Explaining the current unprecedented credit spreads: "It’s the economy, stupid"

Is it? Well kind of. Credit spreads (ie the excess yields on corporate bonds over government bonds) are very closely correlated to the strength of the underlying economy – when times are good, investors demand a small risk premium, and when things turn nasty, investors demand a much bigger risk premium. Right now, credit spreads are at almost unprecedented levels – see the chart in Richard’s recent comment here.

To understand why, you need to understand what’s driving credit spreads. If you want to try to quantify it, you can think of it like this (please bear with me a second, I promise it’s actually very intuitive):

Credit spread = (risk premium for default – recovery)+ risk premium for other factors

Firstly the risk premium for defaults. When you’re a long term investor and you buy a corporate bond, the most important thing is that the credit spread compensates you for default, which is the potential loss of coupon payments and principal. In working out what default rate is priced into the market, you have to make a load of assumptions – as well as the potential for default, you have to consider the uncertainty around the timing of default, the level of recovery in the event of default, and how long it might take to see any of the recovery value.

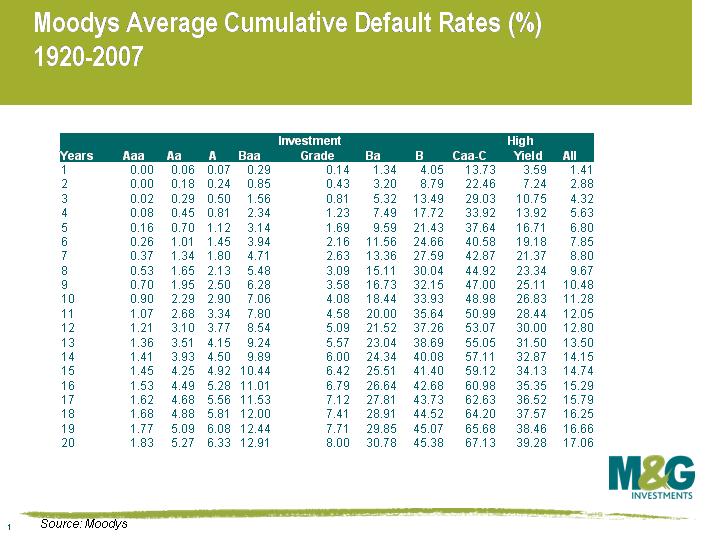

Deutsche Bank have had a go at quantifying the implied default rate. Their research suggests that current spreads are significantly overcompensating for default risks. Taking historical data compiled by Moody’s between 1920-2007 as the graph on the left shows, and assuming average recoveries, European investment grade bonds are implying 35% cumulative defaults over the next five years and European high yield 67%; way above levels experienced over any five year period since 1970, which is a period capturing a number of recessions. The previous highs were 2.4% and 31.1% respectively. In fact, even assuming an extremely improbable recovery rate of zero, current spreads are still pricing in 21% for investment grade and 48% for high yield, again way above anything previously experienced, see here.

Deutsche Bank have had a go at quantifying the implied default rate. Their research suggests that current spreads are significantly overcompensating for default risks. Taking historical data compiled by Moody’s between 1920-2007 as the graph on the left shows, and assuming average recoveries, European investment grade bonds are implying 35% cumulative defaults over the next five years and European high yield 67%; way above levels experienced over any five year period since 1970, which is a period capturing a number of recessions. The previous highs were 2.4% and 31.1% respectively. In fact, even assuming an extremely improbable recovery rate of zero, current spreads are still pricing in 21% for investment grade and 48% for high yield, again way above anything previously experienced, see here.

Clearly the ‘other factors’ bit of the equation above is playing a huge part. I blame the effect that deleveraging is having on the technical side. As banks remove liquidity and delever, hedge funds, SIVs, conduits and other special purpose vehicles (SPVs) are dumping assets on the market. A lot of these assets are fundamentally fine – what we’re seeing is distressed sellers of non-distressed assets. Supply significantly exceeds demand, and prices are being forced lower.

When the number of sellers significantly outweighs buyers, prices are forced to adjust to a level where new or extra capital is attracted. In terms of bonds, this extra capital may be pension funds changing asset allocation, it may be the money you’ve been saving up in your high street bank, or it may even come from bond issuers themselves (they can take advantage of debt market mispricing by simply issuing equity or using cash on balance sheet and buying buy back debt , which is earnings enhancing).

So technicals are responsible for this extra risk premium and a lot of the volatility we’re seeing. Such an environment creates fantastic opportunities for those interested in fundamental value – those long term investors with committed capital willing to endure some short term volatility.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox