The relationship between financial and non-financial credit – decoupling?

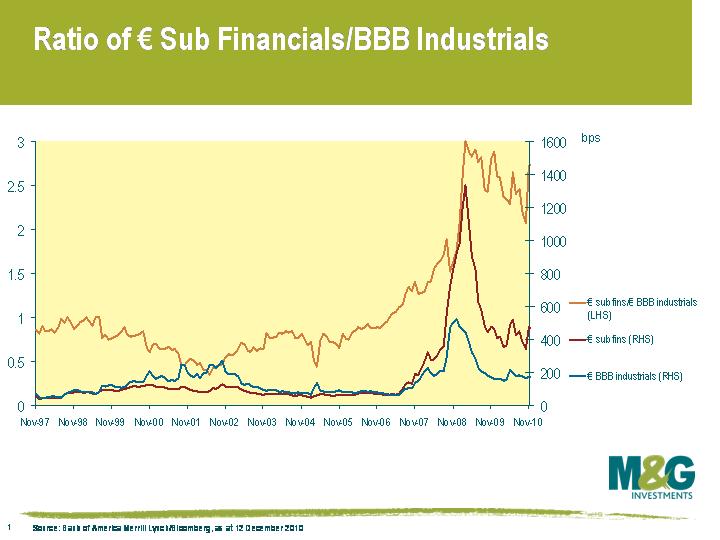

A renewed focus on European bank balance sheets, their sovereign exposures, fears of creditor bail ins and a general risk apathy saw subordinated financials spreads move significantly wider through November. I’ve charted the ratio of spreads, comparing the Merrill Lynch EMU Financial Corporate Index, Sub Type (EBSU) against the EMU Corporates, Industrial, BBB rated (EJ40) below. Whilst sub financial spreads are still somewhat tighter than levels reached in June 2010 ( +466 vs +519), the relationship between financials and non-financials has moved back to levels not witnessed since the end of 2009.

Where does this relationship go from here? Is a ratio near record wides sufficient to entice investors back into subordinated financials ?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox