The Further Demise of ‘Supersub’ Bank Bonds

As our regular readers will know, we have been tracking Tier 1 (T1) capital’s fall from grace since last August. Unfortunately for these bank bond holders, the picture has not improved this week, with S&P and Fitch widening the notching between senior and hybrid debt on a number of European banks. This is because in their view (which has also been the long held view of our analysts) the risk/reward characteristics of these securities are becoming more akin to those of equity than debt. It feels as though the wider market is coming round to our way of thinking. This is significant because any further credit rating downgrades on T1 bank bonds will cause these bonds to drop out of investment grade indices, leading to more investors becoming forced sellers, and driving prices even lower.

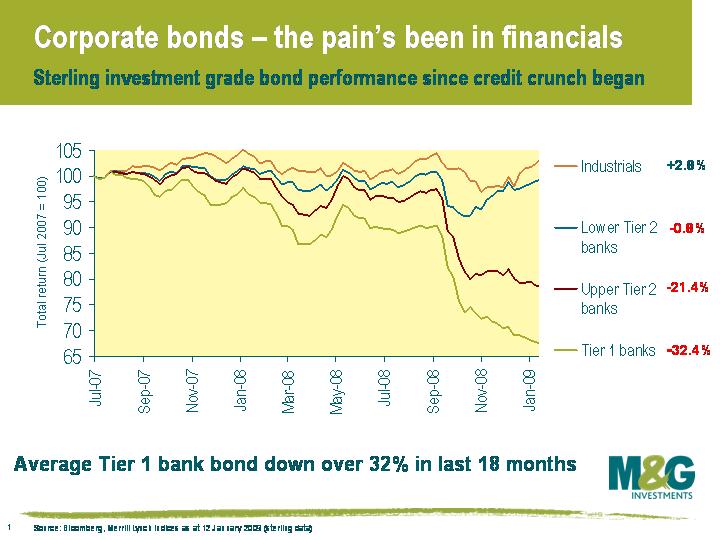

Here is an update of the chart Richard used in his October 3rd blog. It shows that T1 has fallen even further since Deutsche Bank’s decision not to call a Lower Tier 2 bond in December; the average T1 bank bond is now down over 32% since July ’07. If more banks’ T1/UT2 ratings are cut things could get even gloomier.

If you would like more information on hybrid debt, or Deutsche not calling its LT2 bond, it is worth taking a look at last month’s blogs by Mike here and from Jim here.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox