Chinese housing market, not so magic – will the dragon run out of puff?

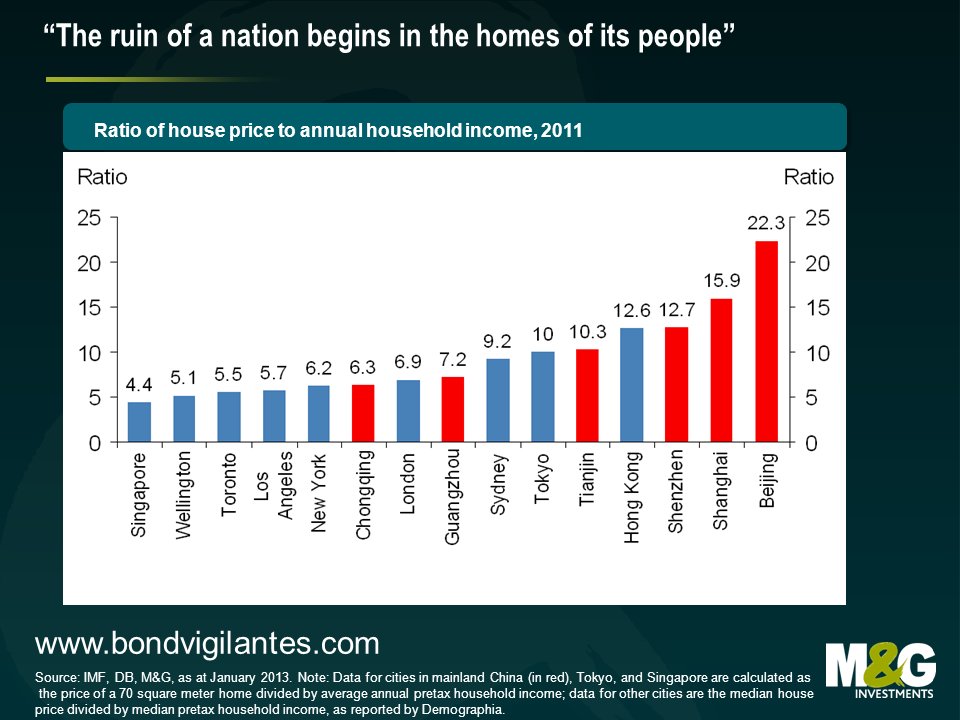

‘The ruin of a nation begins in the homes of its people.” – Ashanti proverb

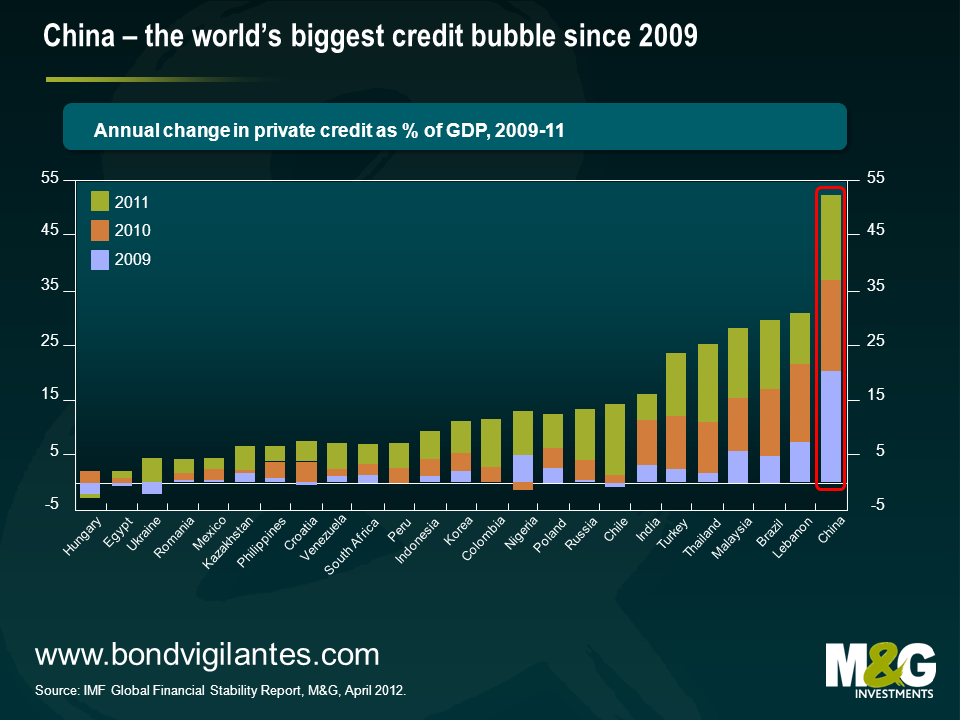

In the last ten years, around the world, we’ve seen a series of housing led credit booms inflict heavy recessions on economies. We seem to be seeing the same thing happening today in parts of China.

Deutsche Bank’s excellent economist Torsten Slok has produced the following graph; which clearly shows how unaffordable house prices are becoming, relative to incomes, in some major Chinese cities.

While property prices in the rest of the world continue to adjust towards more fundamental valuations, China’s credit boom is allowing the opposite to happen.

Current property prices in major Chinese cities are unsustainable. Either they adjust (a bursting of the bubble) or real wages have to catch up (massive inflationary pressure).

The currently inflated dragon is unlikely to survive in its current form.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox