Career opportunities – the ones that never knock. With youth unemployment rising steadily in the UK, where are the protest songs?

“Wham, bam – I am, a man

Job or no job, you can’t tell me that I’m not.

Hey everybody take a look at me

I’ve got street credibility

I may not have a job but I have a good time

With the boys that I meet down on the line.”

“Wham Rap” by Wham!, 1982

My mate told me recently that the first Wham! album was surprisingly good, so I bought it. It is good, and I am surprised. I was also surprised to find how political songs like Wham Rap were, and it got me thinking about writing a blog about the political songs that made the charts in the 1980s in response to the recession, and wondering why today’s youth haven’t written any. After all, youth unemployment is famously high isn’t it?

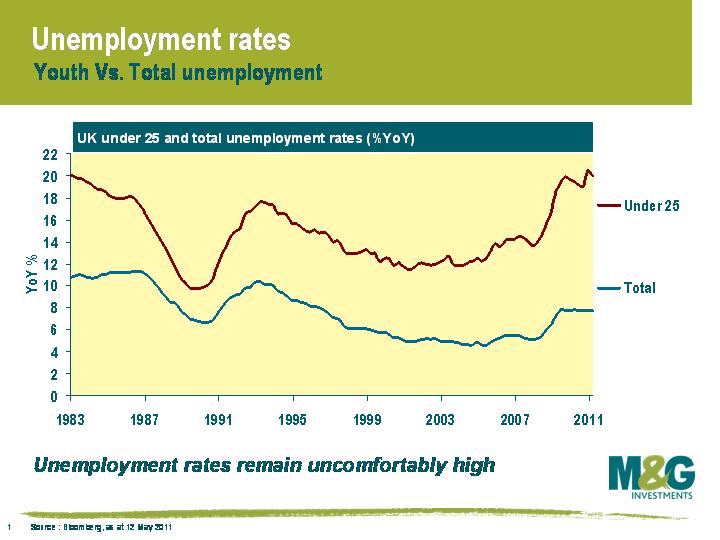

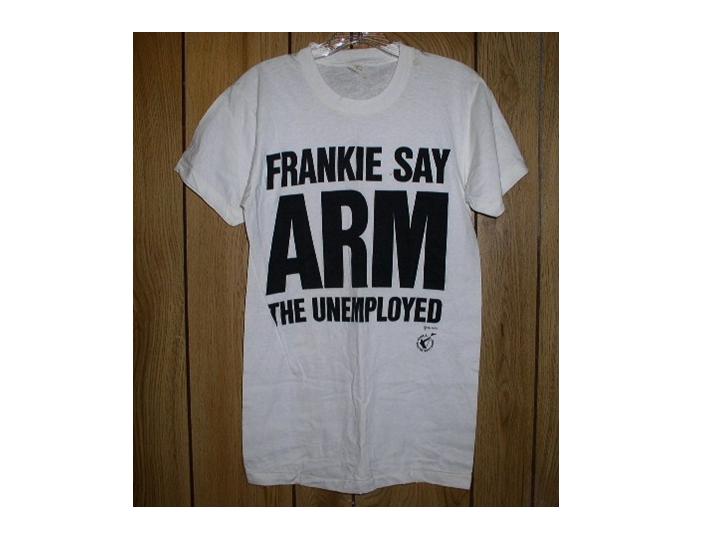

The data only go back to 1983 for youth unemployment – but you can see that the early 80s were a time of youth unemployment rates of nearly 20%. In 1981 we had songs like Ghost Town by the Specials, 1 in 10 by UB40 (the band itself named after the dole claim form), Shipbuilding by Elvis Costello in 1982, and by 1985 Frankie Goes to Hollywood were selling T-Shirts saying “Frankie Say Arm the Unemployed” and leading a delegation to Downing Street to deliver a petition against the axeing of benefits for school leavers if they didn’t go onto a Youth Training Scheme (YTS). It was signed by Paul Weller, Madness, Smiley Culture, the Flying Pickets (another politically relevant name inspired by the miners’ strike) and Alison Moyet.

Some argue that the youth unemployment numbers are distorted (this post on the website Straight Statistics says that the treatment of youths in education is a distorting factor, and that the outright number of young people claiming unemployment benefits is little different than it was in the early 1990s, although it was high then too). Nevertheless there are 1.7 million people between the ages of 18 and 24 who are economically inactive (of which 0.7 million are officially unemployed, the remainder are largely in education). If anything, with free tertiary education a thing of the past (although with access to that education easier) the kids of today have even more to be aggrieved about – those going to university are being saddled with debts of tens of thousands of pounds. And never before has the technology to make music (or indeed film) been so cheap and available. I’ve a grand piano, a drum machine, and an 8 track recording studio on my mobile phone. Maybe you can only be a protest singer if you have an acoustic guitar. Incidentally whilst thinking about this issue I stumbled across an article on the BBC website, by an American writer wondering where the great US cultural response to the Great Financial Crisis is. Perhaps, he speculates, the safety net is greater than it once was, and the starting point for living standards higher thanks to multi-income families?

Perhaps though there are protest songs out there but I’m missing them? Let me know.

On an unrelated note, I was in Ireland seeing clients earlier this week – one recommended I read an article by Morgan Kelly, a notorious economics professor at University College Dublin, from Saturday’s Irish Times. In it he claims that the Central Bank governor Patrick Hononhan’s decision to keep a government guarantee on Irish bank bonds was “the costliest mistake ever made by an Irish person”. He says that the only way to avoid an Irish sovereign bond default is to effectively default on the ECB loans made to the Irish banking sector, halving Ireland’s debt to Euro 110 billion. He also thinks government borrowing needs to fall to zero. Neither of these outcomes looks likely – Irish CDS currently trades at 640 bps and there is open talk about default being both acceptable and even desirable. The mood is relentlessly gloomy in Dublin – our taxi driver told us that his firm now hires him out at a daily rate of Euro 200 compared with Euro 440 a couple of years ago. There’s no shortage of taxis – it’s a service where demand collapses simultaneously with a dramatic increase in supply as people try to earn an extra income.

Finally, and totally unrelated to bond markets or economics, the film How to Lose Friends and Alienate People was on TV earlier this week. This is the story of Toby Young (who is trying to set up a Free School near where I live in Hammersmith – don’t get me started…) and his disastrous time on the staff of Vanity Fair in New York working for the famous editor Graydon Carter. It reminded me that I read the book when it first came out, and finished it on a plane. I’d never heard of Graydon Carter before, but as I disembarked the man in front of me’s tennis racket case dangled in my face revealing a business card tag stating “Graydon Carter, Vanity Fair”. What are the chances of that? Then I realised that whilst for me, the chances of being on a flight with him were minutely small, the chance of Graydon Carter being on the same flight as somebody reading that newly published book were probably evens or better.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox