Record sell off in European bunds

Short dated European bonds experienced a huge sell off last Thursday, after Jean-Claude Trichet surprised the market by stating that the ECB is now on ‘heightened alert,’ interpreted by many to mean a rate hike is very much on the cards next month. The yield on two year German bunds jumped by 29 basis points, or 0.29%, which was easily the biggest daily jump in 2 year bund yields since the index began in 1990 (this is still some way below the US record of 4th October 1982, when 2 year Treasury yields soared by a record 146 basis points).

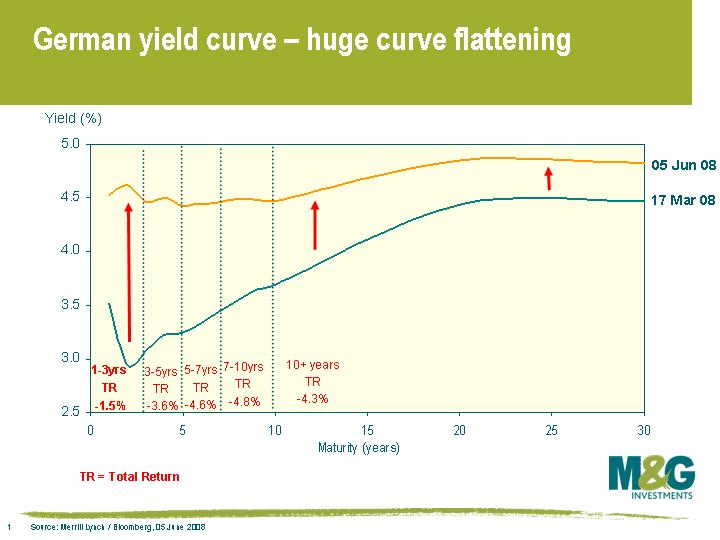

This chart shows how the German yield curve has dramatically flattened since Bear Stearn’s rescue in March, and as can be seen by the returns on the chart, medium dated bunds have been hurt the most (note that this is in local currency terms).

Whilst Trichet appeared to prepare the market for a rate hike next month, he stopped short of pre-committing to such an action. This is no doubt a lesson learnt from last autumn, when the credit crunch forced the ECB to pull out of a rate hike that had been pre-signalled the previous month. The hawkish tone demonstrates that the ECB are clearly very concerned about inflation running considerably above its 2% target – indeed, inflation has been above 3% since last year. However, the change in tone seems to have been borne out of a fear that Europe could begin to witness second round effects, as wages adjust higher to keep pace with headline inflation and longer term inflation expectations lose their anchors.

The likelihood is that inflation will remain above the ECB’s comfort zone at the same time as growth begins to slow markedly, undoubtedly posing a significant dilemma for the Central Bank. The combination of a weakening labour & housing market, tighter credit conditions, a strong euro, further banking sector writedowns and a weakening European consumer mean tough decisions lie ahead.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox