UK inflation jumps most in one month since 1993 – cue mass hysteria

A 1% jump in UK CPI in December meant that the year on year inflation rate in the UK soared from 3.3% to 3.7% year on year, once again beating consensus expectations of 3.4%. No doubt we’ll have the newspapers tomorrow full of talk of a return to the 1970s, and no doubt we’ll also have various MPC members continuing to come out over the next few weeks and months explaining that this inflation problem is (still) temporary.

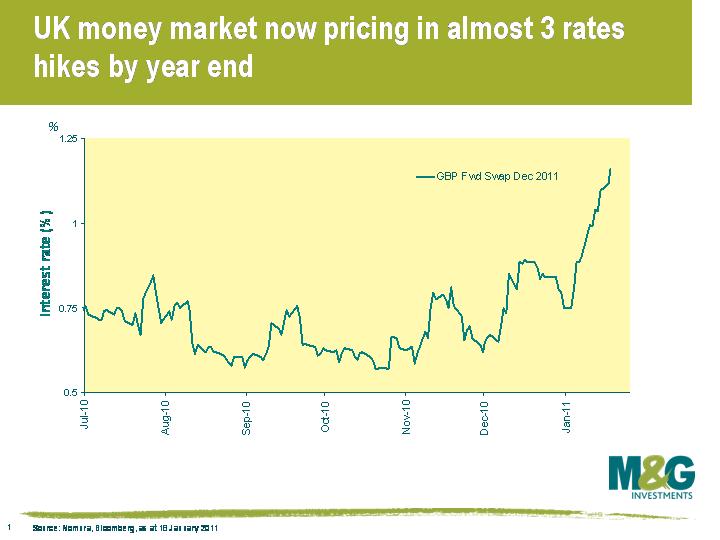

Two charts which I think are interesting. This one shows that the bond market is taking the inflation number seriously, and is now pricing in almost 3 lots of 0.25% rate hikes by the end of this year. The first rate hike is now fully priced in for June.

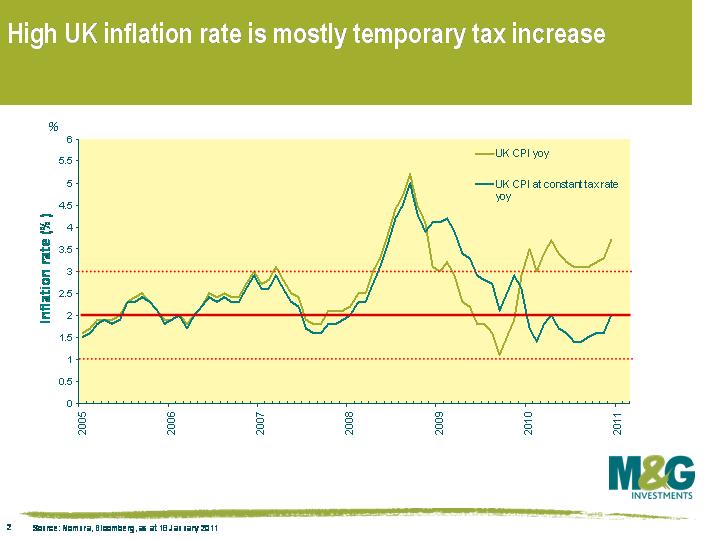

The second chart demonstrates that while the MPC has done a bad job inflation forecasting over the past few years, it still definitely has a point about inflation being temporary. If you measure inflation at constant taxes, then the inflation rate is only 2%, so assuming we don’t see another VAT hike in January 2012, we should see UK inflation fall sharply from the beginning of next year.

That said, UK inflation at constant taxes has still gone from 1.4% yoy in August to 2.0% yoy now, so I wouldn’t relax entirely, but today’s headline inflation figure is nowhere near as bad as it looks. As Jim mentioned in a recent blog, hiking rates could be GDP suicide, and I’d be surprised if UK interest rates went up as much as the market’s expecting.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox