High yield – it’s pickin’ time

It’s fair to say that we have been toning down our view on the high yield market of late. We could well see returns in the high single digits for 2013, but the potential for more substantial capital gains is less apparent in today’s context.

This does, however, ignore quite a powerful feature of the current high yield environment – the scope for exploiting opportunities and pricing dislocations within the market itself. To use a more technical term, spread dispersion within the market is very elevated. What do we mean by this?

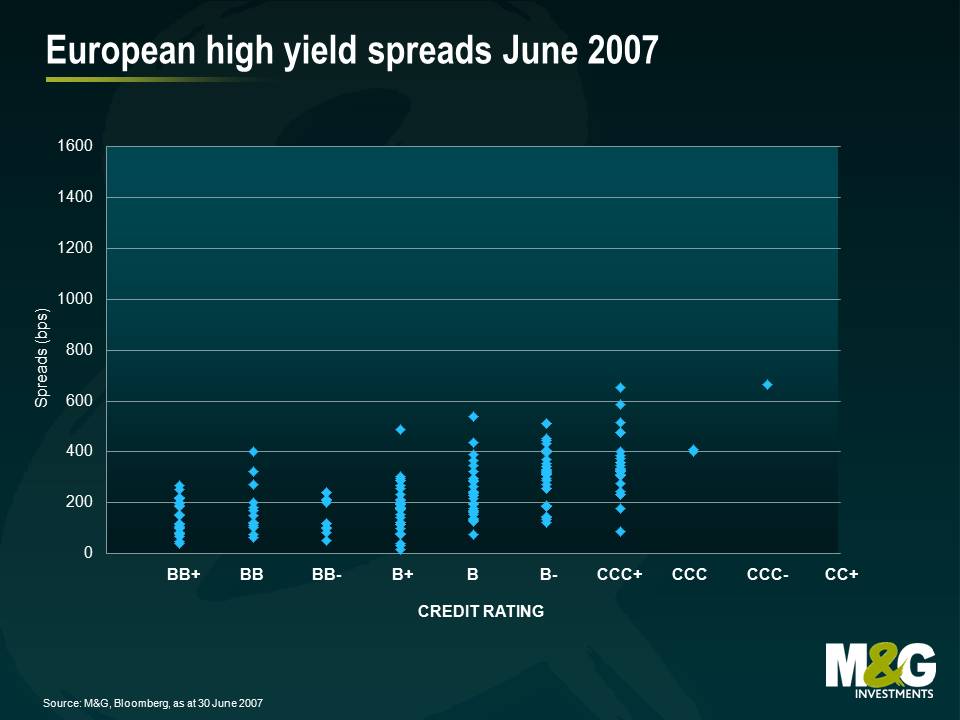

Here is a snapshot of the European high yield market back in 2007 with credit rating plotted against credit spread. As credit risk increased, you got paid incrementally more credit risk premium. This produced a gentle upward sloping curve. The market was fairly efficient and the level of spread dispersion within a credit rating category was fairly limited.

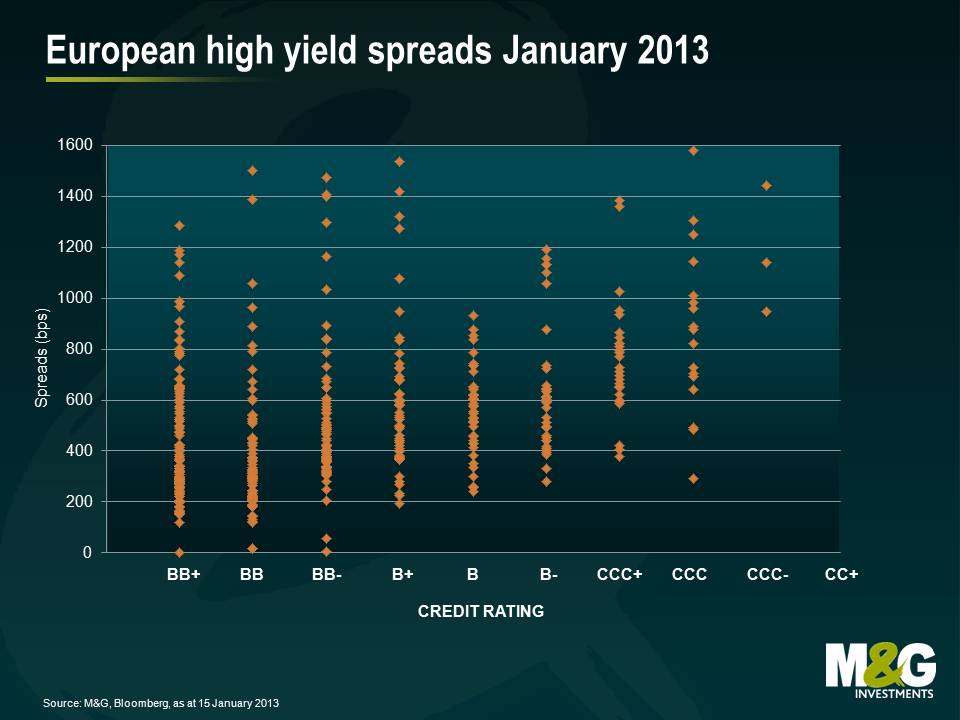

Compare this to a snapshot of today’s market below: not only is the average risk premium significantly higher than in 2007, but more importantly, there is a much higher range of spreads within each rating category.

How can this obvious dislocation be exploited? If you can correctly assess credit risk independent of the ratings agencies, then you can start to pick and chose the bonds that are mispriced. Furthermore the reward for getting this “stock selection” correct can be meaningful. If for example you purchase Bond X at a credit spread of 750bps and sell Bond Y at 250bps, this is a 500bps difference. Let’s say that this difference moves to zero over time with both Bond X and Bond Y converging to a credit spread of 500bps, with a duration of 5 years. This is a relative price performance of 25% (a capital gain of 12.5% for Bond X, and avoiding a 12.5% capital loss for Bond Y).

If an active manager can realise even a small element of these sorts of opportunities across a portfolio, then the additional returns can be meaningful. It’s (stock) pickin’ time.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox