4 Housing Markets, One Country

The Eurozone has become a very extreme example of the dangers inherent of creating a single currency area populated with a myriad of different countries and regions. There is little doubt that the right monetary policy for Germany is not necessarily the correct one for Portugal given the underlying structural differences and lack of fiscal coordination.

However, closer to home, there could be an argument that the same (albeit in a less extreme form) is true of the UK. Looking through the prism of the UK housing market over the past 30 years, it’s possible to argue that there are 4 distinct regional markets within the UK. The UK is not an optimal currency area.

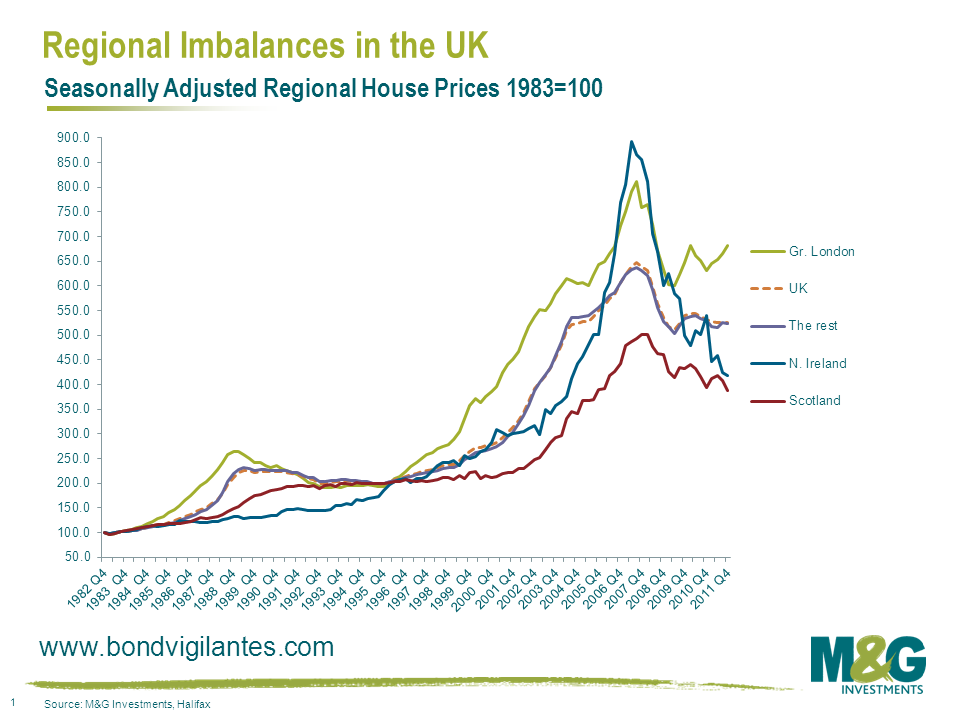

Using historical regional data from the Halifax house price index (see the chart below), there have been some very large and identifiable variations between different regions within the UK. Prices within Greater London have fared the best over the period, showing a strong bounce back from recent lows. Northern Ireland has suffered from an extreme boom and bust whereas the Scottish market has been the relative underperformer over the same period. In contrast, the other regions of the UK have, by and large, moved in lock step with each other.

Given the fact that Bank Rate is the same in Chelsea & Kensington as it is in Dundee, the potential to exacerbate structural imbalances between regions due to a common monetary policy is clear to see. Indeed there is a sense that as central London market prices rise to new highs in absolute and relative terms, we are witnessing a new liquidity fuelled bubble divorced from the economic fundamentals of the rest of the UK.

However, there are mitigating factors: existing within a single sovereign political entity, fiscal transfers and labour force mobility should all help redress these imbalances over time. The fact the London and the South East contribute a greater proportion in tax revenue is a case in point. However, due to the foibles of negative equity, labour mobility has been greatly constrained in recent years. Differences in regional unemployment bear witness to this fact. For example, the latest ONS data states that the unemployment rate in the North East is 12.0% compared to 6.4% in the South East.

Are we therefore condemned to a future of further economic stresses and strains within the UK? Maybe not. If the Scottish do eventually decide to leave the United Kingdom with their own central bank and currency, maybe the Northern Irish and Londoners should be given the same option too?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox