Eurozone sovereigns – all eyes on the ratings agencies, watch those tails go

People are still wondering what caused the big surge in Italian and Spanish government bond yields back in July that lurched the Eurozone debt crisis into the current very serious phase (eg see here). I suspect that, if anything, the most likely trigger was Moody’s decision to cut Portugal’s rating from Baa1 all the way down to Ba2, a four notch downgrade, on July 5th this year. The junking of Portugal, while surely not that unexpected, managed to spark a wave of forced selling by investors who presumably were only permitted to own investment grade sovereigns. Portugal 10 year bonds collapsed immediately after the downgrade, with 10 year yields soaring from 10.75% to 12.7% in a day. The effect was rapidly felt in other peripheral Eurozone sovereigns, and in just one week, Spanish 10 year yields leapt 60bps to 6%, a level at which market participants began to question debt sustainability.

The lesson is that whatever you may think of the credit rating agencies, they really matter. They also tend to follow what the market does. As I mentioned in a blog comment on July 7th here, the tail tends to wag the dog when it comes to the rating agencies. A sovereign bond sell-off = domestic bank sell off = higher borrowing costs all round = higher interest costs = creditworthiness deteriorates = ratings downgrade = sovereign bond sell-off. But now that the market has figured out this reaction function, it just results in Eurozone sovereigns and banks getting dragged into the vortex.

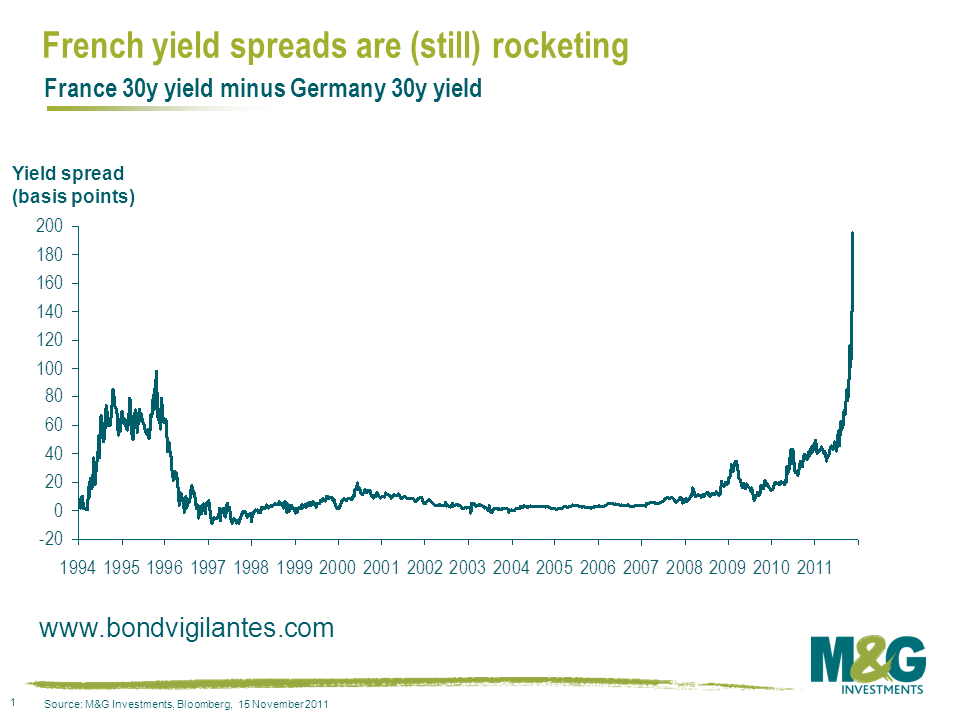

Today we’ve seen probably the most worrying day of this crisis so far. It’s a ‘risk off’ day, yet even the Netherlands, which the market perceives to be the second strongest Eurozone sovereign, is coming under a bit of pressure with Netherlands 5 year bond prices down 1% on a day when Germany has rallied. France is seeing a full blown run on its debt, with France 30 year bond yields soaring to 4.43%, the highest since June 2009 (German 30 year bond yields are at record lows of 2.45%). In price terms, 30 year French bonds have underperformed 30 year German bonds by 14% since the beginning of November and by 20% since the beginning of October. See below for a chart on French spreads over Germany, updated from a blog comment on the developing situation in France last month here.

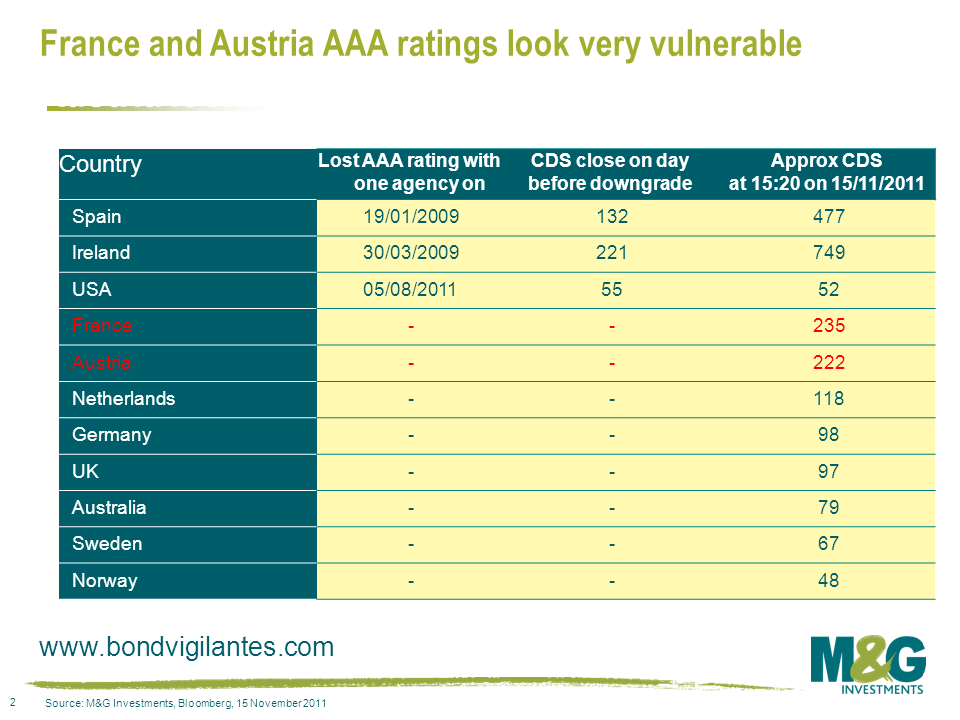

What does the CDS market, which has arguably slightly led the sovereign cash bond market in the past few years, say about the risk of France or Austria losing their AAA ratings? Pretty much nailed on, as the table below shows. The pesky bond vigilantes have found a whole heap of bones, their tails are wagging furiously, and surely the rating agencies’ threatening barks are about to turn into bites. Get prepared for a dog’s dinner.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox