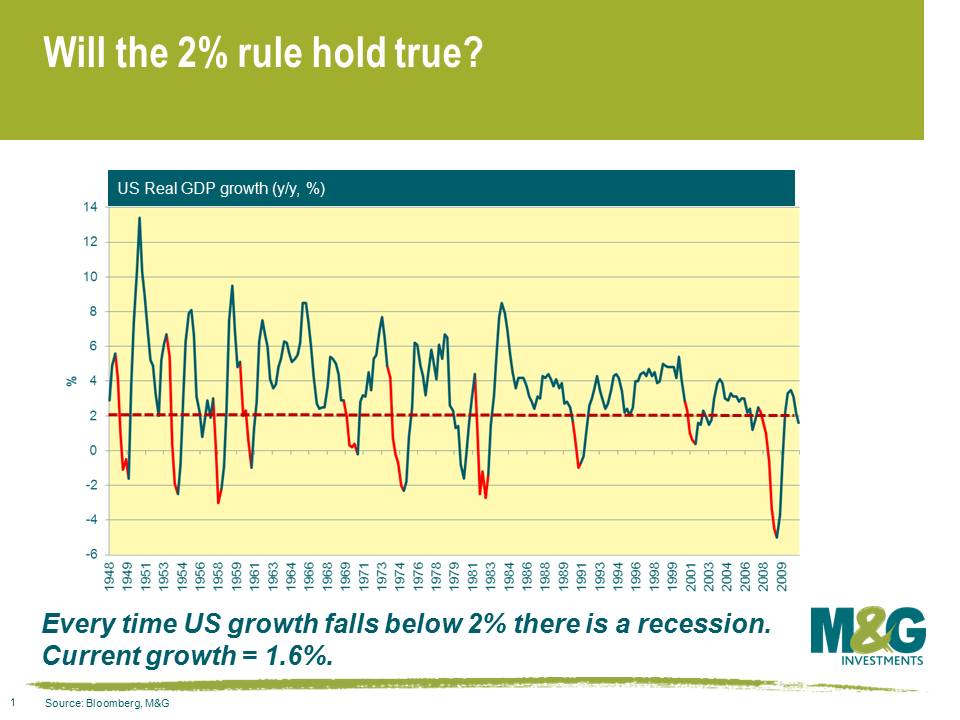

The US is headed for recession – if 63 years of economic data are any guide to the future

Think the US is out of the woods now that congress has come to an agreement on the debt ceiling? Not according to this chart from Rich Yamarone, an economist at Bloomberg. It’s called the “2 percent rule”. When US GDP falls below 2%, it usually means the world’s largest economy is headed for a recession.

Last week, we received confirmation that US GDP was just 1.6% in Q2 2011. Combined with yesterday’s much weaker than expected ISM report and an unemployment rate at 9.2% , it suggests that the US Federal Reserve won’t be in any rush to hike interest rates this year. Fed Governor Ben Bernanke may even be warming up the printing press (as Mike alluded to here) if US employment and growth outcomes don’t start to improve – and quickly.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox