Red screens at night, stockpickers’ delight

In this heightened atmosphere of risk aversion, the high yield market as a whole has been far more discriminating when it comes to any poor fundamental performance from individual issuers or sectors. This has led to some large relative moves between certain bonds and sectors within the market. To put it another way, 2011 is turning out to have been a vintage year for stock picking. Those high yield fund managers who have managed to correctly back the “winners” and avoid the “losers” will have significantly outperformed.

This has been particularly true of one major trend that happens to affect a lot of high yield issuers, namely the shift away from traditional physical and analogue media toward online and digital media.

This shift has been occurring for years, but the pace of the change in how people consume content has suddenly accelerated in the last 18 months, with profound consequences for many companies within the high yield market.

One group of “winners” in this case has been the broadband and cable operators in Europe. As people start to watch more digital TV, use more bandwidth intensive services and consume content online, the demand for faster and more reliable broadband and digital TV has increased rapidly. With well invested fibre optic networks and with consumers willing to pay premium prices for premium services, a lot of European cable companies have been enjoying a miniature boom despite the broader travails of the European economy. The latest round of third quarter results from companies such as Virgin Media in the UK, Kabel Baden Wurttemberg in Germany and Ziggo in the Netherlands, have merely affirmed the trend. (Full disclosure: M&G funds own bonds issued by the companies mentioned).

The “losers” in all this have been companies who have been involved in the traditional provision of physical media.

For instance, let me ask you a question: when was the last time you picked up a physical telephone directory?

Directories businesses (traditionally large issuers in the high yield markets) have been having to cope with gradual structural decline for years. This in itself is not a large negative for creditors. A company that is in decline can still generate a lot of cash and repay its debts. The pertinent issue for bondholders is the pace of decline and whether those debts are manageable.

What the directory companies have found is that in the age of Google and Facebook, fewer consumers are reaching for the Yellow Pages to find a plumber and are instead reaching for their laptop or smart-phone to type in a search or ask their social circle for a recommendation. As a result small businesses are reallocating their advertising budgets online at an ever-accelerating rate. Directories companies have tried to mitigate the shift by entering the online space but with mixed results. Consequently, as earnings and cash flow have been falling ever faster in 2011, debt loads are starting to look increasingly unsustainable. Debt restructurings and bankruptcies are becoming a recurring feature of this sector. (Seat Pagine in Italy, for instance, is currently in talks with its bond holders to exchange almost € 1.3bn of high yield bonds into equity)

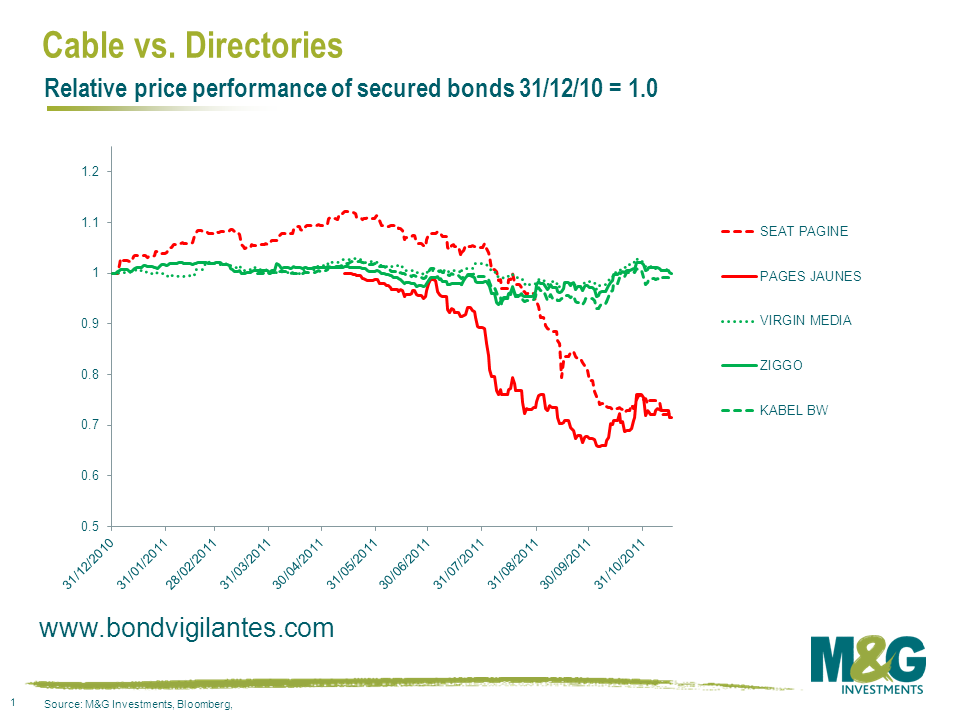

The crucial thing for us as high yield investors is that this fundamental trend has been starkly reflected in the performance of the bonds over the course of this year. As we can see in the chart below, backing the “winners” (in this case senior secured bonds issues by Virgin Media, Kabel Baden Wurttemburg and Ziggo) in green and avoiding the “losers” (senior secured bonds issued by Seat Pagine and Pages Jaune) would have meant a relative outperformance of almost 30% this year.

As the Eurozone melodrama continues to dominate the headlines, it’s easy to forget that for the millions of European consumers and thousands of companies, life (for now at least) carries on. As it does so, there are many profound shifts within the economy that should not be ignored by investors.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox