Testing the zero bound: the strange effects of a strange recession, in 2020 and beyond

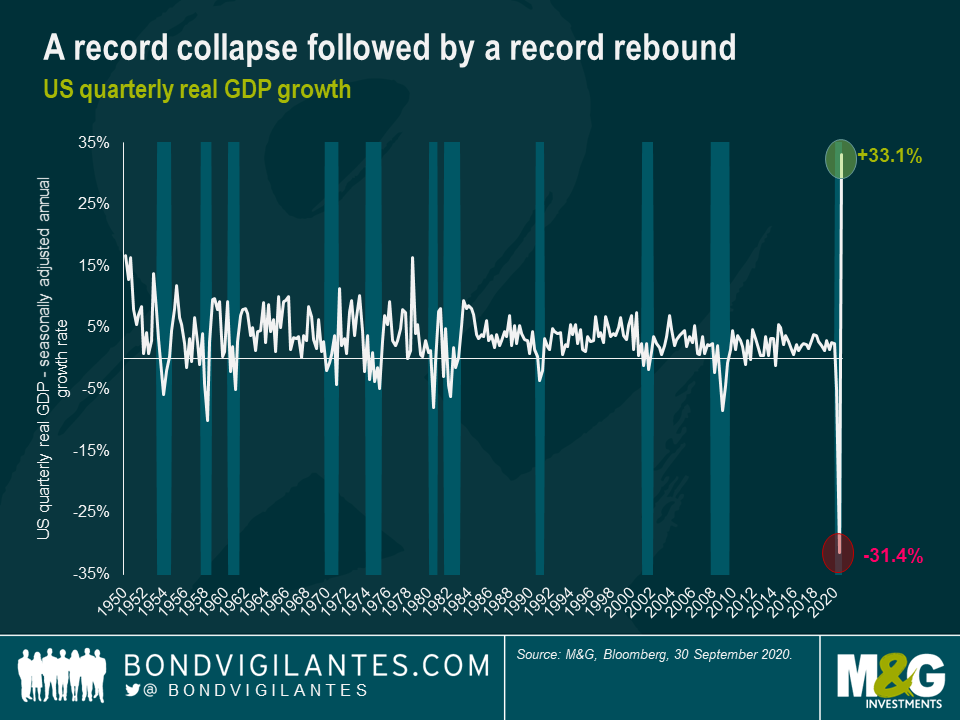

This year has seen the sharpest and largest economic downturn the modern global economy has ever seen. However, as I have commented several times this year, this recession is a rather strange one: for once, this time really is different (see chart below).

This recession has not been caused by any of the usual suspects: namely tight financial conditions, a real or market bubble bursting, a sharp rise in commodity prices or some combination of these. We have not seen the effect of this recession in many of the typical areas of weakness that follow such a downturn: I’m thinking of everything from the housing market and disposable incomes, to the huge rally in financial asset prices we have seen this year. Finally, this year has pushed investors to accept more than ever the bizarre situation of paying for the privilege of lending out their money — testing the zero bound in interest rates and leading to some very strange consequences indeed.

As we sit at this zero bound, I believe there are some important consequences for investors, ranging from the purpose of investing to the independence of central banks.

The theory of investing

The cornerstone of saving is security and return. In the following Panoramic we are going to focus on risk-free bond returns, and particularly on the strange consequences we see when this asset class has a negative return.

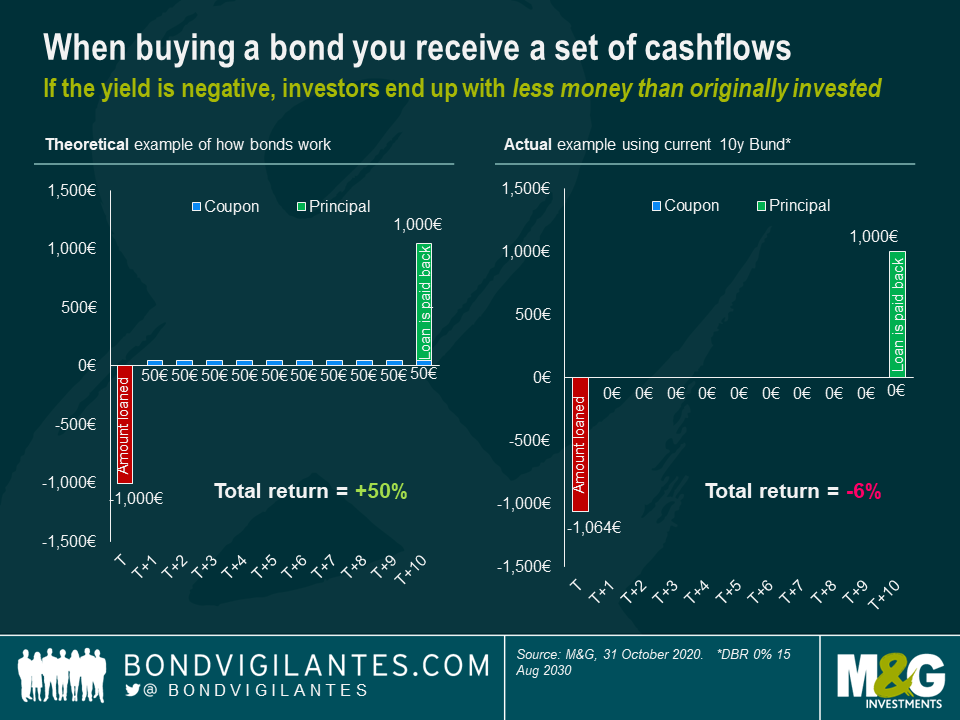

When buying a bond, you receive a set of cashflows in return for your investment. This is illustrated simply below.

This shows the income you receive and the final redemption payment. This income stream in the theoretical example generates a positive yield – the sum of the cash flows earned is positive. This is the fundamental basis of bond investing. However, recently this cashflow dynamic has been spun round. The actual example shows the cashflows you receive as a result of your investment in a negative-yielding bond, as we see in German bunds, for example. The cashflows earned are negative and the investor ends up with less money than originally invested.

Positive-yielding bonds offer a positive total return if held to maturity. Negative-yielding bonds provide a negative total return if held to maturity. Economic textbooks show savers receiving income, and building their wealth. Meanwhile, borrowers pay income for the privilege of borrowing. Yet, in a negative yield world, the saver receives the negative cashflow of the borrower, and the borrower receives income for borrowing. This is a very strange world indeed! In the past, this would have been very much a theoretical exercise, but now it is a real-world phenomenon, which investors are accepting – see the amount of negative-yielding debt illustrated below. [1]

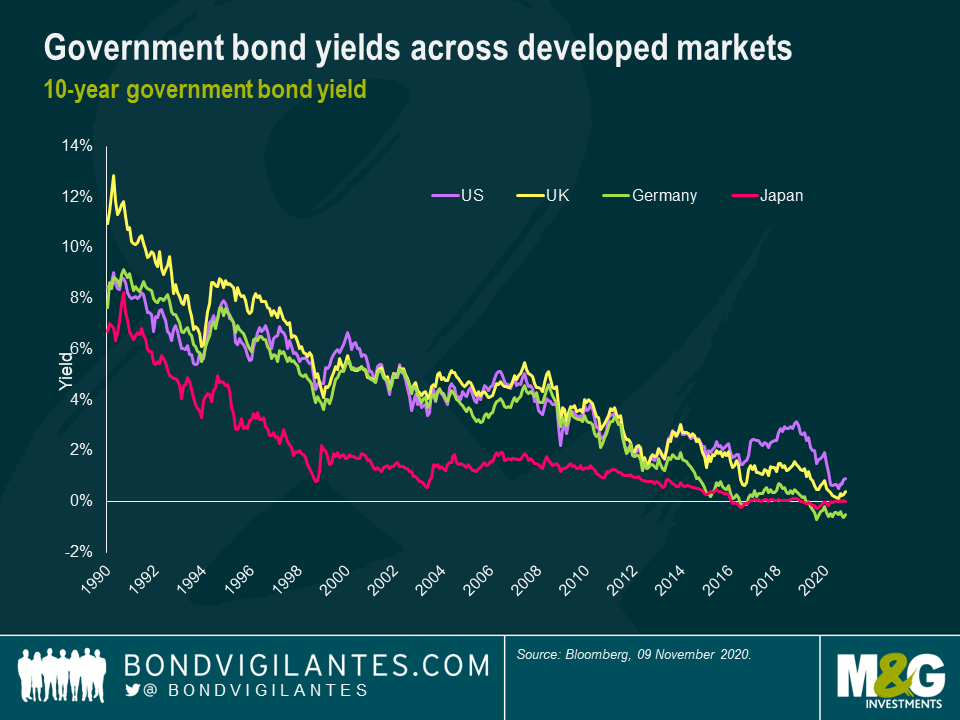

How did we get to this point? The bull market of the last cycle has driven bond yields to new lows, while many central banks have cut rates to try to stimulate inflation in economies. The question now is whether this downward trend can continue forever. I don’t think so: at some point, the consequences of having negative rates become too great for investors to accept. At this point we hit the “zero bound” – near zero, though not necessarily exactly at zero. The chart of 10-year rates below shows the trend over the last 30 years, with rates declining and halting at the zero bound. So why do rates stop at the “zero bound”?

Why there is a zero bound

Bond yields have difficulty going much below zero because if investors are faced with owning negative yielding debt in Japanese yen, for instance, they have an alternative. They can simply hold Japanese yen cash instead. Rather than exchanging 100 yen and receiving fewer yen at maturity if purchasing a bond, an individual could simply hold 100 yen in cash and not suffer the loss. Holding cash has its risks and potential costs in terms of security and storage. These costs effectively set where the zero bound falls, and why it is not exactly zero: it would be zero, were there no costs to holding cash instead of bonds. The presence of this alternative risk-free investment explains why central banks around the world have not enacted a significant negative rate policy: the existence of cash is the main barrier to negative rates.

The risk/reward of the zero bound – There Is No Yield (TINY)

Once we recognise there is a zero bound somewhere, what does that actually mean for bond investors?

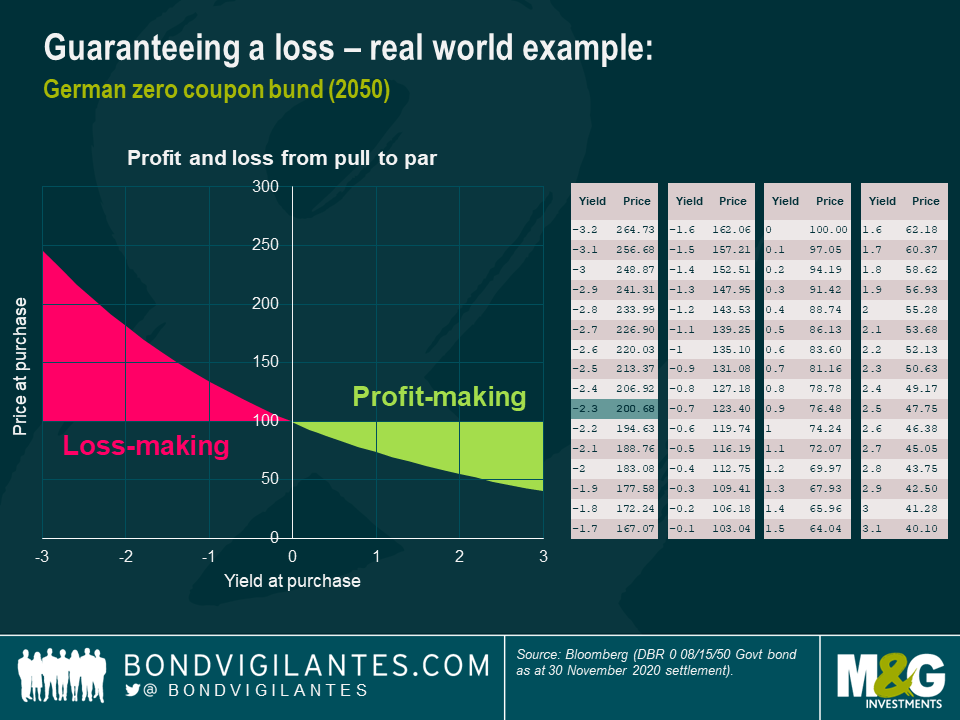

When looking at the risk/reward of the zero bound, the first issue we face is that There Is No Yield (TINY). With yields at all-time lows, investors are not earning significant returns at all, while in some cases paying for the privilege of lending. Secondly, it is clear that yields can’t fall forever: the upside of holding duration is limited due to the existence of the zero bound. One way to explore this is to use zero coupon bonds to illustrate the risk and reward profile to which investors are exposed when buying bonds in the TINY world.

Currently, if you agree to buy a 30-year German bund at a negative yield, you essentially agree to make a loss if held to maturity. This is of course different from a positive interest rate environment, where if you hold the bond until maturity you will end up with a positive return. The profit or loss involved is illustrated in the chart below: if you buy a bond with a -2.3% yield, you lock in a halving of your money.

The upside to holding low- or negative-yielding bond securities is therefore very limited and explains the short duration view I express in my funds. When you hit the negative bound, or get near the negative bound, it becomes challenging to invest; upside is limited and losses can quickly accrue (even more so if you hold longer-term debt to maturity).

So while it is possible to get to negative interest rates in principle, it is rarer in practice, and there is a limit: the upside to investors is limited, but the downside could be quite large, and so at a certain point investors won’t accept this. This means it is hard to justify being long duration, from my perspective. As a risk-reward instrument, holding interest rate duration becomes unattractive when you get near the zero-bound. There are also other, wider consequences beyond the risk-reward of owning bonds as yields reach the zero bound.

Consequences of reaching the zero bound

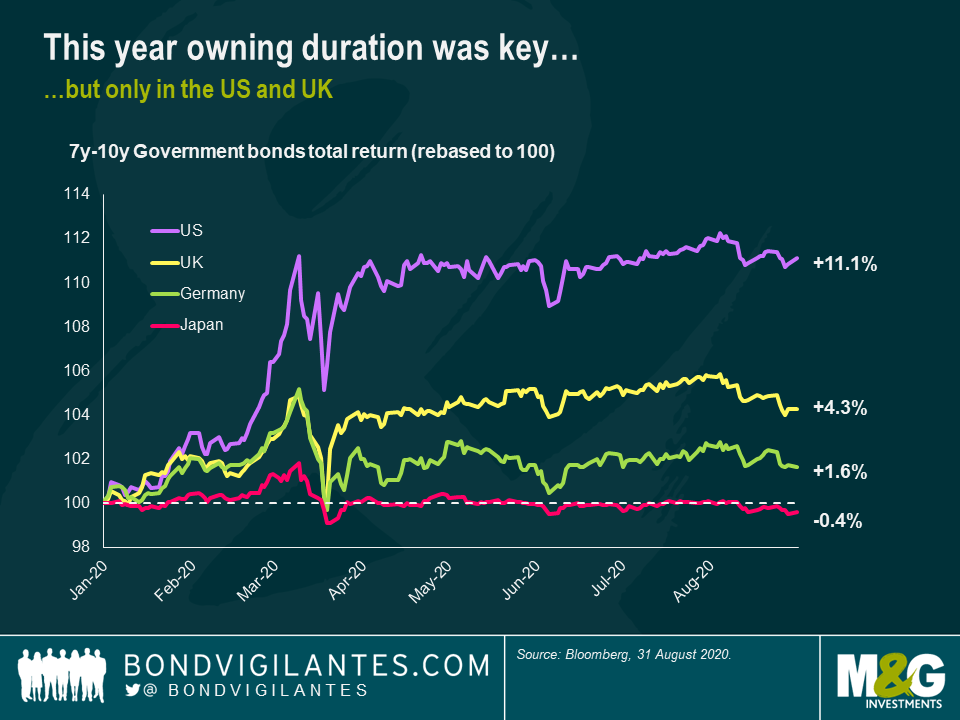

One of the most obvious consequences of reaching the zero bound is that central banks can no longer stimulate the economy in the event of a deterioration in growth and demand. As rates cannot go very negative, the policy tool is effectively removed from their toolkit. This is illustrated by the actions of central banks in regions where rates were already negative or near zero, like Europe and Japan: the policy option has gone. We saw the effect on holders of interest rate duration over the past year: in countries where rates could still be cut (the US and the UK), falling interest rates provide some upside to bond investors; in countries with zero or near-zero rates (German and Japan), they did not provide much upside at all (see charts below).

Another effect of short-term zero or negative interest rates is the extent to which this undermines the banking system’s traditional role in bridging saver and lender. As former Bank of England Governor Mervyn King alluded to in a recent TV interview: “[Negative rates] can’t work with a successful banking sector unless the banks can pass on negative rates to their retail customers. Once that happens, I think you should expect to see a long line of customers seeking to take their cash out of the bank and keep it under the mattress, or at least in a new home safe. I don’t think that is a politically attractive prospect at all”. [2]

It is clear that having zero or negative rates is a threat to the ability of central banks to use monetary policy and to the banking system’s effective functioning.

Unable to cut rates, central banks then pursue other options, resulting mainly in driving rates lower along the yield curve via measures such as forward guidance (i.e. pre-committing policy to a low rate range) and quantitative easing. These actions lower rates along the whole yield curve, flattening it by pushing longer-term rates towards the zero bound too. This can be seen in the chart below of the market 50-year sterling overnight lending rate: it reached the zero bound.

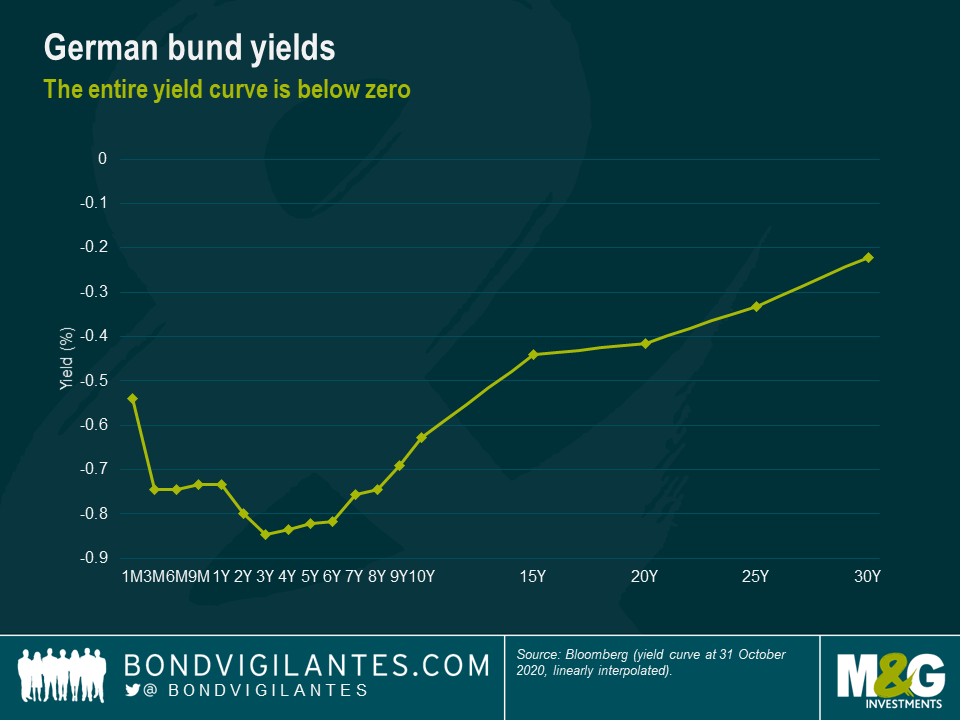

Likewise, the psychology of investors not wanting to lock in a guaranteed loss leads them to extend the maturity of their investment, again pushing the whole curve towards the zero bound. Investors’ purchases of longer-dated bonds result in very flat yield curves as can be seen below. This effect is so powerful that in extremis whole bond curves can exhibit negative yields (see chart below).

As monetary policy reaches its limits, fiscal policy has to take a greater burden in reviving the economy. Consider the recent comments from Federal Reserve chairman Jerome Powell, and European Central Bank President Christine Lagarde. Both central bank chiefs have called on extended fiscal support to boost Covid-hit economies as we approach a tough winter. Powell said that “too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses”, while stating that even if stimulus is above what is needed “it will not go to waste”. Meanwhile, Lagarde emphasised that it is “more important than ever for monetary policy and fiscal policy to keep working hand in hand”.[3]

Interest rates are a pricing mechanism that set a level at which savers and borrowers can interact, and provide an efficient recycling of savings. Between these two economic agents, we have a banking system that recycles that capital. These banks make money on the bid- offer spread between borrowing and lending, but are also heavily dependent on the central bank for help. When the central bank sets a high rate, it is guaranteeing savers and banks a high return for taking no risk – in effect offering a subsidy and a transfer of wealth from the state to the saver. In an environment of negative rates, the central bank is instead taxing the financial system, and savers will be reluctant to lend. In that case, the recycling of capital grinds to a halt.

How to remove the zero bound

The simplest way to remove the zero bound and restore the ability of central banks to cut rates would be to remove the option of holding cash. Electronic money is a solution as, if there were no cash, then your electronic money deposit could decay over time, producing negative rates with no alternative cash to hand. Politically, though, this would be highly unpopular for various, obvious reasons – and individuals may see this as a tax on capital. Other alternatives to money might also be sought, which would undermine this approach: gold, a foreign currency or a different version of electronic money such as Bitcoin are examples.

The second way would be to let the central bank lend money below zero to subsidise the banks. That is the ECB’s approach with its TLTRO (targeted longer-term refinancing operations) programme, designed to stimulate lending and act as a simple subsidy from the central bank to private sector banks. However, this is an intrinsically loss-making transaction by the central banks and ultimately has limited power, because it creates an arbitrage opportunity between negative rates and physical cash.

The third option is to print money. This is perhaps the simplest way to escape the zero bound, but unfortunately raises the difficult question: who do you give the printed money to? Central banks are in the business of lending money, not granting money. As Federal Reserve Chair Jerome Powell said in his May keynote speech, “the Fed has lending powers, not spending powers”. [4]

The printing of money is a government decision

To escape the zero bound requires a number of key elements. It would require the support of governments through fiscal spending, the printing of money by the central bank and hopefully a pick-up in inflation. But this requires central banks and governments to work together. Fiscal spending is within the remit of government and, if the central bank is printing money, the decision on how that money is distributed is a political one. Central banks and governments have to work together.

No Independent Central (NICe) Banks

The ultimate way to do this, for fiscal and monetary policy to be aligned, would be to remove central bank independence. Arguably we have begun to see signs of this over the past year, with the significant government debt purchases of a number of central banks. Independent central banks were created in the first place to help control inflation and I would argue that, in politicising central banks, we would be allowing the inflation genie back out of the bottle. In order to escape the zero bound we need inflation, and by politicising central banks inflation and inflation expectations would rise.

It would be easier to remove the independence of some central banks than others, of course. The simple delineation here is federal central banks versus state central banks. It would be relatively straightforward to regain full control of the Bank of England, for example – in fact, it is already provided for under existing legislation: according to the Bank of England Act 1998, “the Treasury is given reserve powers to give orders to the Bank in the field of monetary policy, but the Act states that this is only if the Treasury is satisfied that they are required in the public interest and by ‘extreme economic circumstances’.” [5]

In the case of federal central banks it is more complicated. With federal central banks, monetary and fiscal policy are generally harder to carry out in tandem, as typified by the challenges faced by the European Central Bank.

The future of central banks

Central banks are an ever-evolving beast. Their need for independence was born in the high inflation conditions of the 1970s. This regime has worked exceptionally well in reducing inflation to the targets that have been set. If we now have a situation where inflation is permanently anchored around a two percent target then, by definition, central banks will quite likely be faced with the zero bound issue. The tapering of political influence on monetary policy has also helped reduce inflation, and this has been combined with the tailwind of falling inflation from globalisation and progress in technological productivity.

While central banks cherish their independence, they have been exceptionally vocal recently that fiscal measures (that are inherently political) are required. The gap between politics and central banking has been further eroded as central banks are now opining and focusing on what were previously political issues. For example they are now focusing more on income inequality and the global warming conversation — both historically hot political topics and not the remit of unelected central bankers. With these issues in mind, it may be practical for central banks to become less independent, and the political bias to generate inflation may be an appropriate change in economic direction.

Implications for investors

Given the authorities are going to do what they can to exit the zero bound, what are the implications for investors? It would be logical to assume that escaping the zero bound would require extensive monetary and fiscal policy. This would mean short rates being kept low for a number of years, while inflation needs to be re-established as a permanent feature. This points potentially to a very steep yield curve, with short rates pegged, a heavy supply of government debt, and inflation making real bond returns less attractive. It is likely that this high level of monetary and fiscal stimulus will be a strong boost for the global economy. What kind of traction will it provide in 2021 and beyond?

Outlook and concluding thoughts

The world is going through a t-shaped recession: a sharp fall down, with a recovery back towards previous levels. The question is how high up the “t” the crossbar gets. Given that the service sector has been the main victim of the lockdown recession and government action, the ability to reopen quickly may mean at the extreme that we even get close to a T-shaped recession. The lower the bounce, the better for interest rate risk and the worse for credit risk, and vice versa. This is why the economic outlook is so significant in bond investing. However, the risk-reward profile of taking interest rate duration is currently skewed: there is limited upside on profiting from further falls in interest rates if the zero bound persists. This has been demonstrated in the real world of bond investing this year.

There is a need to escape the zero bound for micro and macro policy reasons. This will require central banks to be more “NICe” as they work closely with governments. In such a scenario, fiscal and monetary policy will need to remain loose for some while, potentially aided by central banks printing money to provide the fuel to escape the zero bound. This type of policy generally leads to higher growth and inflation. This bodes well for the economy and for credit risk, but points to a rise in longer-term bond yields.

[1] When looking at total negative rates, one should bear in mind that rates are defined as the rate in a given currency. If we were to hedge global debt into a base currency of euros for example, the negative outstanding debt would be boosted; if it were turned into US dollars, it would be reduced substantially.

[2] Mervyn King, Bloomberg TV, 16/11/20.

[3] https://www.marketwatch.com/story/powell-says-u-s-economy-needs-more-fiscal-support-11601995205, https://uk.finance.yahoo.com/news/lagarde-pledges-forceful-ecb-stimulus-082057866.html

[4] Current Economic Issues: Remarks by Jerome H. Powell, Chair, Board of Governors of the Federal Reserve System at Peterson Institute for International Economics, Washington, D.C., May 13, 2020 https://www.federalreserve.gov/newsevents/speech/powell20200513a.htm

[5] https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/1998/the-boe-act.pdf

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox