"Fire, Fire in Noah’s Flood’ – are we right to be scared about inflation?

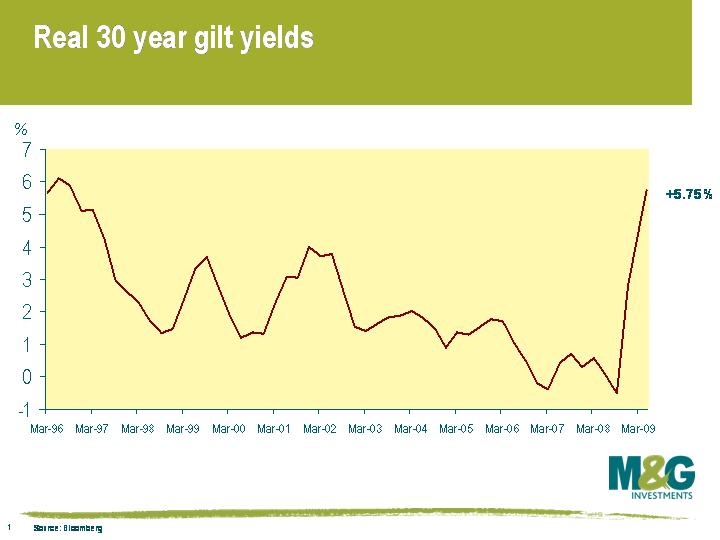

Right now the most commonly submitted question to this blog is about the impact of QE, high budget deficits and zero rates on inflation. Most people are inclined to think that after a brief period of deflation, largely as a result of lower year on year energy prices, we’re heading into hyperinflation. I guess my cop out answer to that question is that we just don’t know – it is uncharted territory, and of course, as good bond vigilantes, we are very nervous in particular about the levels of government borrowing (even though the relationship between high deficits and low bond prices is poor) and also about the way in which central banks will manage to exit QE (do gilts tank on the day that the BoE says it’s ending, or reducing, its repurchase programme?). As a result we have small short duration (i.e. bearish) positions on in our portfolios. But it isn’t a strong conviction position, and with the recent selloff in government bonds, real yields are as high as they’ve been since 1997 and perhaps we should be buying government bonds again. The real yield (the bond yield adjusted for inflation) of the 30 year gilt is now 5.75%, having been at minus 0.5% in 2008.

So rather than answer that question in detail, here is a link to a piece by the New York Times columnist Paul Krugman called The Big Inflation Scare, which debates these issues. It concludes that we are still very much in a deflationary world as output gaps increase, that the current forms of QE are having no inflationary impact, and finally that governments can cope with elevated levels of debt without having to resort to inflating it away. Krugman quotes economist Ralph Hawtrey’s comment about those who fretted about inflation during the Great Depression: “Fantastic fears of inflation were expressed. That was to cry, Fire, Fire in Noah’s Flood”.

So rather than answer that question in detail, here is a link to a piece by the New York Times columnist Paul Krugman called The Big Inflation Scare, which debates these issues. It concludes that we are still very much in a deflationary world as output gaps increase, that the current forms of QE are having no inflationary impact, and finally that governments can cope with elevated levels of debt without having to resort to inflating it away. Krugman quotes economist Ralph Hawtrey’s comment about those who fretted about inflation during the Great Depression: “Fantastic fears of inflation were expressed. That was to cry, Fire, Fire in Noah’s Flood”.

And could the recent sell off in government bond markets itself trigger a new wave downwards in economic activity, and an even bigger output gap? Yesterday in the US, Freddie Mac announced that the 30 year mortgage rate had hit 4.91%, a leap of over 75 bps in a handful of trading sessions. This means that millions of US homeowners will no longer find it possible to refinance their existing mortgages at attractive levels, and could cap any recovery in consumer spending. It’s also bad news for a banking sector that still owns billions of dollars of mortgage bonds. Risky assets have rallied hard as hopes of a V shaped recovery have multiplied – but it might be time to pause for breath.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox