‘Tier 1’ bank bonds continue to deteriorate

Spreads on Euro denominated ‘Tier 1′ bank bonds hit record wides yesterday, reflecting the growing concern in the market about banks’ ability and willingness to repay investors. ‘Tier 1′ bank bonds are the highest yielding, highest risk bonds in a banks’ capital structure. Essentially, banks issue a spectrum of different ‘tiers’ of debt securities in an attempt to minimise their cost of funding, ranging from senior, which is closest to customer deposits at banks (though they don’t carry the same government guarantees as deposits), to tier 1, which is the type of security that bears the greatest resemblance to equity (ie they can be perpetual, loss absorbing, and interest can be deferred). For this reason, they are the highest risk bank bonds, and so the highest yielding.

There are a number of reasons for the continued underperformance of bank bonds, and particularly of ‘Tier 1’ bonds. First and foremost is the continuing deterioration in the global financial crisis, and the further stress that this is putting on the banking sector. Professor Rogoff, who was the IMF’s chief economist from 2001-04, last week warned that the worst is still to come, going as far as to say “we’re not just going to see mid-sized banks go under in the next few months, we’re going to see a whopper, we’re going to see a big one – one of the big investment banks or big banks”. These kind of comments aren’t particularly helpful for banks – no bank can withstand a run on its assets and banking is built almost purely on confidence – but Professor Rogoff’s view is becoming increasingly widely shared.

Secondly, there is the issue that Stefan alluded to here on Wednesday. Banks need to raise more capital, and the amount will only increase as writedowns increase further. Equity investors, having been stung in recent months, are becoming more reluctant to part with the cash that banks are so desperate for. Banks therefore look set to issue even more in the way of Tier 1 bank paper, and the huge supply that seems set to come to market is causing prices to fall further.

Another problem is what’s known as ‘extension risk’. Tier 1 bank bonds can be called on predetermined dates, and it always used to be assumed that banks would repay investors at the call date for reputational reasons. However, many banks aren’t willing (or perhaps in some cases able) to repay these bonds on the call date at a price dramatically above where these bonds are now trading. These bonds may therefore go from having a maturity of a few years, to being undated, perpetual bonds. Furthermore, if banks do run into further difficulties then it will be Tier 1 investors who bear the losses first. So Tier 1 bank bonds could become perpetual bonds without any coupons – not a very attractive investment.

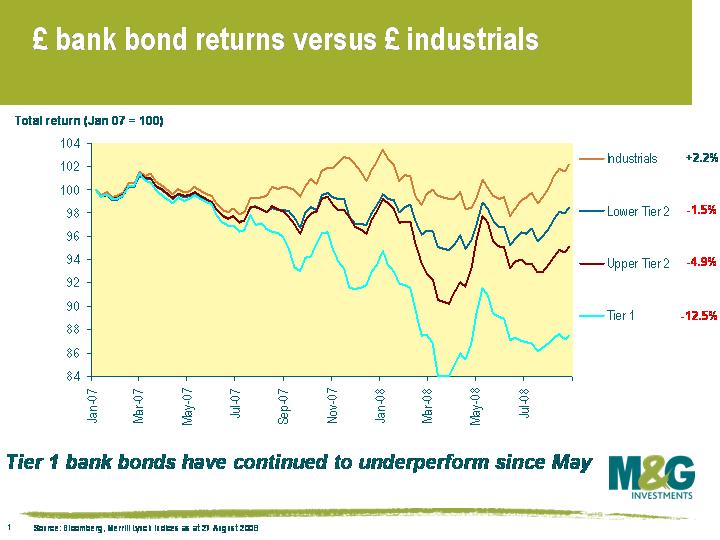

This chart shows the total return of the different tiers of sterling bank bonds since the beginning of 2007. Sterling tier 1 banks have returned -12.5% since the beginning of 2007, versus a return of +2.2% for sterling industrials and a +7.3% return for gilts. Our team’s views on senior bank bonds vary, with Richard the most bearish, but we are united in our belief that the deeply subordinated bank bonds are set to experience more pain.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox