Mr 7 percent – exploring unemployment in the UK

The governor at the Bank of England stepped forward last week with guidance about its future plans and conditions regarding the tightening of monetary policy. Ben gave his views on the announcement here last week, but what I am going to focus on is the 7 percent unemployment rate ‘knockout’.

Firstly, why has the Bank of England decided to use the unemployment rate as an indicator of inflationary pressures? Well, in the press conference they expressed that this is a good indicator of excess capacity. This has some obvious logic to it, so let’s explore this knockout level in an historical context.

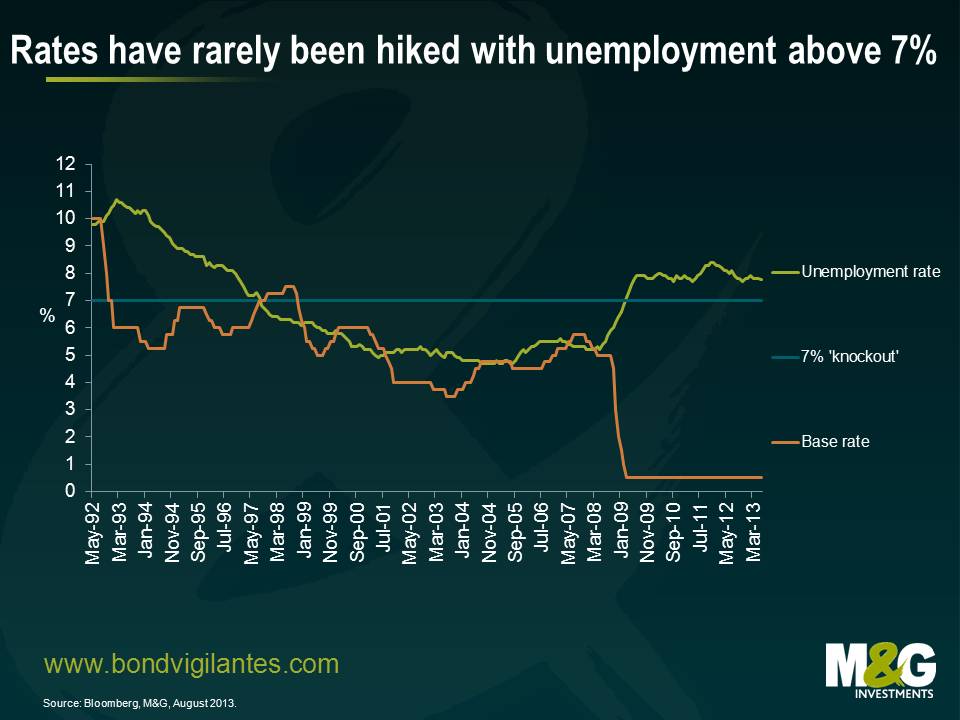

Below is a chart of UK unemployment going back 20 years. As you can see, the rate was below 7 percent from 1997 to 2009 – a period of good economic growth where the bank acted regularly to tighten policy to keep inflation under control. In fact this new knockout does not appear to be new news, as the bank rate has rarely increased when unemployment exceeded 7 percent over this period.

Looking at the next chart you can see the regions that currently have unemployment at 7 percent or below and the ones that do not. This regional disparity is not as strong as in Europe, but is something one should take into account.

Mobility of labour is needed for the rate to fall below 7 percent, with work relocated to labour and labour relocated to work. This is beyond the Bank of England’s remit, and is more of a central government economic project. The better regional labour mobility is, the quicker the UK can get unemployment below 7 percent. So, the easier it is to move house, or the quicker transport links are, the quicker unemployment can get below 7 percent. If regional labour mobility in the UK is very rigid then getting below 7 percent may not occur for years.

One new factor that we should take into account is the developing context of the wider European labour market. The UK workforce is not only competing as a whole internationally, but within the domestic economy it now also competes with international labour. The free movement of labour in the European Union combined with high rates of unemployment on the continent means that UK unemployment (spare labour capacity) can no longer be set with reference to our domestic borders. The huge pool of available labour could well dampen reductions in UK measured unemployment, aided by the UK’s tradition of welcoming foreign labour, its diversity of population (especially in areas seeking workers), and the fact that English is a well taught second language abroad. This could well act to reduce the ability of unemployment to fall in the UK despite low policy rates.

Even if the UK economy does respond to monetary policy and we reach escape velocity, labour immobility in the UK and or the supply of continental labour will have a baring on when the 7 percent unemployment rate is knocked out. Using this as a signal to raise rates could well mean that rates stay low for a long time even as the economy recovers.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox