What is the increase in US money supply telling us?

Bernanke is clear about why the Fed has embarked on “Operation Twist” – the Federal Reserve has both greatly increased its holdings of longer-term Treasury securities and broadened its portfolio to include agency debt and agency mortgage-backed securities. Its goal in doing so was to provide additional monetary accommodation by putting downward pressure on longer-term Treasury and agency yields while inducing investors to shift their portfolios toward alternative assets such as corporate bonds and equities. Bernanke wants investors to take more risk. He would be much happier if there wasn’t so much cash sitting on the sidelines. Certainly, negative real cash rates will entice investors to search for higher yielding assets.

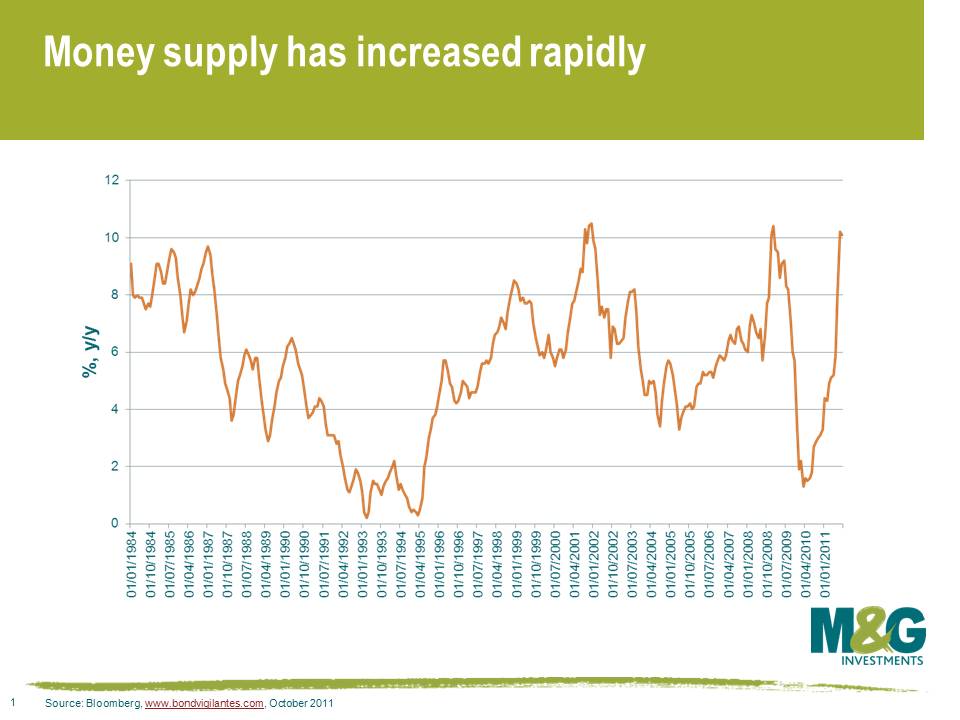

Looking at US M2 money supply, an increase of 10.1% over the year to September 2011 should be a cause for concern. A higher rate of money supply growth has occurred on only five occasions since 1984 (including last month). The Fed thinks this is because institutional investors, concerned about exposures of money funds to European financial institutions, shifted from prime money funds to bank deposits, and money fund managers accumulated sizable bank deposits in anticipation of potentially large redemptions by investors. In addition, retail investors evidently placed redemptions from equity and bond mutual funds into bank deposits and retail money market funds.

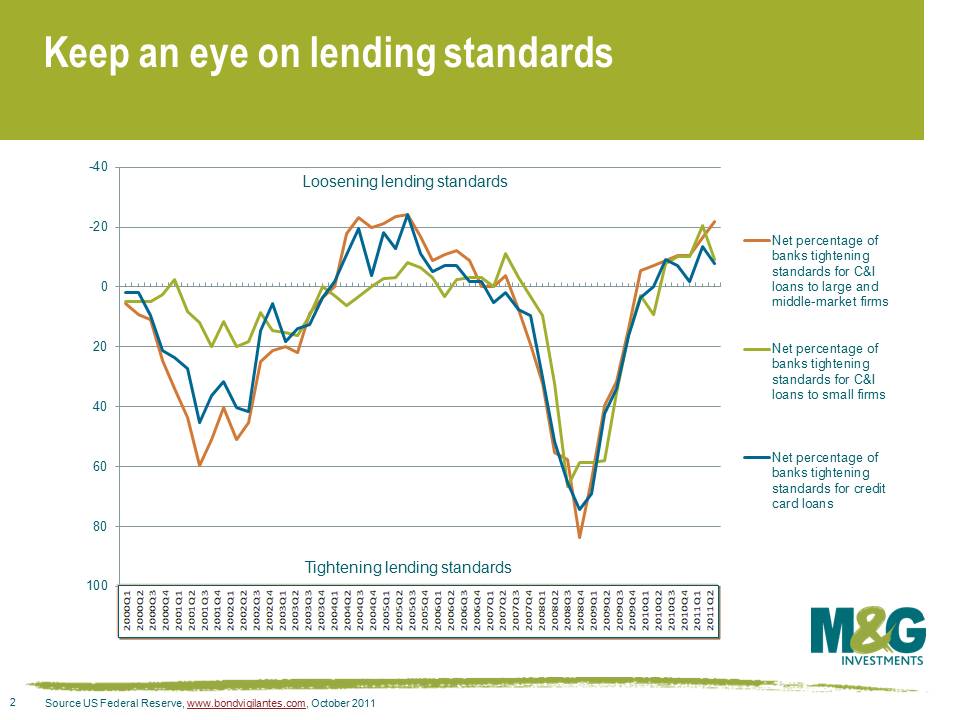

We have always been told that “inflation is always and everywhere a monetary phenomenon”. According to economic theory, an excessive expansion of the money supply should be inflationary. Arguably, the current expansion in money supply is not inflationary because banks are not lending. Or are they?

Looking at the Fed’s survey on bank lending practices, banks have been loosening lending standards since the third quarter of 2008. The ability of large and medium sized firms to access credit has improved dramatically over the past couple of years. Banks have also reported a loosening in lending standards for credit card loans as well. With the lending standard survey due to be updated at the end of this month, we are keeping a close eye on this indicator. Banks may have reacted to the events of recent months by tightening lending standards again, exactly at a time when the US economy is flirting with recession. On the other hand, ultra-easy monetary policy may result in the banks easing loan standards further in a search for profits.

Some economists believe excess growth in money supply suggests asset price inflation and consumer price inflation. Others believe the increase is a deflationary signal in the short-term as it likely reflects a flight to safety and low expected asset returns. I have some sympathy for this view as the last time year-over-year growth in demand deposits was at current levels the US economy was in a deep recession. The bottom line is, no one knows what impacts extraordinary loose monetary policy is having on the real economy. With so much confusion going on, the only thing that is clear is that central bankers have their work cut out for them in trying to understand this mess. Now we know why economics is the only field in which two people can share a Nobel Prize for saying opposing things.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox