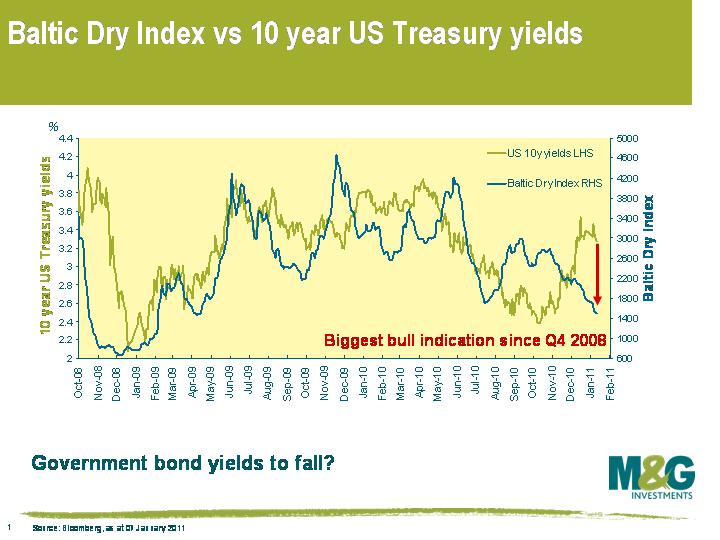

Baltic Dry Index indicating grim growth outlook and bond rally

The Baltic Dry Index, a measure of commodity shipping costs, is often used as an indicator of global demand, and it has a pretty good relationship with government bond markets too as we’ve discussed previously. The index has received much publicity over the past few years since it very accurately flagged the carnage of Q4 2008. One of the index’s attractions is that unlike financial markets, it’s not subject to speculation (although of course shipping rates are influenced by their own set of demand and supply factors).

Today the index fell to 1495 points, which is the lowest since April 2009, and the trend is fairly firmly downwards.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox