Carry On Regardless

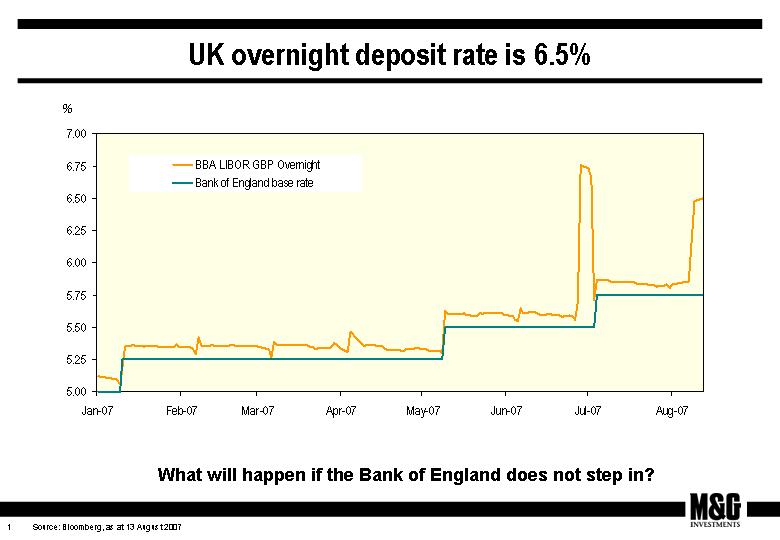

Following on from my comment on Friday, it’s interesting to note that the Bank of England has so far refused to pump liquidity (Ooh matron) into the UK money markets, and as a result, the UK overnight interest rate is currently 6.5%.

Mervyn King (who is one of the hawks in the MPC) last week said that credit turmoil might be a good thing if it persuaded investors to take a more realistic view of risk, and denied that there is currently an international financial crisis. He may be right, but if the overnight deposit rate remains at 6.5% rather than 5.75%, then monetary policy will in effect be much tighter than the Bank of England has intended.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox