France now yields more than EFSF. Hmm

France has started wobbling again recently. France 10 year government bond yield spreads over Germany have blown out from just under 100 basis points at the beginning of December to 150 basis points today, although this is still a bit below the wides of 190bps in mid November. Maybe people have woken up to the likelihood of France losing its AAA status, or the probability that France is going to have to issue even more bonds in the next three years than heavily indebted Italy.

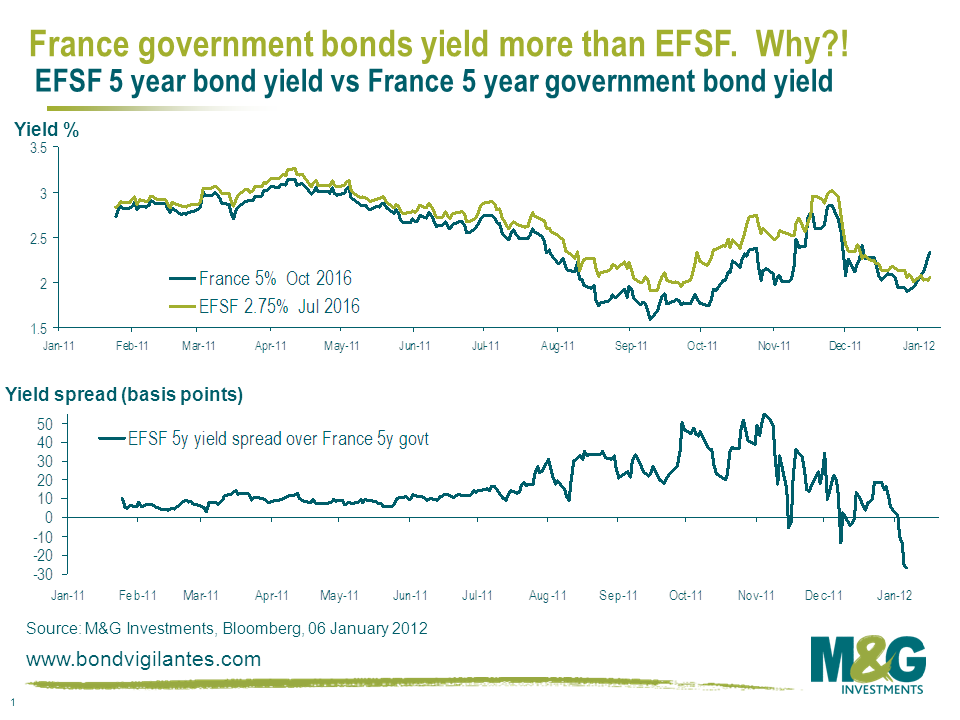

What makes much less sense is that France government bonds now yield more than EFSF bonds (eg see chart below). Fitch pointed out the obvious at the end of December when they said that EFSF’s AAA rating depends on France remaining AAA, and highlighted that France and Germany provide over 80% of the ‘guarantees’ for EFSF (France provides €158.5 billion of guarantees plus over-guarantees to the EFSF pool). If France defaults, EFSF isn’t going to work. If Spain or particularly Italy default, France might default, and maybe even Germany will default. But if we get to the stage where Spain or Italy defaults, you can be pretty certain that EFSF guarantors will renege on their ‘guarantees’ since the bailing out of Spain or Italy would dramatically increase the risk that the guarantors themselves default. And this is just one of the problems with EFSF (see my comment from last September here for a longer list)

So surely EFSF bonds are effectively subordinated French government bonds. Personally I wouldn’t touch either of them, but shouldn’t EFSF bonds yield more than France?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox