Tail about to wag dog again – Italy and Spain downgrades are coming, more carnage to follow

So now we know that the firewall was indeed an illusion. We had the biggest ever sell off in Portuguese and Irish CDS on Wednesday (and the second biggest sell off in Greece CDS), and now it’s a bloodbath in Italy. Italian 10 year bond yield spreads have widened 25 bps versus Germany to a Euro era record. Long dated Italian government bonds fell as much as 2 points earlier today. Unicredito shares were suspended limit down, as they were exactly two weeks ago.

It now costs Italy 4.6% if it wants to borrow for five years, and 5.3% if it wants to borrow for 10 years. Italy was until recently deemed by the market (not by us) to be the ‘safe’ peripheral country, and a lot of international investors have been overweight Italy versus benchmarks as a proxy against zero holdings in Portugal, Ireland, Greece and Spain. The Italy bulls have put forward arguments such as while the public sector debt/GDP ratio is a worrying 120%, Italy actually has very little private sector debt (a bit like Japan). Or that Italy is too big to fail (it has the third most government debt outstanding in the world at over €1.6 trillion; only Japan and the US have more). Or that Italy has a very big liquid government bond market, with big domestic buyers. Or that its public/debt GDP ratio and its interest burden were much worse in the 1990s and it survived that. Or that Italy’s debt has a long average maturity, meaning that immediate funding costs aren’t too onerous and it can tolerate higher bond yields without seeing its interest burden rise too much (a bit like the UK).

The Italy bears argue that Italy may be seen as too big to fail, but that doesn’t mean that it won’t, it’s too big to bail out. Or Italy’s banks are seeing a slow but steady deterioration in asset quality. Or the deteriorating political situation. The bears’ main worry is how Italy can prevent its high public debt/GDP profile from deteriorating given its appalling growth outlook. Perhaps my favourite Italy statistic is that Italy’s GDP per capita is lower today than it was in 1999, which is remarkable considering the dismal economic performance was during the ‘boom’ years (Zimbabwe and Haiti are two of only a small handful of countries to have fared worse).

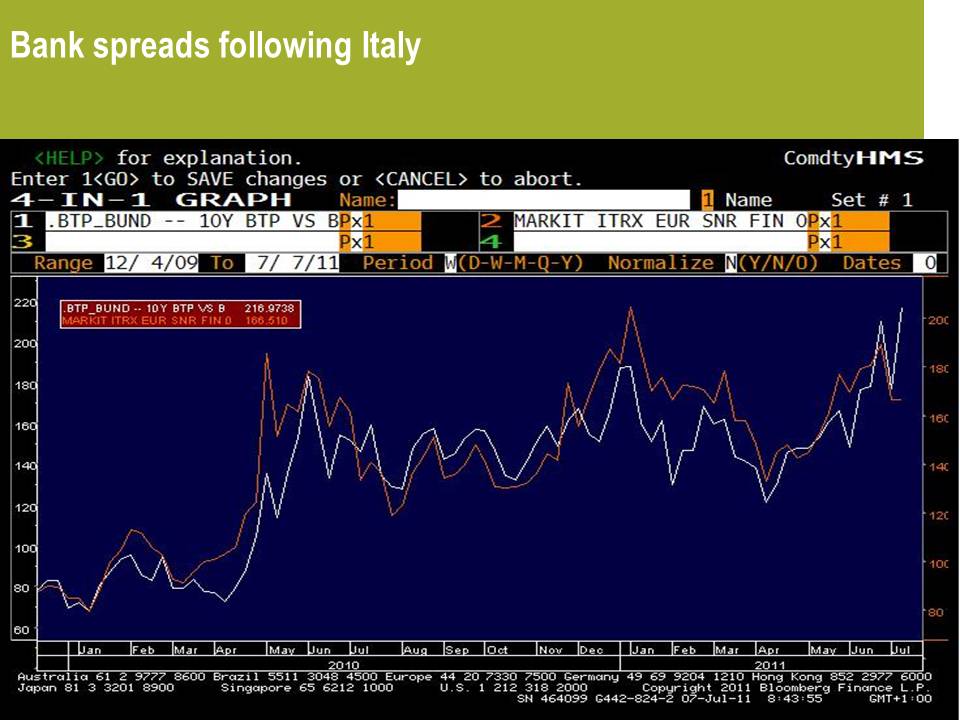

But whatever your view is or was, the reality now is that those pesky bond vigilantes have caught sight of Italy, and that is basically all that matters. As Italy or Spain or whoever’s bond prices collapse, the borrowing costs rise. As the borrowing costs rise, the interest costs steadily rise and the fiscal situation deteriorates. This puts pressure on the banking sector, as the tidy chart below from BNP Paribas demonstrates – it’s hardly a novel idea, but reinforces the point that as Italian & Spanish sovereigns come under ever greater stress, senior financial spreads widen in sympathy. As peripheral sovereigns blow out, banks need to raise more and more capital to cushion themselves against the cost of future sovereign restructuring, but this bank capital will get increasingly expensive just at the time that the banks need it most.

And then there’s the credit rating agencies. Rising sovereign and bank borrowing costs will lead to credit rating downgrades. As Jim mentioned in his blog comment on the subject last year here, a major input into the decisions to downgrade seems to be the movement in bond prices. In other words, credit ratings partly get cut because the bond prices fall. To some extent this is rational, since as interest costs rise with higher government bond yields, creditworthiness falls.

And then there’s the credit rating agencies. Rising sovereign and bank borrowing costs will lead to credit rating downgrades. As Jim mentioned in his blog comment on the subject last year here, a major input into the decisions to downgrade seems to be the movement in bond prices. In other words, credit ratings partly get cut because the bond prices fall. To some extent this is rational, since as interest costs rise with higher government bond yields, creditworthiness falls.

Italy doesn’t have the luxury of Japan, where 95% of Japanese sovereign debt is domestically owned. In Italy, despite the talk of strong domestic buyers, the reality is that only half of Italy’s sovereign debt is domestically owned and the international investors are clearly getting very nervous. Trichet yesterday had a pop at the credit rating agencies, but it’s not going to make a difference – when the confidence genie gets out of the bottle, it’s very hard to get it back in again. It’s a classic vicious circle.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox