High yield market still not pricing in recession risk

Alan Greenspan made the headlines at the beginning of this year when he said that the risk of a US recession was 1 in 3, and has since said that recession risk had risen. Larry Summers (former US Treasury Secretary and Chief Economist at the World Bank) put the risk at 50/50 in September. The truly horrendous data coming from the US housing market makes us think that the risk of recession is probably greater than this.

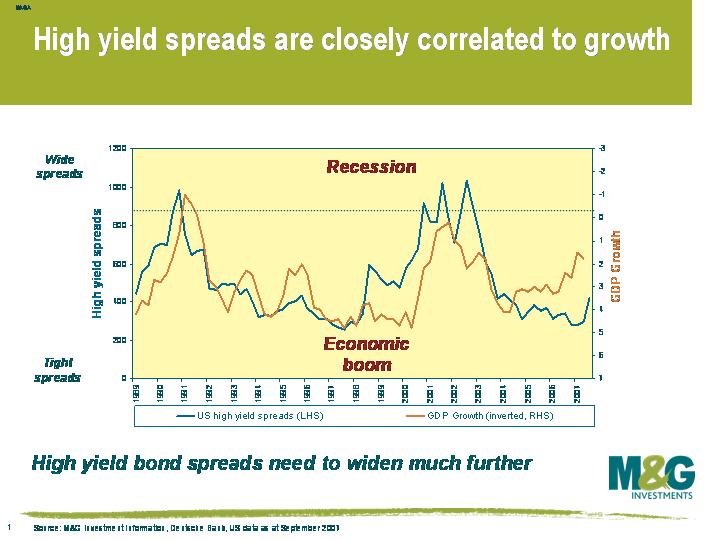

What does this mean for high yield bonds? Well there’s a very close correlation between high yield bonds and economic growth – strong economic growth coincides with strong profits, low defaults and tight high yield bond spreads (ie high yield bonds become much lower yielding bonds). When the economy is in recession, more companies are going bust and high yield spreads tend to be wide (ie investors demand a big yield to be compensated for the significant risk that their bonds will blow up).

This chart shows that high yield spreads (left hand axis) are severely out of synch with US economic growth (right hand axis, inverted). There are three possible conclusions that can be drawn from the divergence of the lines. Number 1: this credit crisis will blow over and the US growth rate will jump back to 3%. Number 2: the correlation between growth and spreads has broken down (“it’s different this time”), or number 3: the high yield market is very expensive.

This chart shows that high yield spreads (left hand axis) are severely out of synch with US economic growth (right hand axis, inverted). There are three possible conclusions that can be drawn from the divergence of the lines. Number 1: this credit crisis will blow over and the US growth rate will jump back to 3%. Number 2: the correlation between growth and spreads has broken down (“it’s different this time”), or number 3: the high yield market is very expensive.

I favour number 3. US growth has been below trend for about a year, and yet high yield spreads actually reached their tightest ever levels in May this year. Spreads widened a bit over the summer, but are still close to all-time lows on an historical basis. And if you consider that US growth is likely to fall towards zero and possibly lower, then history suggests that the average high yield bond should yield around 12%, not 8%. A correction of this magnitude over the course of one year would result in double-digit negative returns. The European high yield market closely tracks the US market, and I remain very underweight of high yield assets across my portfolios.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox