Bank Capital Securities: the new club 18-30

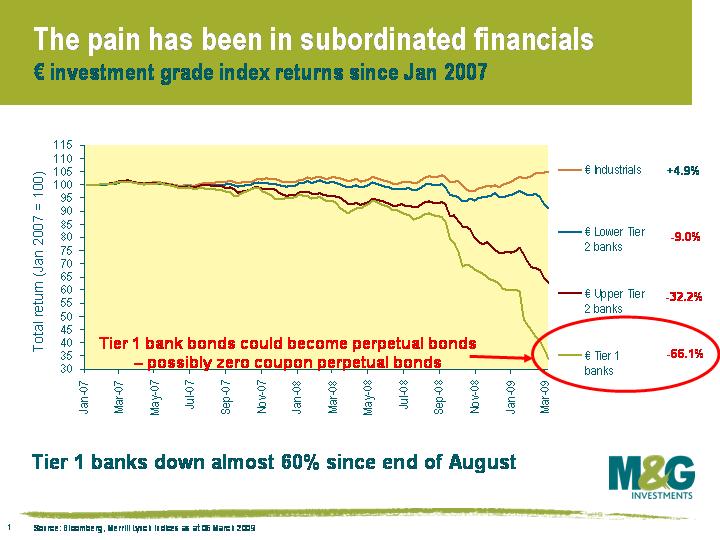

The somewhat bizarre title owes to the fact that euro and sterling bank tier one securities (the most subordinated and equity-like ones) are now priced roughly between 18 cents in the euro, or 18p and 30p in the pound! We have discussed these bonds at length in previous blogs (see the most recent comment from Jim here) and have outlined the reasons for their being a very high risk way of taking exposure to banks. Nonetheless, the decline in the valuation of these subordinated bonds has been both fast and brutal, accelerating further this year so far (see graph). I thought I’d take a moment to briefly draw attention to a few of the relevant events that have taken place in recent weeks and that relate to bank bonds.

The somewhat bizarre title owes to the fact that euro and sterling bank tier one securities (the most subordinated and equity-like ones) are now priced roughly between 18 cents in the euro, or 18p and 30p in the pound! We have discussed these bonds at length in previous blogs (see the most recent comment from Jim here) and have outlined the reasons for their being a very high risk way of taking exposure to banks. Nonetheless, the decline in the valuation of these subordinated bonds has been both fast and brutal, accelerating further this year so far (see graph). I thought I’d take a moment to briefly draw attention to a few of the relevant events that have taken place in recent weeks and that relate to bank bonds.

The End of Contract Law?

The first hammer blow to the industry took place recently when Her Majesty’s Treasury announced that Bradford & Bingley’s lower tier two bonds (a senior-ish type of capital security that should pay you interest and principal in all circumstances other than wind-down, in which case you probably get nothing) could now defer interest and defer principal. Or in other words, it can default, without actually being an event of default. HMT had in effect torn up the rule book and subordinated the lower tier 2 bonds to the ranking of preference shares. The markets, quite predictably, took this to mean that the contracts that exist between issuers of bonds and investors, and that form the basis for the investment in the first place, were now not worth the paper they were written on. All bank capital notes, and especially lower tier 2, which had thus far held up relatively well, went into freefall again.

And then some urgent back-peddling!

6 days later, with the lower tier 2 market still frozen, and with tier 1 securities shacked up in the 18-30 territory, Lord Myners released a letter of intent stating that the Bradford & Bingley action had only come as a result of its being a ‘special case’ – ie being in wind-down. He explicitly stated that going forward, and in regards to banks that remain ‘going concerns’, banking powers “do not provide for the modification of the terms of contracts (including subordinated debt instruments) of a banking institution”. The significant and widespread negative reaction to the original change of ranking had warranted an urgent response to quash market fears. And market sentiment improved, but recovered only part of the ground lost on the above news. So, thankfully, the sanctity of contract law remains in place in the UK. For now. At least for banks that remain ‘sufficiently’ free from government control. Our belief and fear is that we may not yet have heard the end of this issue.

Dresdner tier 1 principal loss participation

Bank tier 1 notes in Germany generally have loss participation clauses in them. These state that in the event of erosion of balance sheet reserves and a balance sheet ‘loss’ (which is loosely defined within each bond’s prospectus but is roughly a loss for the year), then the tier 1 securities can have their principal written down. Tier 1 bond investors therefore share in the losses that equity holders will also have borne. The actual figure for the writedown of the value of Dresdner’s tier 1 bonds has not yet been released, and will be determined between regulators and some overly-complex formula, but this announcement and realisation gave the markets another cause for alarm. It is worth remembering that in the tier 1 market every domicile, every issuer and every individual bond has extremely important differences. Buyer beware! In the bull market it felt like the engineers of these capital products had achieved the remarkable feat of getting regulatory capital for banks whilst giving the bond holders a bond product. As we work through this bear market, though, it feels more and more as though the engineers have manufactured a product that could be sold as a bond, but which in actual fact is equity.

Citigroup conversion

Citigroup released another set of ugly results last Friday, and has now lost somewhere in the region of $80 billion dollars so far this cycle (see WDCI screen on Bloomberg for a full list of bank losses). It announced that dividends will be ceased on common and preferred stock. Now at first this doesn’t sound too surprising, given the scale of losses. But we here at Bond Vigilantes just wonder if there may be the beginning of a trend somewhere in here. Banks don’t have enough capital for their leverage and their bad loans. Still. And confidence in the banking sector must have a very positive correlation with bank capital. So the first round of getting more capital was rights issues to existing shareholders; the second round was government injections of preference shares; and the third round is Citigroup (and RBS and Lloyds) having their government preference shares exchanged for common shares. Now, if the third round proves to be insufficient, what next? We wonder whether in certain particularly troubled names, certain classes of capital securities are exchanged for common shares. The Citigroup action last week suggests we are closer to this stage than one might have thought.

RBS and Lloyds Re(re-re) Capitalisation and Asset Protection Scheme

Along the same lines, Lloyds (or perhaps more accurately, HBOS) and RBS announced awful numbers. So the government is adding to its existing investment in part through converting the preference share investments and in larger part by injecting ‘near-common’ stock called class B shares. These shares were carefully invested below existing preference shares and above common stock so as to avoid another huge sell-off in bank capital securities: if the government had subordinated capital securities by investing above them, then the message would have been taken to mean that losses were even more likely than before on these subordinated classes of notes. The B shares have non-cumulative dividends of 7% and convert to ordinary stock when/if the share price has rallied above a certain price. Whilst this action can be taken as an immediate positive, since everything is being done to avoid nationalisation of the banks, it also clearly shows that the banks continue to have a sizeable shortfall in terms of required capital. The question now remains ‘do these recent injections of capital do enough?’. Our inclination is perhaps not, and that ultimately very junior debt holders may have to share in some of the losses thus far taken by shareholders and the government.

More importantly, though, was the announcement that both the above banking groups were able to remove hundreds of billions of pounds worth of bad assets from their balance sheets and into the Asset Protection Scheme. This is another clear effort to cleanse the banks’ balance sheets and to restore confidence in their businesses. The banks retain a first loss piece on assets placed with the scheme of 10%, and they must also pay a 6% fee for the assets placed within the structure. Our view on this new measure is that it is positive for the banks involved (and it seems as though Barclays may follow Lloyds and RBS into the APS). Ultimate losses on these assets could well exceed 16% (the fee and first loss piece), in which case we, the taxpayer, take the hit. Again, though, our concern remains that we may see these names having to top up their assets in the APS at a later date.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox