The quiet de-coupling of high yield from equity markets continues

High yield and equities have historically been seen as highly correlated in terms of their returns, and before 2008, this was true. However, what we have witnessed in the post-Lehman environment is a structural shift that requires a more nuanced appreciation of the relationship between fixed income and equities. This is something we looked at in a more in depth piece we published earlier this year.

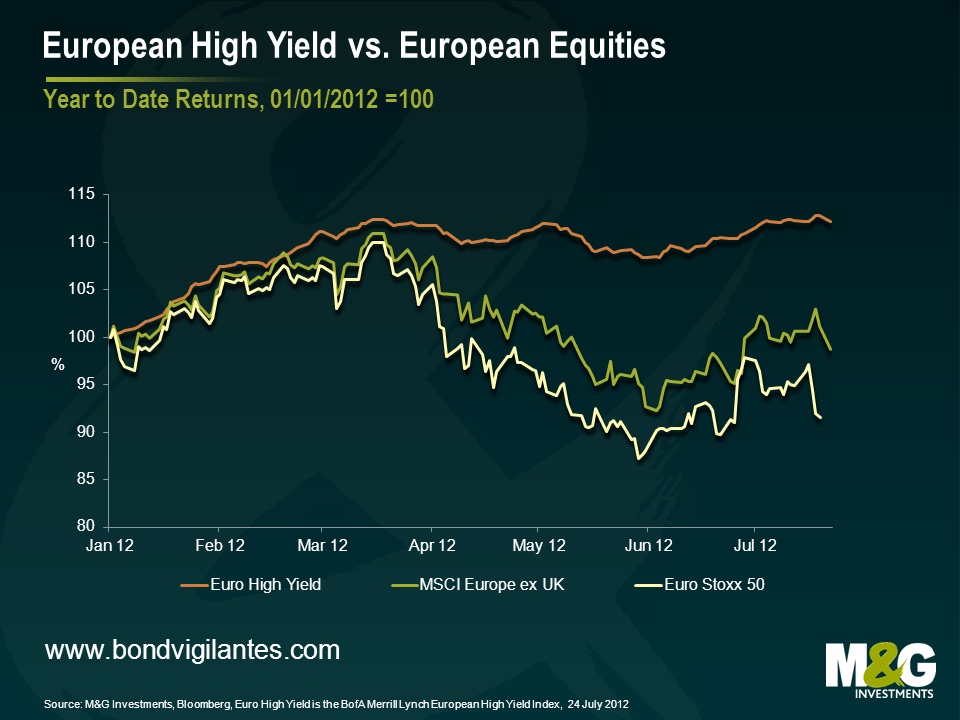

This point has been reinforced by the surprisingly divergent performance of the European high yield market and the European equity markets so far this year.

The chart below shows that European high yield performance has been strong, returning a little over 12% year to date. This contrasts sharply with lacklustre equity returns. The MSCI Europe ex UK index is down 1.3% at the time of writing whereas the more concentrated DJ Euro Stoxx 50 is showing a negative 8.4% return.

Accordingly, whilst high yield returns will always be sensitive to the economic cycle and market sentiment, in a world of zero interest rates, financial repression, deleveraging and slow growth, we continue to believe that the relationship between equities and high yield bonds has shifted in a subtle but meaningful way.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox