Competitiveness confusion reigns supreme

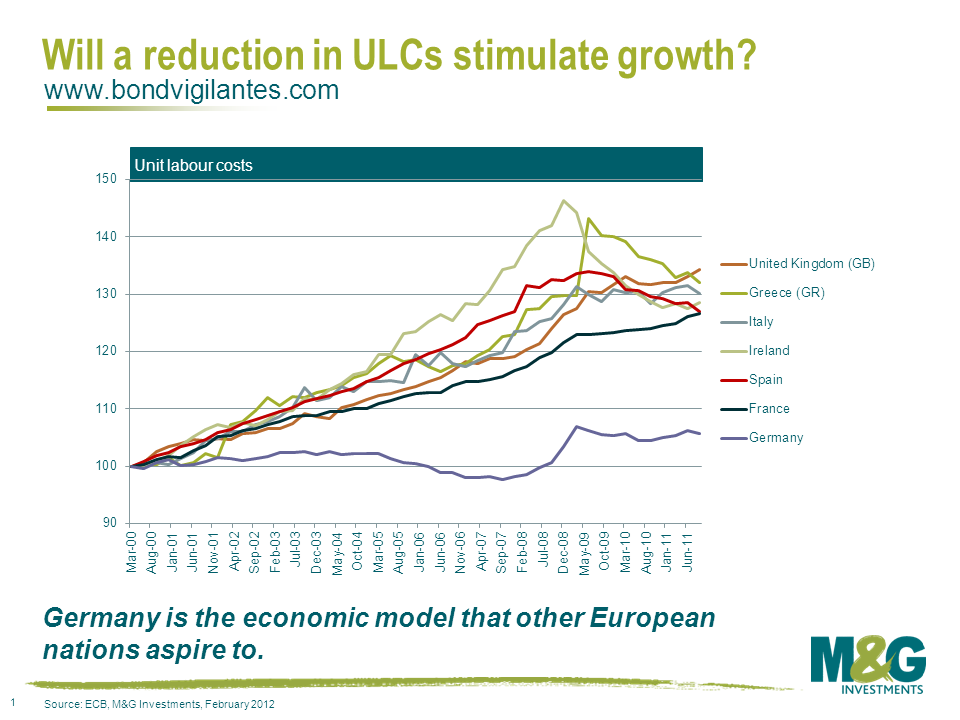

Many question how the heavily indebted European nations will get out of the mess they are in. Absent a break-up of the single currency unit, most economists point to a significant reduction in unit labour costs (through a reduction in nominal wages) as the answer. In fact, Nicolas Sarkozy has stated that France has to bring down labour costs to improve its competitiveness like Germany did a decade ago. The question we are asking ourselves is if this so-called “internal devaluation” is the answer?

Competitiveness is a buzz word that gets thrown around a lot. But what is it exactly? The most widely used measure of competitiveness is unit labour costs (ULCs), the ratio of nominal wage growth to labour productivity. It is important to economists because they will deem an economy to be more competitive the lower the ULC is. This would suggest that an economy is more competitive the lower the share of the labour force’s contribution to GDP. Thus, in order to close the “competitiveness gap” that exists between unproductive countries (like Greece) and productive countries (like Germany), countries need to implement policies that will result in downward adjustments in relative wages.

In extremis, this means that the most competitive economy would have a labour share of GDP of zero (because wages are zero), and a capital share of GDP of 100%. Does this make sense? No. Reducing the income generated by labour by reducing nominal wages will be a drag on economic growth, and several economists have investigated the impact that ULCs have on an economy. Kaldor’s paradox, put forward by Nicholas Kaldor in 1978, showed that the fastest growing economies in the post-war period also experienced faster growth in ULCs, and vice versa. This suggests that a higher labour share will not necessarily lead to a less competitive economy. The argument that many have been spouting that lower ULCs will lead to higher economic growth is a highly simplistic view, and may not reflect reality. Remember, those economies with the fastest growth rates in the 2000s, like Ireland and Spain, actually had the fastest rising ULCs over the same time period.

An increase in labour’s share of income can have a number of effects. Firstly, it has been shown that the propensity to consume out of wages is higher than that of profits, so if you really want to get an economy going, the trick is to increase the amount of money that gets into people’s pockets. And that is exactly what the central banks are trying to do, by flooding the financial system with cash. Of course, there is another way to reduce ULCs to become more competitive and that is to increase productivity, which means working more efficiently for the same amount of pay. If ULCs fall due to productivity gains, the benefits will largely accrue to the business owner and not the worker.

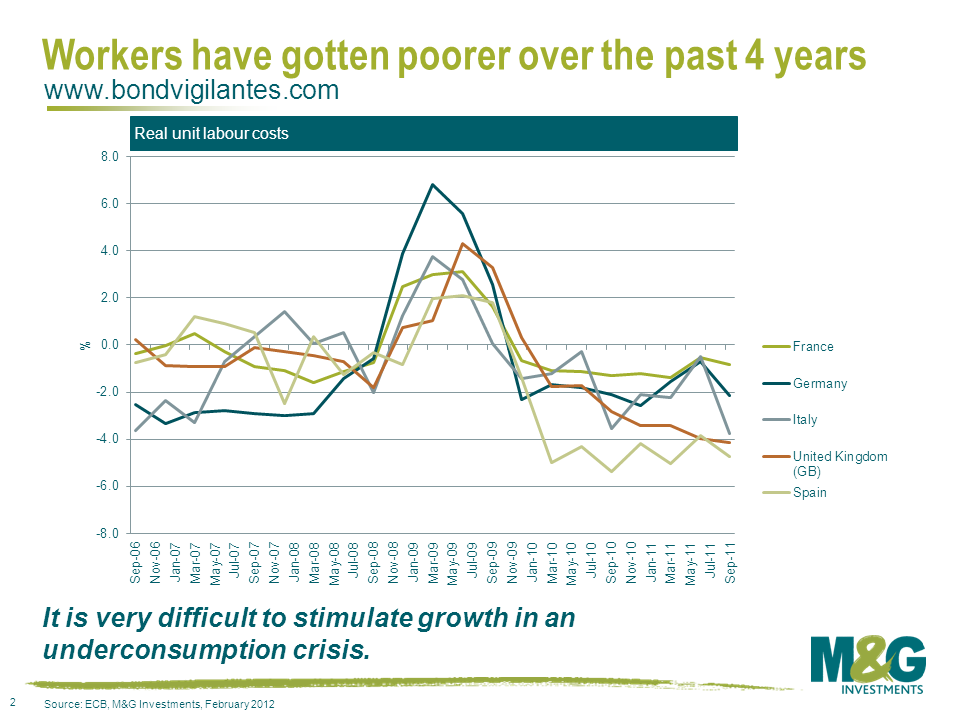

However, workers are getting poorer as shown by the below chart. It is very difficult to stimulate consumption when real wage growth is negative, as it has been for the last four years in the largest European nations. £100 in 2000 is now worth £68 in real terms, and €100 in 2000 is now worth €78 in Germany, €59 in Spain, €74 in France, and €67 in Italy (all in real terms). For the last four years wage increases across Europe and the UK have not kept up with the pace of inflation.

Secondly, if nominal wages are rising then prices for goods will also rise, though they will become less competitive in international markets. This will have a negative effect on growth. Would workers in countries like Spain, where unemployment is currently 22.9% and inflation is 2.4%, accept a reduction in nominal wages to maintain their firms’ competitiveness and therefore keep their jobs? The point is, the overall result on GDP of a redistribution of income towards workers is ambiguous and depends on which of the two effects dominates.

Let’s have a look at a shift in the distribution of income towards capital. Initially, an economy will probably experience an increase in investment causing GDP to increase. However, sooner or later prices will fall because of excess capacity caused by both an increase in investment and fall in consumption. Capacity utilisation will have to fall, followed by a reduction in investment, a decline in income will follow, and then a fall in production and employment.

The major challenge facing Europe is a lack of demand. This is an underconsumption crisis. Reducing ULCs will not solve this underconsumption crisis through either nominal wage falls or productivity gains. If a worker wakes up tomorrow and can do the job of two people, then the business owner could sack the second person to keep costs down and improve profitability. In this example, productivity gains will lead to rising unemployment and a further deterioration in government finances through reduced taxes and higher transfer payments.

It is true that the growth rate of an economy will depend on the growth rate of exports, but the problem is the growth rate of exports depends upon world demand and how competitive those exports are in the international marketplace. We doubt an internal devaluation is the answer to Europe’s problems. To say that a reduction in ULCs will result in a rebound in growth numbers is wrong. You have to be producing stuff that people want to buy. Or you need your currency to devalue by enough to make your goods relatively cheap. This isn’t going to happen in Europe, where the euro has been remarkably strong given the sovereign crisis. The growth answer lies in getting credit flowing through the economy again, and central banks recognise that. It is important to realise that sometimes the obvious solution – like “we need to be more competitive” – is not always the right solution.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox