European recession will put a huge strain on European Monetary Union

After a few teething problems, it’s not contentious to say that the euro has been a success. Helped by the US dollar’s demise, the euro is gradually becoming a rival as the reserve currency of choice for central banks. European unemployment has plummeted, and the European economy probably grew at around 3% last year. Some countries have boomed – Spanish economic growth has averaged about 4% over the past two years, while Ireland has done even better, with growth averaging almost 7% over the past decade. The unemployment rate in Spain 10 years ago was 20%, and it touched 8% last year.

The problem is, however, that some areas of Europe have been far too hot. ECB interest rates may have been about right for Germany or France, but they have definitely not been high enough for countries like Ireland and Spain. As we know so well from the US experience, artificially low interest rates cause asset price bubbles. Spanish and Irish property markets were el scorchio until recently, but the house price chart for Ireland looks uncannily like that of the US – double digit house price growth from 2000-06, followed by a slump of -7.3% for 2007. Spanish and Irish banks are now in serious trouble due to their huge property exposure.

European economics is about to get very, very political. How will Irish politicians react if the Irish economy enters a depression? Will they sit quietly while the ECB keeps interest rates on hold, and continues its tough talk on anchoring inflation expectations? How will the Irish public react when unemployment surges? Spain’s prime minister, Jose Luis Rodriguez Zapatero, kicked things off this week by saying that the ECB will cut interest rates by 0.5% this year. The ECB would have been none too impressed, given its obsession with appearing unified in its rate decisions and its communication to financial markets (Bank of England style voting results are inconceivable).

A big recession in Europe could put the European Monetary Union (EMU) at risk, as leaders accountable for their struggling economies decide that they’re better off in control of their own monetary policy.

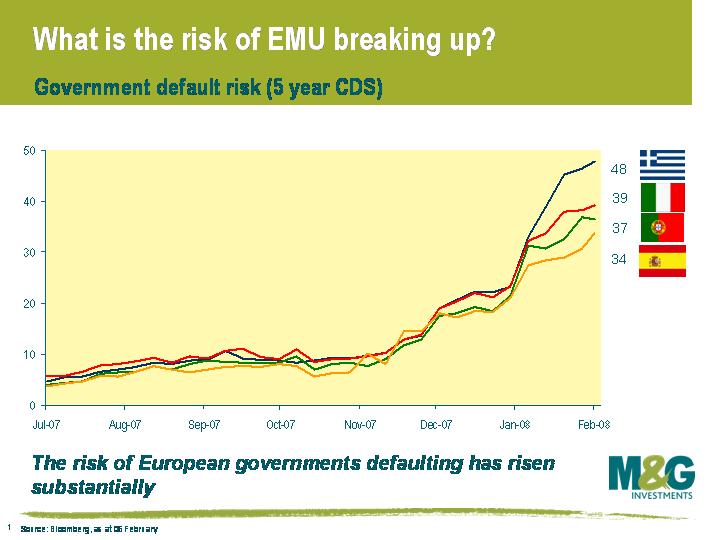

This chart is fascinating as it shows that financial markets are starting to consider the potential of EMU breaking apart. If EMU collapsed, you can be sure that countries such as Italy, Greece and Spain would trade at a much wider premium than they do now (particularly if an economic depression in these countries was the reason for EMU falling apart). As the chart shows, the cost of taking out insurance on Greek government bonds defaulting in the next five years is now 0.5% (as shown by 5 year CDS spreads). When the credit crunch began in July 2007, the cost of insurance on Greek government bonds was 0.05%. To put the figure of 0.5% into context, this is where Astrazeneca or Glaxosmithkline 5 year CDS trades right now, and is where Societe Generale senior 5 year CDS traded less than a month ago.

I believe that the risk of EMU collapsing is very small, precisely because the ECB will do anything to stop it from happening. The breakup of EMU will mean the death of the ECB, so it’s hardly in their interests. As European economic data continues to weaken over the coming months, I believe the ECB will start to downplay the inflation risks and increase emphasis on downside risks to growth. Then, from the summer, I think they will start a cycle of interest rate cutting. For this reason, I have moved longer duration in the M&G European Corporate Bond Fund, as I believe rates will fall by more than the market is pricing in.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox