Record low government bond yields – good or bad news?

Today’s FT launches on the significant headline of record low gilt yields (see here). Within the article it discusses a number of issues from quantitative easing to Bill Gross’ famous quote regarding the UK “resting on a bed of nitroglycerine” (which was something we took issue with at the time as commented here).

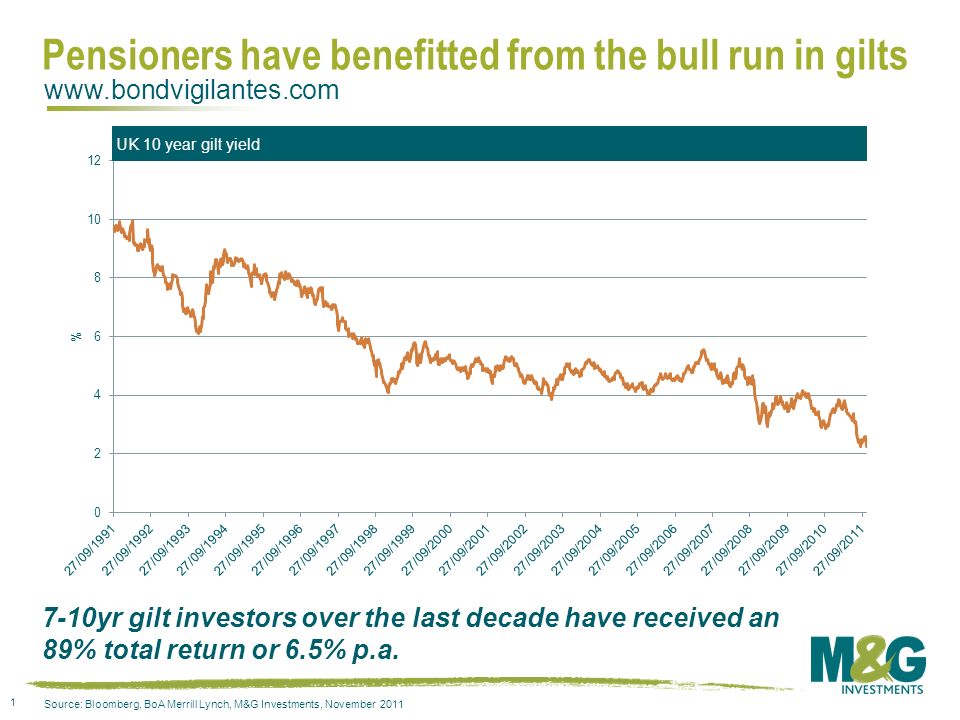

However the new revelation for me today was the opinion that “low gilt yields are bad news for savers and pensioners that rely on interest for income”. At face value true, but what about reality?

If you are a current saver or pensioner and own gilts, or indeed any other good quality bonds, then you have had a cracking year, and a cracking decade. The asset class has been in a huge bull market. Surely that is a position in which a saver wants to be?

If you are about to start seeking an income from government bonds by saving in the asset class then yes, income returns are at historic lows. However for existing investors, record high prices and low yields are presumably good news. If investors think the asset class is now unattractive, at least they have the capital gains and option to buy into an asset class whose performance has lagged and where yields have not fallen to new lows.

If you are about to start seeking an income from government bonds by saving in the asset class then yes, income returns are at historic lows. However for existing investors, record high prices and low yields are presumably good news. If investors think the asset class is now unattractive, at least they have the capital gains and option to buy into an asset class whose performance has lagged and where yields have not fallen to new lows.

The concept that a bull market is bad news for investors is indeed true if you own none of the asset class, but similarly a bear market in equities is great news for pensioners and savers if they have yet to allocate to the asset class.

So regarding record low government bond yields being good or bad news, as always with investments, it depends on your position.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox