High Yield in the Post Lehman Era

We recently published an in-depth note on the high yield market . In it we consider some of the issues facing investors in the era of negative real interest rates and financial repression and how high yield as an asset class fits into the current paradigm.

Our main conclusions are:

- Low interest rates and ageing demographics are enticing investors to high income generating assets.

- High yield fixed interest assets are set to benefit from these structural shifts in investor behaviour.

- The low duration, high income nature of the asset class is attractive in a world of ultra-low interest rates.

- There are genuine opportunities in today’s high yield market due to the wide dispersion of credit spreads. Fundamental credit research is vital.

- There is a structural shift to high yield occurring in fixed income markets right now.

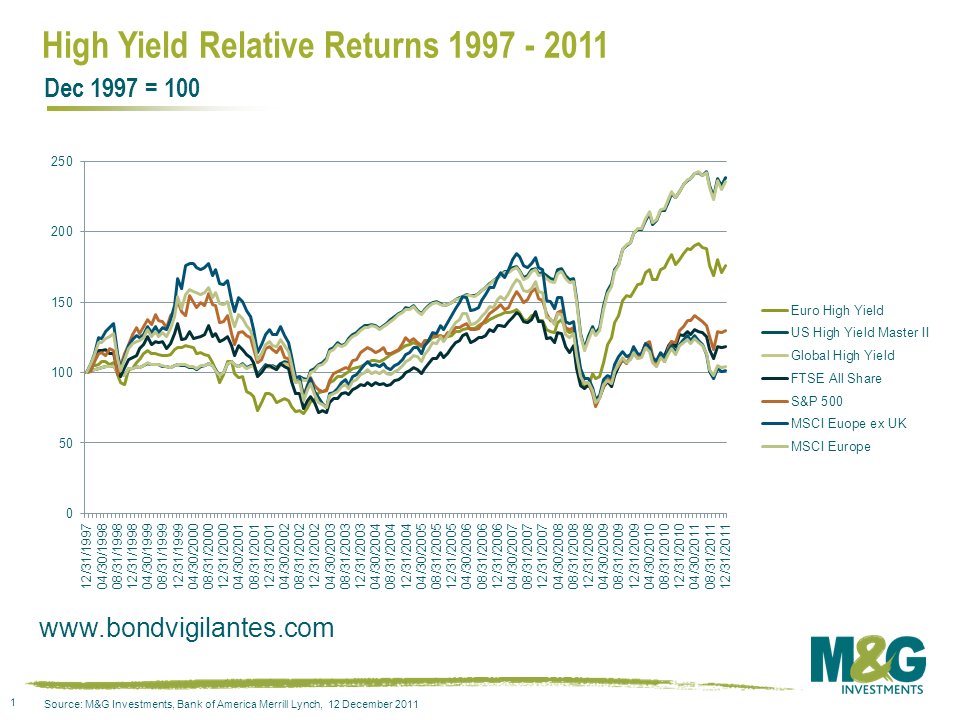

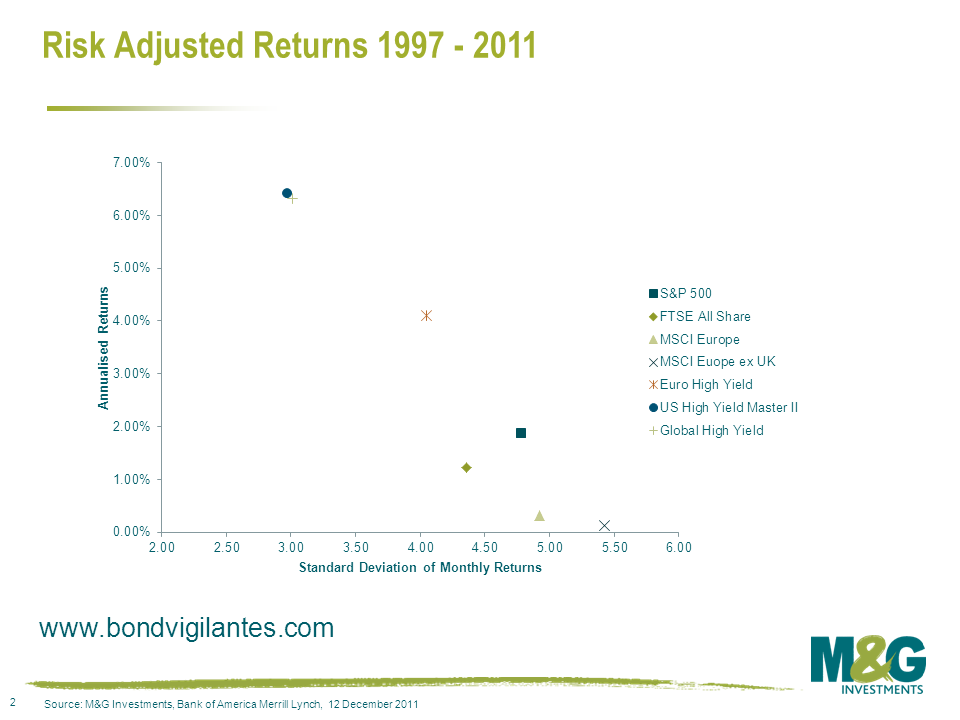

We also looked at the high yield market in terms of current valuations and potential returns after a period of strong relative performance over the past few years (see chart below).

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox