Deflation might be coming, but will it really stay until 2018?

Inflation-linked bonds around the world have seen heavy losses in the past couple of months. 30 year UK index linked gilts are down by nearly 20 points (15%) since August, with similar selloffs seen in the US and European markets. After the inflation scare of the first half of 2008, with oil hitting $140 per barrel and food prices rocketing, the markets are suddenly realising how quickly global growth is slowing, and that we should be more worried about deflation than inflation. Whilst many people had believed us to be right in predicting very low levels of inflation in 2009, the question we got asked the most was about wage inflation. In the UK particularly, with the Labour Party so weak, wouldn’t the government cave-in to its backers, the Trade Unions, and hike public sector pay? Well with unemployment rising rapidly, it’s not surprising that private sector workers are unable to demand big wage rises (and I spoke to two people over the weekend who volunteered that they have been told they are getting pay cuts with immediate effect). Private sector average earnings growth for the UK has fallen to 3.1% from 4.6% in March – but public sector wage growth is also falling (down from 4% to 3.6%). Last week the Home Office announced that the police would be getting just 2.6% per year for the next three years. On top of all of this, oil has halved in price from July this year, and it looks like food price inflation peaked out in August. We now suspect that Europe could print a negative year on year inflation rate in the second quarter of next year, with the UK not far behind.

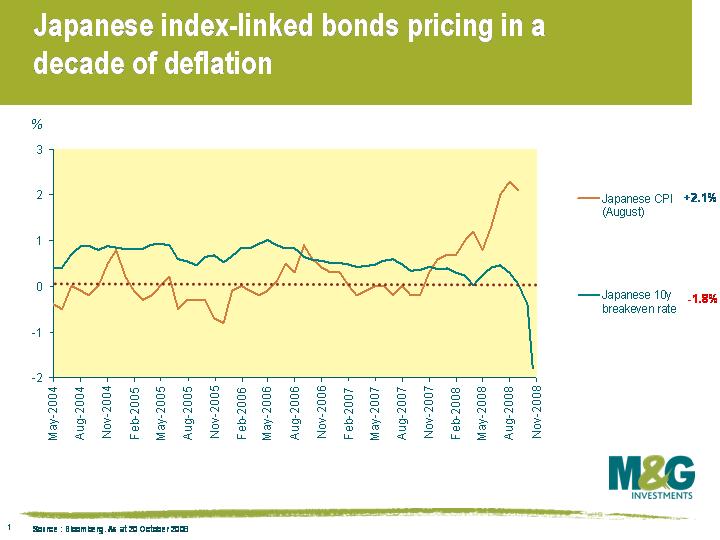

With this backdrop, it is easy to see why linkers have become unloved. However, the selloff has perhaps gone too far, especially in the Japanese market. Japan is no stranger to deflation (it only decisively broke out of falling prices at the start of this year after nearly a decade of negative inflation), but its relatively new JGBI inflation linked bond market is now discounting 10 years of 2% per year deflation (see chart). This is a real yield of 3.5%, the highest available real yield on any G7 government asset (we think – let us know if you find anything higher!). It’s an illiquid and immature market, but that’s sometimes where the best value can be found – UK index linked gilts were issued with real yields of over 4% when our market was brand new. The Japanese government has stopped issuing JGBIs for the foreseeable future as it thinks they are too cheap – we agree.

With this backdrop, it is easy to see why linkers have become unloved. However, the selloff has perhaps gone too far, especially in the Japanese market. Japan is no stranger to deflation (it only decisively broke out of falling prices at the start of this year after nearly a decade of negative inflation), but its relatively new JGBI inflation linked bond market is now discounting 10 years of 2% per year deflation (see chart). This is a real yield of 3.5%, the highest available real yield on any G7 government asset (we think – let us know if you find anything higher!). It’s an illiquid and immature market, but that’s sometimes where the best value can be found – UK index linked gilts were issued with real yields of over 4% when our market was brand new. The Japanese government has stopped issuing JGBIs for the foreseeable future as it thinks they are too cheap – we agree.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox