Beware the doom and gloom merchants on euro unemployment

The euro area unemployment rate rose to 10.1% today, a level not seen since July 1998. But does the market place too much emphasis on this number?

Of course it is always important to keep a close eye on unemployment rates. Strong consumer demand is less likely to be inflationary if the unemployment rate is well above the non-accelerating inflation rate of unemployment (NAIRU) rather than close to it.

However, because of the way the unemployment rate is calculated, countries like Ireland and Spain have made a disproportionate contribution to this deterioration in the unemployment rate relative to the size of their economies in the region over the past couple of years.

In order to calculate labour market statistics for the euro area, Eurostat simply sum the series of the member states. For example, the labour force is the total number of people employed and unemployed in an economy. The unemployment rate equals the amount of unemployed persons divided by the labour force.

This differs from how Eurostat calculate the Harmonised Index of Consumer Prices (HICP), which have an element of weighting involved in the calculations. For example, the country weight of Germany in the HICP is 26% whereas Ireland has a weighting of only 1.5%.

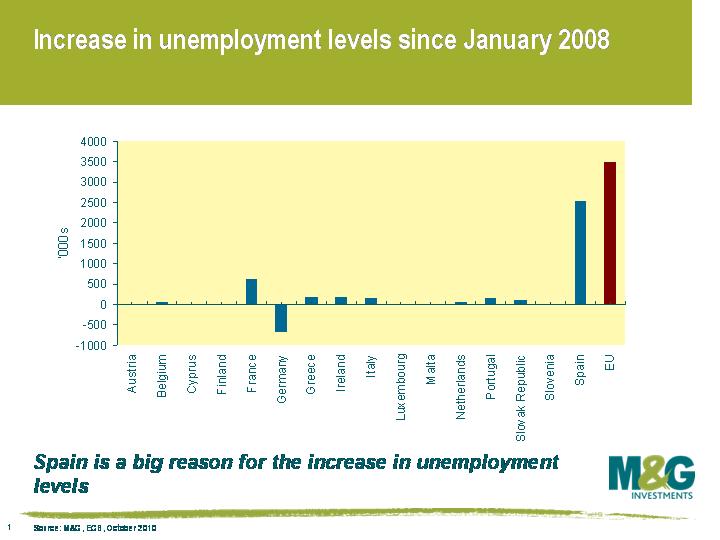

Since the beginning of 2008, the number of unemployed persons in Spain has risen by a massive 2.5 million people. Unemployment in the euro area has risen by 3.5 million people in total over this period. As a result, Spain represents 73% of the total increase in unemployment in the euro area. This is much larger than the size of the Spanish economy relative to the size of the European economy. Spain accounts for around 13% of the European economy on a purchasing power parity basis.

Doing a few back of the envelope calculations produces some surprising results. Excluding “peripheral” Europe, unemployment in Europe has risen by 416,000 people since 2008. This suggests an unemployment rate closer to 7% than 10%. Peripheral Europe accounts for almost 90% of the increase in the number of unemployed persons in the EU since the start of 2008. A very large impact given that as a percentage of EU GDP, the peripheral countries make up only around 20%.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox