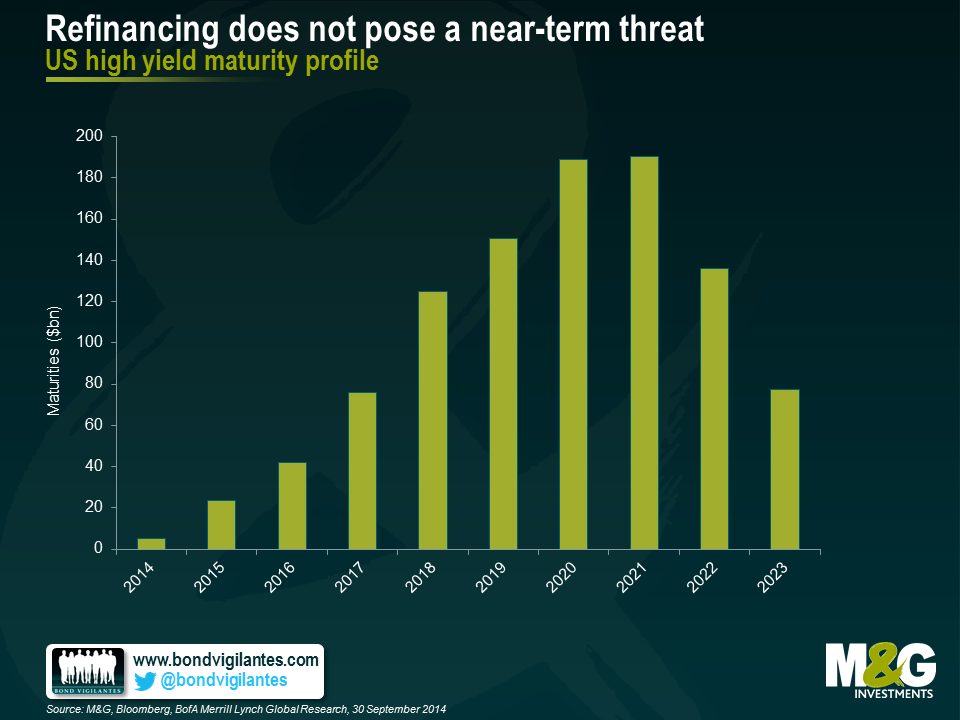

- The backdrop for defaults remains benign. Re-financing risk is one of the major obstacles for leveraged companies, but this risk appears limited over the next couple of years as many companies have taken advantage of abundant liquidity to term out their debt, as illustrated in the chart below.

- When the Fed eventually raises rates, it is likely to err on the side of caution and tighten policy slowly. The carry trade is unlikely to come to an abrupt end in the near future.

- Tighter policy is likely to be accompanied by an improving economic backdrop. Whilst the corporate profit share of GDP is already relatively high, it is likely that this would be sustainable in a stronger economy.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox