The US and Eurozone economies are probably now shrinking

Yesterday’s Philly Fed number was an absolute shocker. The Philadelphia Fed’s general economic index is something we watch closely because it is a good indicator of the Institute for Supply Management indices, and the ISM surveys are arguably the most important monthly US economic data releases.

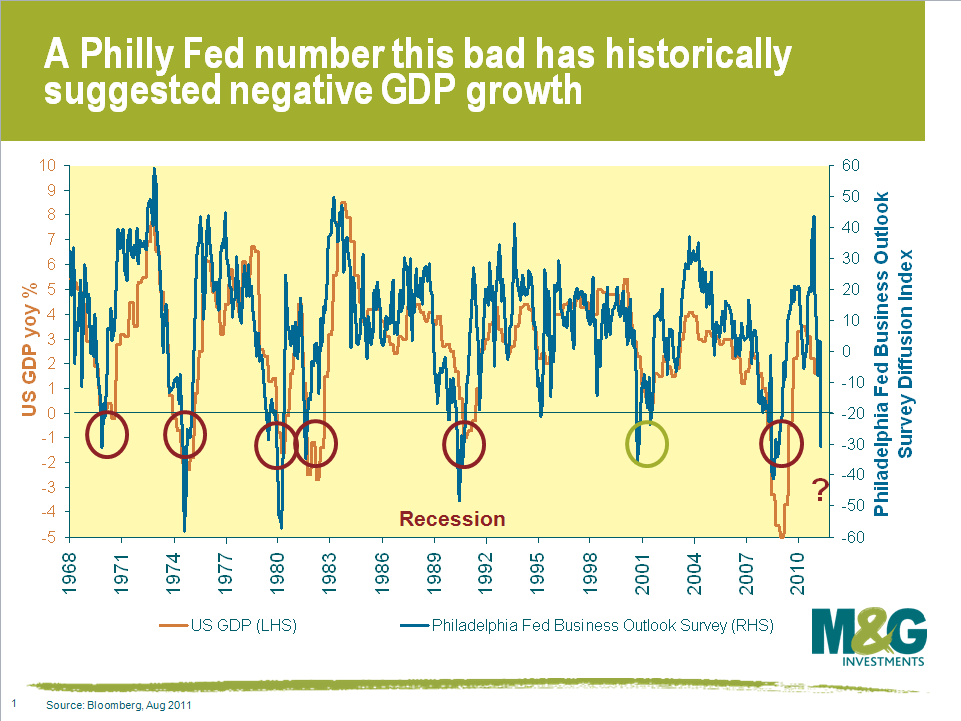

We wrote a comment back in January 2008 about the importance of the Philly Fed data release, which back in 2008 was already flashing red. Yesterday’s release was a staggering minus 30.7 (versus expectations of +2, nice work economists), and as the chart below demonstrates, these kind of levels give a strong indication that a negative US GDP print is coming.

Meanwhile, Eurozone economic data has followed the US in falling off a cliff. It was announced on Tuesday that the Euro area economy grew at just 0.2% quarter on quarter in Q2, with the big worry being that the preliminary growth estimate for the German economic powerhouse was a puny +0.1% versus expectations of +0.5%. More worrying still is that economic conditions appear to have deteriorated significantly since the end of Q2, raising the very real chance that the data for Q3 will be negative.

Meanwhile, Eurozone economic data has followed the US in falling off a cliff. It was announced on Tuesday that the Euro area economy grew at just 0.2% quarter on quarter in Q2, with the big worry being that the preliminary growth estimate for the German economic powerhouse was a puny +0.1% versus expectations of +0.5%. More worrying still is that economic conditions appear to have deteriorated significantly since the end of Q2, raising the very real chance that the data for Q3 will be negative.

We’ve written a lot about the ECB recently, and have been utterly flummoxed by the quite outrageous decision to hike rates twice this year (eg see here). In July 2008, when the ECB had its last major policy disaster, it took three months for the ECB to reverse the decision to hike and start cutting rates. It’s starting to feel like Groundhog Day.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox