AIG woes highlight the curse of the football sponsors

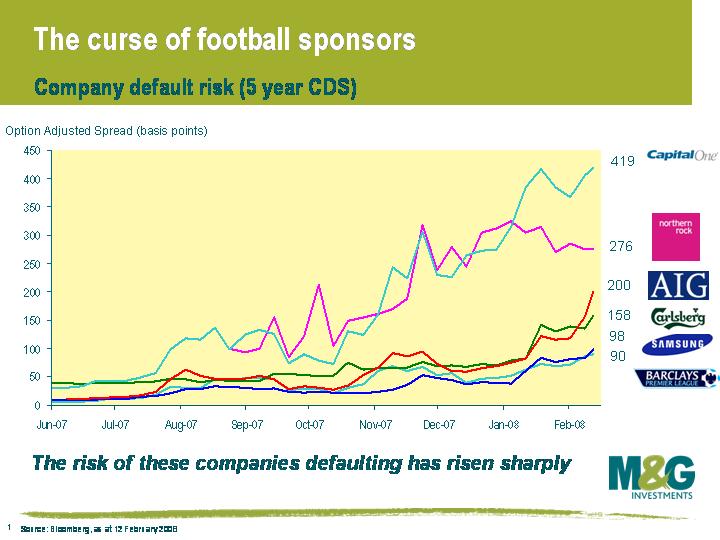

First Man Utd drops points to Arsenal, and then Man U’s shirt sponsor AIG admits that losses on credit derivatives were $4.88bn in October and November, four times worse than the company had previously stated. AIG’s auditor, PricewaterhouseCoopers, found “material weakness” in AIG’s accounting treatment of credit derivatives. AIG’s shares fell by 12% on Monday, the biggest one day fall in the company’s equity since October 1987. The risk of AIG defaulting on its debts rose sharply – 5 year CDS jumped from 156bps to 200bps on the news.

As this chart shows (click chart to enlarge), AIG is not the only shirt sponsor to run into trouble. Newcastle’s sponsor Northern Rock is in a spot of bother right now, to put it mildly. Carlsberg was put on review for a downgrade to junk bond status by Moody’s in January. Barclays (the Premier league sponsors) and Samsung are far from being in distress, but the risk of the companies defaulting has increased by a factor of 15 times and 10 times respectively since June last year. Unfortunately for Jim, the company facing the biggest risk of default on this chart is Capital One, sponsor of Nottingham Forest.

CDS doesn’t exist on a number of football sponsors – not included on this chart is F&C Asset Management’s parent company, Friends Provident, whose bonds have fallen 15% in the last four months on concerns that Friends Provident will be taken over by a closed life fund consolidator. Meanwhile Moody’s put Derbyshire Building Society’s ‘single A’ rating on review for a downgrade in January. (I don’t suppose it does Derbyshire Building Society a lot of good to be associated with possibly the worst team in premiership history either!).

The most famous example of a football sponsor going bust is Parmalat, whose fictitious earnings almost destroyed Parma football club. Real Madrid’s shirt sponsor BenQ went bust in 2006. But it’s not just clubs at the top of the table that are affected. Manchester City’s shirt sponsor, First Advice, went bust in 2003. Watford’s and Wycombe’s sponsor loans.co.uk went bust last year, while Charlton’s sponsor Llanera (a Spanish property company) went bust in January this year. US sport also appears to be cursed by the same issues – read here about Enron’s sponsoring of the Houston Astros or here on PSInet’s sponsorship of the Baltimore Ravens.

On a separate and slightly more serious note, I am giving a teleconference this morning at 10am on what’s going on in the bond markets right now. I’ll provide an update on my views for investment grade corporate bonds and high yield bonds, as well as my view on UK interest rates and inflation. Click here to register, the more the merrier, and please do write in with any questions you may have.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox