Will the Debt Management Office redeem War Loan?

We’ve written about War Loan before – it’s a really interesting gilt, and not only because of its history – it was issued during World War 1 with the 1917 advert stating “if you cannot fight, invest all you can in 5% bonds. Unlike the soldier the investor runs no risk.” The “no risk” bit wasn’t strictly true. In 1932 its coupon was “voluntarily” reduced from the original 5% to 3 1/2% – I’ve argued before that this should be viewed a default event for the UK Government (although if UK CDS had existed then, I’m pretty confident ISDA would have considered the debt restructuring ‘voluntary’). Additionally, because inflation has at times been way above 3 1/2% in the intervening decades, the real returns have therefore been sharply negative, and as recently as 1990 the bond traded at a price below 30 pence in the £. In the 1970s we’re pretty sure the yield of the bond has even been higher than its price – a rare event in bondworld (although Greek bonds have recently seen this happen to them).

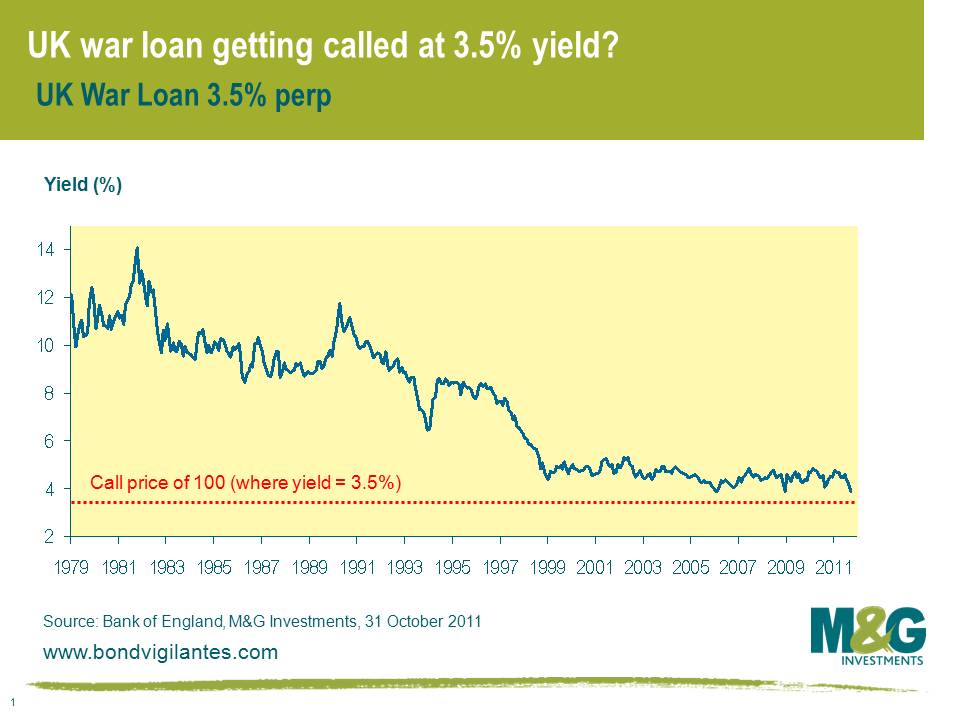

As the Eurozone crisis deepens, with last night’s decision to hold a referendum in Greece about the bailout causing a big flight to quality in the remaining AAA markets (of which, astonishingly, the UK is one), long dated government bonds are rallying hard. War Loan now trades at a price of 91 1/2. Why this is interesting is that the UK Treasury, via the Debt Management Office (DMO) has the right to call this bond (which has no fixed maturity date – it’s a so-called “perpetual” bond) whenever it likes (subject to a notice period) at a price of 100. This has always been academic, as it was so blatantly uneconomical for the taxpayer. But now ultra long gilt yields are hitting record lows. The Treasury can borrow money until 2060 at a yield of 3.28% at the moment. Theoretically then the authorities can repay holders of War Loan at 100, implying a yield of 3.5%, and reissue new long dated gilts at a yield of 3.28%, saving the taxpayer 22 basis points per year.

So why aren’t they doing this? There are perhaps a couple of reasons. Firstly there is a 90 day notice period for such a repayment – the gilt market could move lower again in that period, so making the refinancing look unattractive. Three months is a long time in markets at the moment. So perhaps the market needs to be significantly higher for the DMO to want to do this. Secondly this is not an exact like-for-like switch – it’s exchanging a perpetual bond for a dated bond, so at the margin permanent funding for the government is more valuable than dated funding.

This uncertainty makes War Loan difficult to value – and you get paid a premium of 56 basis points (17% more yield) for owning it rather than the fixed date 4% 2060 gilt. It has an uncertain duration – is it a bond with an infinite maturity, or a 90 day maturity? It won’t participate in a big rally like a fixed rate bond – would you pay 101 for a bond that might get repaid at par? This is what’s known as negative convexity (US mortgage backed bonds also behave like this – as bond yields fall, more people repay their mortgages to refinance at lower rates, and you find yourself with a shorter duration asset than you might have expected).

Whilst it would be a shame to lose one of the last remaining characterful gilts (since Deputy Governor Paul Tucker was head of the Bank of England’s markets division in the mid 1990s there was a deliberate (and necessary) policy to make the gilt market more uniform and transparent, which meant no more perpetual gilts, double-dated gilts and other embedded option gilts), I for one would be happy to see it go. Why? Because – disclaimer – I own it in my gilt fund.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox