Sterling’s strength is hard to explain – but it poses big risks for the UK economy in 2012. Equivalent to a 1.8% rate hike?

So some panic buying of petrol in March saw UK retail sales grow 1.8% from February and almost certainly means that the first quarter of 2012 will see positive GDP growth. As the final quarter of 2011 was negative for growth, this means that we’ll probably avoid the two consecutive quarters of falling growth that would have meant we were back in recession.

But a couple of things make me nervous about the UK’s growth prospects, quite aside from worries about the Eurozone debt crisis or China’s cooling economy. Firstly, it looks as if Quantitative Easing will come to an end in a couple of weeks’ time when the Bank of England buys the last of the £325 billion of gilts of its programme, and even Adam Posen is no longer voting for more QE. And the pound is becoming exceptionally strong (helped in the last couple of days by that perception that money printing is at an end).

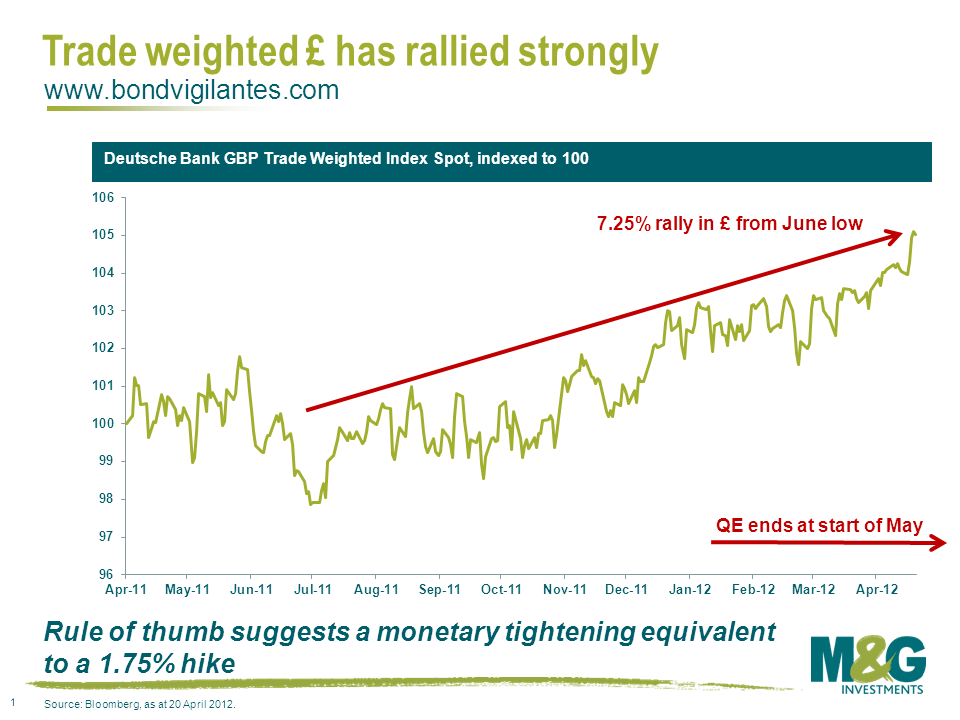

This chart shows that trade weighted sterling is up by over 7.25% since June last year. Today it hit its highest level since August 2009. The old rule of thumb was that every 4% appreciation in the pound was equal to a 1% rate hike (and vice versa for a depreciation). On that basis, if this relationship still holds, the move since June should be equivalent to a significant monetary tightening of 1.8%. Given this, like traditional monetary policy, will likely act with a lag (another rule of thumb is that it takes 6 months for a rate change to feed through into the economy), there could be big headwinds for the UK economy over the next few months. On the other hand, the strength of sterling could mitigate Bank Deputy Governor Paul Tucker’s fears that inflation could be around 3% for the rest of the year.

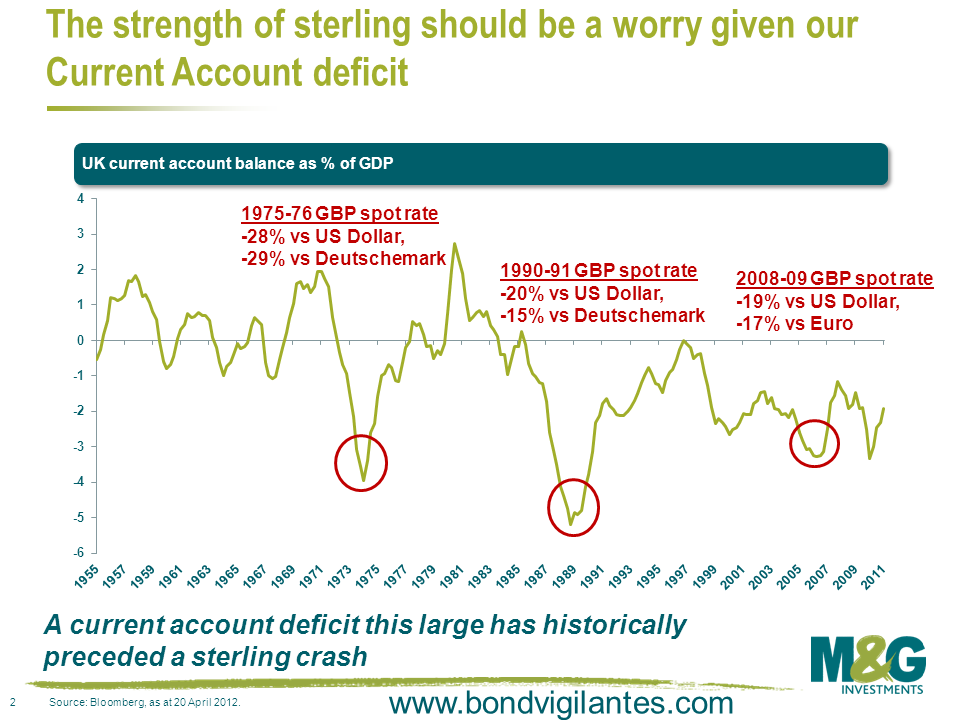

This second chart shows that sterling looks too strong compared with the UK’s current account balance. Typically when the CA deficit has been greater than 2% of GDP we’ve seen significant corrections in the value of sterling against its trading partners, as was the case in the mid 1970s, at the time of the ERM exit, and during the peak of the 2021/12 credit crisis. Recent strength of the pound can only really be explained by a safe haven status that may well not be justified (Moody’s put the UK’s AAA rating on negative watch in February).

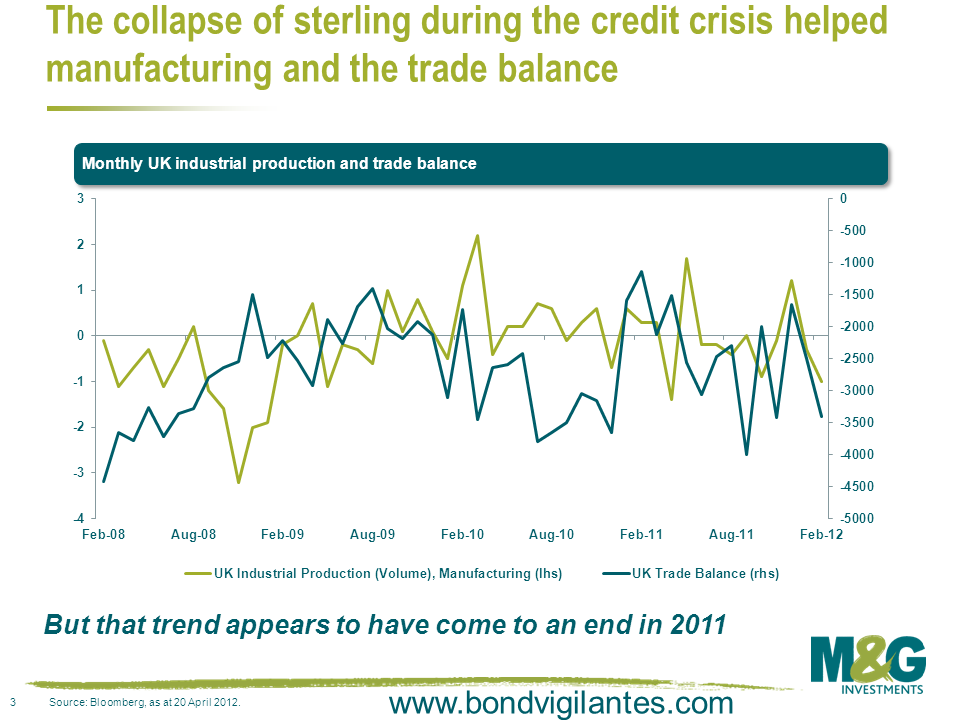

The final chart shows that we had a significant improvement in both UK industrial production and the trade balance in the period post that 2021/12 credit crisis sterling collapse. Industrial production stopped falling and there was talk that the UK would start to rebalance its economy and export its way out of the crisis – that trend came to an end in 2011, and recent manufacturing data have been weak. Whilst the trade balance remained negative through the chart period, you can see some improvement following the big sterling depreciation.

So it’s good news and bad news. The strong pound will help send inflation below 3% during the course of the year, but at the expense of economic growth and a rebalancing of the economy towards manufacturing (just look how Germany has benefitted from the weak euro). You might also consider an elevated level of inflation to be good news for the indebted UK, both at the state and private levels, reducing the value of debts by stealth – I accept that savers don’t see things this way though. It did make me revisit Bank of England MPC member Paul Fisher’s assertion to a Treasury Committee that “the exchange rate is part of monetary policy…the MPC can intervene in exchange markets if it thinks it is appropriate to help meet the inflation target”. If the economy continues to bumble along the bottom, and inflation rates fall sharply thanks to the strong currency, shouldn’t the Bank of England join nations like Switzerland, Japan and Norway in actively selling their currency or talking it down? George Osborne in this year’s Budget speech said “we are also taking the opportunity to rebuild Britain’s reserves”. What better way to do this than to print pound notes to sell into the fx markets for US dollars? Print £380 billion of them and we could buy Apple for the grateful nation. And on the 30th anniversary of the launch of the greatest computer of all time (the ZX Spectrum – my first job was Spectrum games reviewer for the Rugby Advertiser, first review was Daley Thompson’s Decathlon) we should put Sir Clive Sinclair in charge.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox