Deutsche Bank 2012 Default Study – Default bark far worse than the bite?

This week saw Deutsche Bank publish their 2012 Default Study, aptly subtitled ‘5yrs of crisis – The default bark far worse than the bite..’ The annual piece is particularly interesting, especially because the market now has five years of data since the onset of the great recession.

At the risk of failing to do an in-depth report justice it drew out several significant points for credit investors. Firstly, defaults between 2007-2012 have come in significantly lower than most would have expected. Secondly, loss given default (the loss incurred if an obligor defaults) in the last couple of years has been trending higher. Finally, investment grade credit continues to overcompensate investors vis a vis historical default experiences. High yield credit less so.

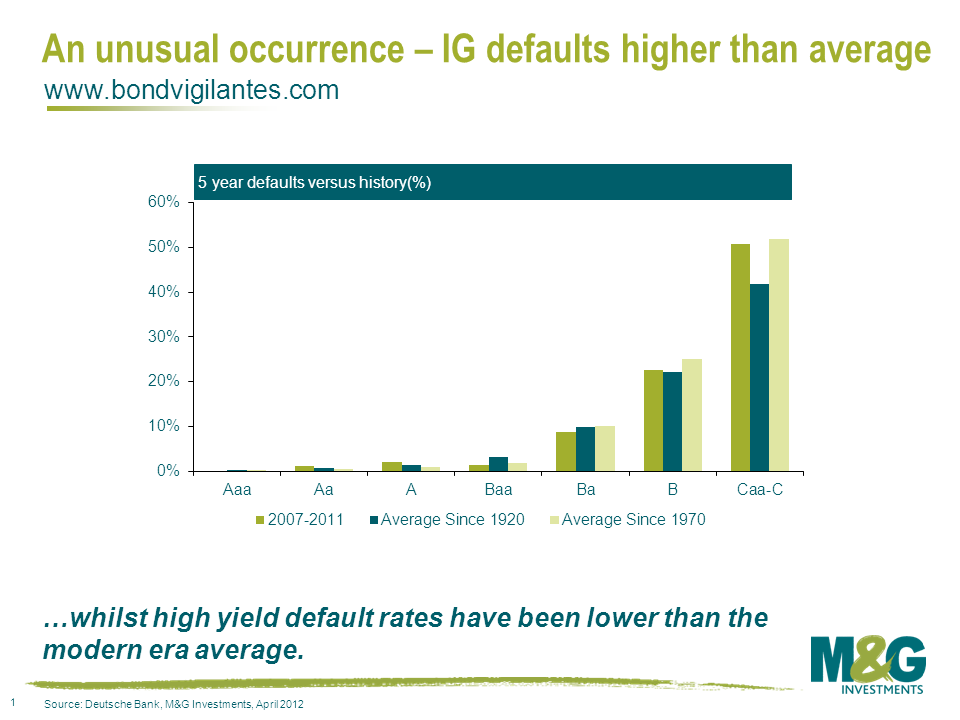

Whilst default rates have been decidedly ‘average’ over the last five years by historic standards, the statement masks an interesting picture. The below chart demonstrates that lower rated credit, especially sub-investment grade, has ‘outperformed’ the historic experience. Conversely Aa and A rated credit saw a higher default rate of 1.1% and 2.1% compared with a long run average of 0.8% & 1.3% respectively. Much of that can be attributed to the aggressive behaviour of financials (traditionally Aa & A rated) in the run up to the financial crisis and more conservative behaviour on the part of industrials. As Deutsche Bank argue, had we not seen massive intervention on the part of the authorities over the last five years then defaults would undoubtedly have been much higher. Perversely, it’s likely that the sheer extent of excess in the financial system forced intervention on a scale which artificially lowered the ‘market- free’ default rate experience.

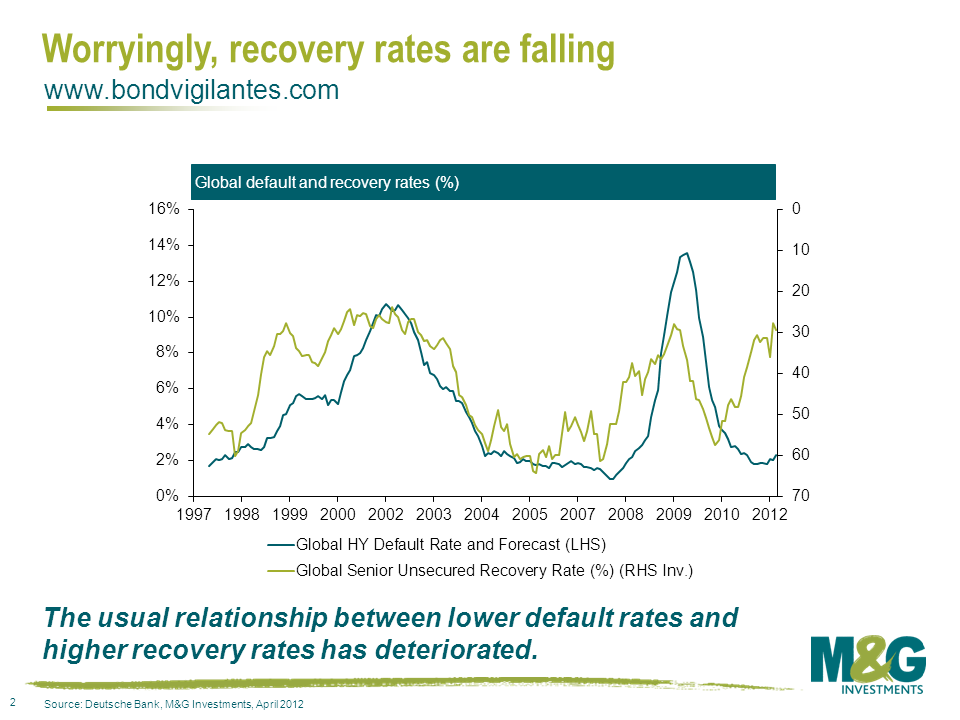

An examination of recovery rates shows that there has been an obvious weakening and worrying trend developing over the past eighteen months or so. The following chart demonstrates this is somewhat out of whack with previous experience. Low default rates should typically correspond to strong recovery rates, partly because they are normally accompanied by better economic times. The current ‘artificially’ low default rate has been accompanied by a broad lack of confidence and a challenging environment for capital raising. This has weighed down on recoveries. Whatever the reason, this is an important trend that requires monitoring. Whilst defaults and their numbers garner headlines the loss given default is more relevant for investors.

Given the weakening trend in recovery rates, it would seem appropriate to apply a conservative recovery assumption of 20%, half the 40% traditionally applied, when analysing whether credit is or isn’t overcompensating a buy and hold investor. On this basis, investment grade non-financial spreads continue to significantly over compensate for historic default risk. Based on current market corporate bond spreads, Sterling investment grade non-financial credit is pricing in a default rate of 12.7% over five years, and 12.0% for European non-financial investment grade credit. This compares to a worst case experience of 2.4% for both European and Sterling credit since 1970. Turning to high yield, and again assuming a conservative 20% recovery, the data is less convincing. Whilst broadly speaking investors are still being overcompensated for investing in the asset class with an implied 5 year default rate of 37.9% versus the long-term average of 31.6%, much of the value comes from BB rated credit. At current valuations B & CCC rated credit provides far less compensation for buy and hold investors and clearly support the need for in-depth credit analysis, especially because of the spread dispersion to be found in the lower rated areas of the high yield market.

As far as the outlook is concerned it seems a reasonable call to argue for continued low default rates amongst investment grade industrials in core European economies and the US. Liquidity remains ample, earnings remain broadly strong and financial discipline adequate. On the other hand, default experiences in the periphery and financial arenas are very much at the whim of the authorities. The adjustments needed will undoubtedly take time if they are to happen at all. Without the ongoing support of central banks and creditor nations it is unlikely that default rates will go anywhere but up.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox